Looking For The Best Industrial Stocks To Buy? 3 Names To Know

Industrial stocks represent the backbone of an economy. Manufacturing is an important force behind productivity growth and innovation, which directly contributes to the economy. In fact, manufacturing data are often what analysts and investors use to gauge the economic growth of a particular industry.

This week, industrials started off on a low note after the broader market sell-off. It is easy to get carried away. Some try to avoid these stocks as the market continues to exhibit bearish signals. Investors who have been paying attention to the stock market would know this pack has managed to gain over the past month. This came after the hopes of infrastructure spending would rise after the U.S. election. The XLI Industrials ETF (XLI Stock Report) is up more than 50% since the stock market crash in March.

“I think the irony here is we’re in one of the most contentious elections in U.S. history and if there’s one thing that both candidates agree on it’s the infrastructure spend. I think not only is the U.S. far behind other developed countries with this, just take Penn Station for example here in New York, but it’ll also help the fundamentals in the country to help the markets grow. You’ll see small- and midsize businesses gain in the construction industry,”– Michael Bapis, Managing Director of Vios Advisors at Rockefeller Capital.

Could These Industrial Stocks Manufacture Growth For Your Portfolio?

At first glance, it may seem that tech stocks are the best way to make money in the stock market today. Perhaps the dizzying rally in top tech stocks made you forget about industrials. But it’s not too late to focus some of our attention on some of the top industrial stocks to buy in the market. For instance, Tupperware Brands (TUP Stock Report) skyrocketed 41% higher during Wednesday’s intraday trading. And some would have seen it coming with more people cooking at home. If you are one of them, kudos to you. If you are trying to look for similar companies that could potentially benefit from the stay-at-home measures, rivals like Newell Brands (NWL Stock Report) and Lifetime Brands (LCUT Stock Report) might be worth taking a closer look.

Many would think that the industrial assembly lines in the U.S. have not returned to full capacity yet. This came as the coronavirus pandemic continues to rage. But the truth is, the Institute for Supply Management’s (ISM) manufacturing index hit a 21 month high of 56% in August. The sector continued its recovery in September, reflecting a surge in industrial production. With the industry continuing to recover, are these the best industrial stocks to buy right now amid a recovery in industrial production?

Read More

- Looking For The Best Stocks To Buy As The Third Coronavirus Wave Hits? 3 In Focus

- Are These The Best 5G Stocks To Watch In Q4 2020?

Top Industrial Stocks To Watch: General Electric

Shares of General Electric Company (GE Stock Report) surged about 10% during intraday trading yesterday, before closing 4.5% higher. This came after the company pleasantly surprised investors by reporting positive third-quarter adjusted net profit and positive free cash flows. The company is also reportedly making progress in restructuring its business.

“Our transformation of GE is accelerating,” Chief Executive Larry Culp said in the post-earnings conference call with analysts, according to a FactSet transcript. “We rise to the challenge of building a world that works. This is more true than ever as we continue to deliver for our customers and tackle the world’s biggest challenges, from precision health to the safe return to flight to the energy transition.”

No doubt, the coronavirus pandemic has made things harder for Larry Culp to turn things around after the company performed poorly. The global health crisis has caused airlines to retrench and cut business to GE’s massive aviation and aircraft engine business. That contributed to a 28% organic decline. Of course, the company is still far away from being healthy. But the earnings reports today were a lot better than what many analysts have expected. The question is, can GE stock continue this positive momentum?

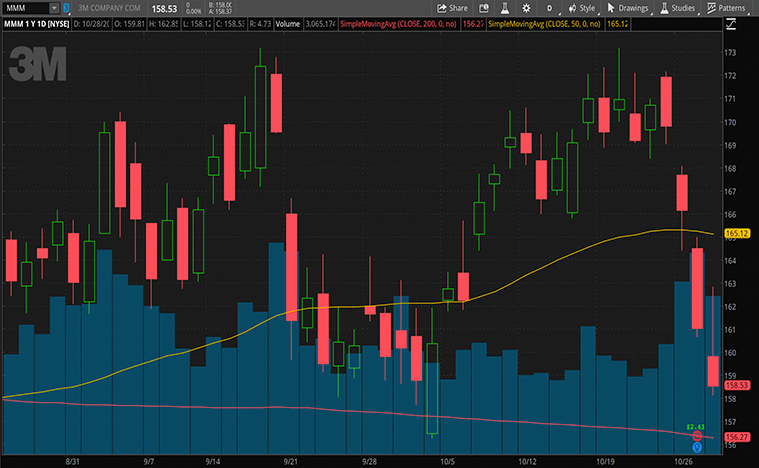

Top Industrial Stocks To Watch: 3M

Industrial and chemical giant 3M (MMM Stock Report) third-quarter earnings which exceeded Wall Street’s expectations. It seems the company’s diversified range of businesses drove the strong performance during these tough times. This came as the company saw improvements in demand for its healthcare products during the coronavirus pandemic. This shouldn’t come as a surprise as 3M’s respirators have been selling like hotcakes.

“Though economic uncertainty and challenges due to the COVID-19 pandemic remain, we returned to positive organic sales growth with sequential improvement across businesses and geographies. We posted another quarter of robust cash flow, aggressively managed costs and further strengthened our balance sheet,” said Mike Roman, 3M chairman, and Chief Executive Officer.

Even today, shortages of personal protective equipment (PPE) for health-care workers, including masks, have remained at critical levels during the pandemic. With hospitalizations rising in many of the states, the need for more PPEs couldn’t be more pronounced. With the coronavirus pandemic showing no signs of stopping, the demand for PPEs from 3M is going to be huge. Even if a vaccine is available today, the demand for these PPEs is going to stay for some time. That said, would MMM stock be a great addition to your portfolio?

[Read More] What Are The Best Biotech Stocks To Watch Before November? 3 For Your List

Top Industrial Stocks To Watch: Siemens

Last on the list, Siemens (SIEGY Stock Report) is also one of the top industrial stocks to watch in the stock market. Not only does the company have a very solid financial history, but its future also looks bright too. Siemens is active in the digital industries space, with businesses in factory and process automation, and industrial software. Furthermore, the company’s smart infrastructure exposure includes grid control and energy solutions. The company has certainly poised itself to ride on these secular trends.

The difficulties in the supply chains of some companies have led to a higher interest in automation. After all, more automation means less crowded factories. We can see why this is beneficial during a pandemic. Besides, with the growing interest to restore production in certain industries, automation helps improve the economics of such plans. After all, high wages here have been a hurdle. The rise of the Internet of Things further increased the viability of automation.

That’s not all for Siemens. The company can also rely on its 72% stake in Siemens Healthineers to produce a steady stream of cash flow. On top of that, the mobility segment is a low risk albeit low growth business. It consists of rail rolling stock, rail infrastructure, traffic systems, and rail customer services. This segment has no problem converting its earnings into free cash flows. You can say Siemens is a company that covers both new and old industries. And that could make SIEGY stock a top industrial stock to buy and hold for the long term, don’t you think so?