Do You Have These 4 Semiconductor Stocks In Your 2022 Watchlist?

As we start off the first trading day of the year, investors are wondering what they could invest in. Could semiconductor stocks continue to flourish in the stock market this year? After all, semiconductor stocks have been on the radars of many investors in the past few years. Due to the pandemic, semiconductor companies all around have seen an exponential increase in revenue. With the Omicron variant seemingly introducing a new wave of coronavirus cases globally, this trend could be here to stay. This is due to work-from-home mandates causing a spike in demand for electronic devices. From laptops and mobile phones to TVs and automobiles, the demand for these items continues to increase year after year. Furthermore, with the ongoing supply chain issues, chip prices are increasing as well.

As a result, investors may want to buckle down on semiconductor stocks. Back in November, NVIDIA (NASDAQ: NVDA), reported a record revenue of $7.1 billion, 50% more than in 2020. Besides that, GAAP earnings per diluted share for the quarter were $0.97, 83% more than in 2020. Meanwhile, in December, Taiwan Semiconductor (NYSE: TSM) was in early talks with the German government about potentially establishing a plant in the European country. This would help to increase chip production in the EU to mitigate future supply chain disruptions. Given the optimism surrounding semiconductor stocks right now, here are 4 names to know in the stock market today.

Top Semiconductor Stocks To Watch In January 2022

- NXP Semiconductors (NASDAQ: NXPI)

- ASML Holding (NASDAQ: ASML)

- MaxLinear Inc. (NASDAQ: MXL)

- Synopsys Inc. (NASDAQ: SNPS)

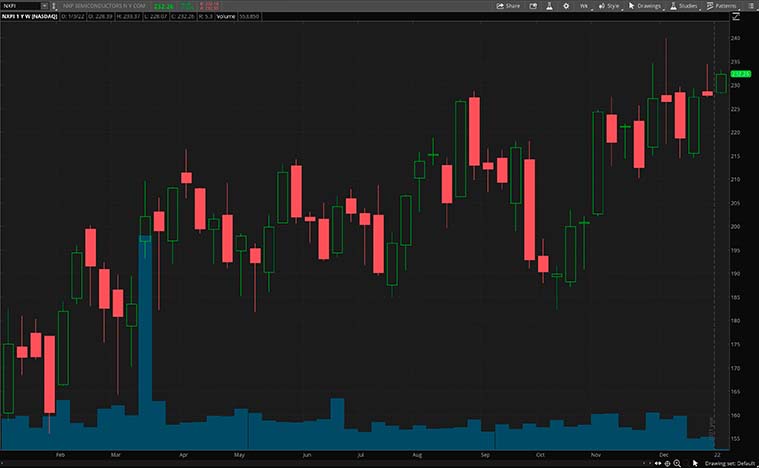

NXP Semiconductors

First on our list is NXP Semiconductors. In brief, the Netherlands-based company earns its revenue from selling chips to the automotive industry. Additionally, it makes chips for industrial uses, Internet of Things (IoT), as well as chips for infrastructure applications. It boasts approximately 31,000 employees in more than 35 countries. NXPI stock currently trades at $231.95 as of 1:14 p.m. ET.

In December, NXP announced a strategic partnership with Foxconn Industrial Internet (FII), a subsidiary company of Foxconn Technology. The partnership between the two companies aims to accelerate automotive innovation by NXP providing Foxconn Industrial Internet with its comprehensive portfolio of automotive technologies. Namely, the joint project will focus on the development of a fully digital cockpit solution based on the NXP i.MX 8 QuadMax. NXP claims that this will enable global automotive companies to deliver a vivid in-vehicle experience for their customers. Essentially, the cockpit will include digital clusters and a head-up display (HUD) system. The digital cockpit solution is expected to start mass production in 2023. With that being said, could NXP stock be one to watch?

[Read More] Best Stocks To Invest In 2022? 4 Tech Stocks For Your Watchlist

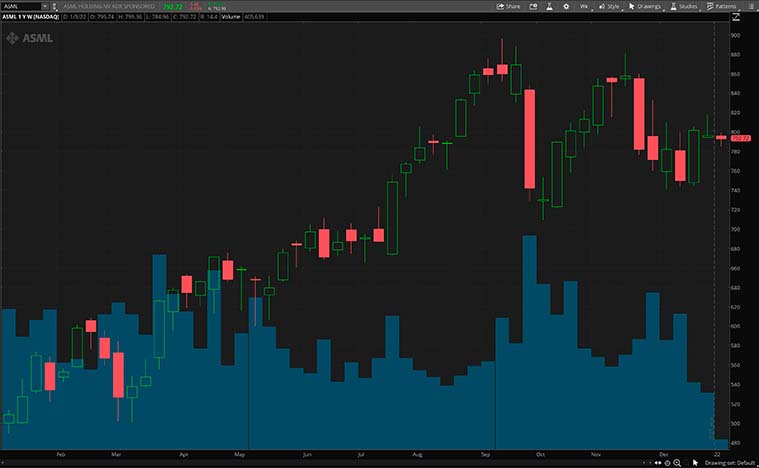

ASML Holding

Next up, we have another notable name in the industry, ASML Holding. In brief, the company manufactures complex lithography systems that are crucial to the production of microchips. Lithography systems are machines that are used to make the aforementioned chips. As a matter of fact, the company’s products are used by various major chipmakers. It is also the only company in the world capable of making extreme ultraviolet (EUV) lithography machines. This essentially makes them the sole enabler for big tech companies to manufacture their products. Hence, most of the electronics we use today may not exist without ASML’s machines. ASML stock currently trades at $792.84 as of 1:14 p.m. ET.

In the past year, ASML stock has risen by over 55%. This is largely due to the global chip shortage, which the company has benefitted from. Last October, the company reported a third-quarter revenue of over $5.94 billion, a 32% increase year-over-year. Besides that, net income was over $1.97 billion, a 63% annual increase. According to ASML, global megatrends in the electronic industry and a fiercely innovative ecosystem are expected to further propel the semiconductor industry. With all that in mind, would you consider investing in ASML stock this year?

MaxLinear Inc.

Third, we have MaxLinear, a company that is a pioneer in communication technology. In brief, the company focuses on developing technology that solves some of the world’s most challenging communication technology problems. Furthermore, its product offerings help to support existing 5G wireless infrastructure, which benefits the company given the current 5G trend. Additionally, it is known for developing the low-power broadband CMOS single-chip tuner, a chip that is used worldwide in televisions and set-top boxes today. It’s worth pointing out that MXL stock has more than doubled over the past year and currently trades at $76.36 as of 1:15 p.m. ET.

In December 2021, German-based Centec chose MaxLinear as its partner to manufacture next-generation Multi-Gigabit whitebox switch solutions. This solution leverages upon the newly released MaxLinear 2.5G Ethernet Quad-port PHY. By doing so, it helps to meet the next generation Metro and Enterprise network requirements. Ultimately, this helps customers quickly adopt the speed-upgrade to Multi-Gigabit Ethernet. During the third quarter of 2021, MaxLinear reported a 46.7% increase in revenue to over $229 million. With such growth, could MXL stock earn a spot on your watchlist?

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

Synopsys Inc.

Finally, we have software company Synopsys. In short, Synopsys identifies itself as an electronic design automation company. The company mainly focuses on silicon design and verification. Additionally, it offers intellectual property, software security, and quality-related services. Essentially, the company develops products and software for the semiconductor and software development industry. In doing so, it also offers a wide portfolio of application security testing tools and services. SNPS stock currently trades at $360.13 as of 1:15 p.m. ET.

In December, Synopsys announced that Juniper Networks (NYSE: JNPR) has chosen Synopsys to accelerate its development of photonic-enabled chips. This partnership will help Juniper Networks to develop the next generation of chips used in optical communications. Specifically, Juniper Networks intends to tap into Synopsys’ solutions to design and optimize its hybrid silicon and InP optical platform. Simply put, this enables customers to address optical connectivity in data centers and telecom networks. According to Tom Mader, head of Silicon Photonics at Juniper Networks, “This will enable Juniper silicon photonics to bring our revolutionary hybrid integrated laser platform to a broad array of customers in several photonic market segments, with the potential to lower cost and eliminate product barriers to entry.” Considering all this, could SNPS stock be worth the watch?

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!