Should You Be Watching These Top AI Stocks Amid The Artificial Intelligence Boom?

Artificial Intelligence (AI) remains a hot area in the broader tech industry. Indeed, many would consider AI and AI stocks prominent growth sectors right now. This would be thanks to how AI empowers and enables the most cutting-edge tech in the world today. But, what exactly is AI?

Simply put, AI allows computers to comprehend and learn from observable data. This machine learning is done via algorithms and is steadily outperforming humans at many tasks. Ranging from data analytics to security surveillance along with fraud detection. For one thing, these are but a few cases of AI application and the list continues to grow each day. According to Grand View Research, the global AI market could grow to a whopping $733.7 billion by 2027. Even ARK Invest estimates that the industry could create $30 trillion in stock market value over the next 15 years. Given all of this, I can see why investors would be looking for the best AI stocks now.

For example, we could look at the likes of DocuSign (NASDAQ: DOCU) and Nuance Communications (NASDAQ: NUAN). On one hand, DocuSign employs AI to uncover hidden risks while also highlighting key aspects in digital contracts. By doing so, it helps clients cut down on legal review spending and accelerates deal flow. On the other hand, Nuance’s AI-powered software helps automate paperwork in the healthcare industry. As it stands, both companies’ shares have more than doubled over the past year. With the broader tech industry experiencing some form of pull-back, could these be the top AI stocks to buy now?

Best AI Stocks To Watch Before April 2021

- WiseKey International Holdings (NASDAQ: WKEY)

- Pinterest Inc. (NYSE: PINS)

- Duos Technologies Group Inc. (NASDAQ: DUOT)

- NVIDIA Corporation (NASDAQ: NVDA)

WiseKey International Holdings

Starting us off is leading global cybersecurity company, WiseKey. Generally, WiseKey deploys large-scale digital identity ecosystems for its clients. These ecosystems are powered by AI, blockchain, and the Internet of Things (IoT) based tech. In terms of hardware, the company also manufactures semiconductors. Notably, it has over 1.5 billion microchips installed across the IoT industry. WiseKey’s prominent end markets include the automotive, crypto tokens, anti-counterfeiting, and consumer electronic sectors to name a few.

Overall, WiseKey’s hardware plays a crucial role in producing Big Data while its AI-based offerings help to analyze said data. All of this adds up to form WiseKey’s comprehensive suite of tech offerings. This would likely make WKEY stock a go-to for AI investors now. In fact, WKEY stock doubled in value during intraday trading yesterday on account of WiseKey’s latest announcement.

Yesterday, WiseKey introduced Wise.Art, a digital certificate of authenticity, also known as a non-fungible token (NFT). Wise.Art employs cutting-edge blockchain-based authentication tech to create a one-of-a-kind digital signature, commodifying luxury digital assets. Essentially, this is what an NFT is. Given the current NFT hype amongst novelty collectors today, this is a strategic play by WiseKey. With the company’s experience in blockchain tech, could this make WKEY stock worth watching now? You tell me.

[Read More] 4 Top Growth Stocks To Watch Right Now

Pinterest Inc.

Following that, we have social media company Pinterest. Although it may come as a surprise, the company relies heavily on AI for its core platform. To begin with, Pinterest mainly operates via its visual discovery engine that boasts over 400 million monthly active users. The key aspects of this platform are ‘pins’ and ‘pinboards’. Specifically, pins are concepts and ideas from across the internet which users can save and compile on pinboards.

When putting together pinboards, Pinterest helps users via AI-based suggestion algorithms. Although this may seem simple, you would be surprised as to how many people rely on Pinterest. When 2020 ended, the company reported that users had saved almost 300 billion pins across six billion boards. Likewise, PINS stock is also skyrocketing with gains of over 360% in the past year. Could it have more room to run moving forward?

Well, the company continues to refine its search engine capabilities even after such a stellar year. Just last week, Pinterest announced the expansion of its skin tone range feature to thirteen additional countries. Namely, this is a key feature that allows users to refine their beauty-related searches based on their skin tone. In turn, this could benefit Pinterest and its advertisers by increasing customer engagement and purchases. With Pinterest seeing a 600% increase in usage of this feature in the past year, this could be the case. Above all, Pinterest continues to make the most of its AI-infrastructure, do you think this means big gains for PINS stock?

Read More

- Top Reopening Stocks Worth Investing In Now? 4 Names To Watch

- Best Stocks To Invest In Right Now? 4 Biotech Stocks To Know

Duos Technologies Group Inc.

Next, we will be looking at Duos Technologies. In brief, the company focuses on providing advanced, analytical tech solutions to clients. Powering its solutions are AI and advanced video analytics software. For the most part, Duos delivers these services through its integrated enterprise command and control platform. The company’s main end markets include the rail transportation, retail, petrochemical, government, and banking sectors.

In these cases, Duos’ offerings help optimize mission-critical security, inspection, and operations. Additionally, the company also offers professional consulting services for large data centers. With crucial public bodies relying on its AI tech, it would make sense to watch DUOT stock. The company’s shares are looking at year-to-date gains of over 120% after surging by 18% yesterday.

If anything, investors could be keen to see how Duos performs in its fourth-quarter fiscal after today’s closing bell. This would be the case seeing as the company is expected to see an influx of revenue this quarter from its backlog of significant contracts. In its previous quarter fiscal, CEO Chuck Ferry mentioned that the delays on key projects were to ensure proper execution in the long run. Moving forward, with improving pandemic conditions, the company’s key railroad clients could continue to ramp up orders as well. All things considered, will you be adding DUOT stock to your watchlist?

[Read More] Churchill Capital Corporation IV (CCIV) Vs Fisker (FSR): Which Electric Vehicle Stock Is A Better Buy?

NVIDIA Corporation

Topping off our list is computer tech giant, Nvidia. For the uninitiated, the company designs graphics processing units (GPUs) for the gaming and professional markets. Aside from that, it also manufactures system-on-a-chip units for the mobile computing and automotive markets.

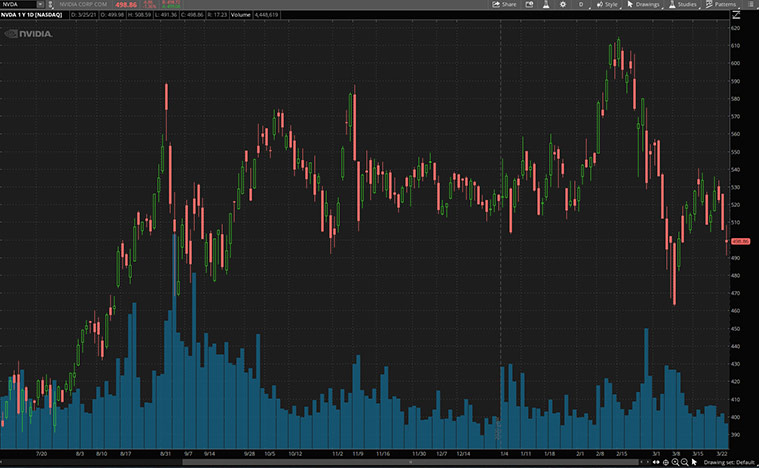

Accordingly, NVDA stock would make for a solid play on the growing AI industry now. This is thanks to its chips which power some of the leading tech advancements in AI. Coupled with the gaming industry tailwinds throughout the pandemic, NVDA stock has more than doubled in value over the past year.

Despite all of this, the company does not seem to be resting on its laurels just yet. Earlier this month, Nvidia launched a suite of AI software in collaboration with cloud computing company, VMware (NYSE: VMW). The software now goes by the name of NVIDIA AI Enterprise (NAE). With the help of Nvidia’s tech, NAE facilitates rapid deployment, management, and scaling of AI workloads. Moreover, the company revealed new AI features in its latest GPU update last week. This included the integration of Adobe’s (NASDAQ: ADBE) Super Resolution software as well. With Nvidia firing on all cylinders, do you see NVDA stock following suit?