Are These 2 Fitness Stocks A Buy For Your Portfolio?

Fitness stocks are one sector that has been greatly affected by the pandemic. Fitness stocks related to gyms fell as gyms were forced to close. This is because of the risk of catching the coronavirus due to the germs in a gym. In some places, gyms have opened once again, with reduced capacity. It’s no surprise that many are still choosing not to go and are canceling memberships. This means that gym equipment companies have seen a dip in sales as well.

On the contrary, fitness companies that allow people to workout at home are on the rise. Fitness companies selling home equipment have seen sales rise. In addition to this, companies that create online fitness courses and applications have increased sales as well. The new normal in the world may be working out at home. Even as the year progresses many will still be afraid to go to the gym. When people eventually do trust the gym once again, it is possible for some home workout companies to lose sales.

Fitness stocks have been able to make some investors profit during these times. Due to the volatile state of the world right now, fitness stocks can be unpredictable. This is why there are two fitness stocks to watch that will be focused on in this article. Let’s have a look at these two fitness stocks that have been trending in the market.

Read More

- Netflix Or Roku: Which Is A Better Tech Stock?

- 2 Small-Cap Stocks To Watch Right Now

- Are These The Top Solar Stocks To Watch In July 2020?

Top Fitness Stocks To Buy [Or Avoid] In 2020: Fitbit

The first fitness stock on this list, Fitbit Inc. (FIT Stock Report) recently made a full recovery. Fitbit was founded in 2007 and has grown to be the fifth-largest wearable company in shipments as of 2019. Fitbit has a growth rate of 14.8% a year. The company produces smartwatches that act as activity trackers for working out. It tracks things like your heart rate, how many steps you’ve climbed, how many steps you’ve walked, and much more.

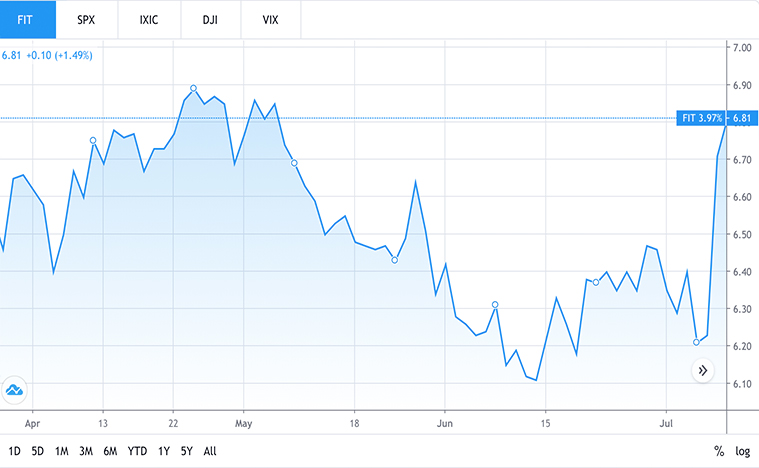

Before the pandemic took over the world shares of FIT stock were around $6.50 on average. Then in March FIT stock price dropped below $6 a share. In April, FIT stock rose as high as $6.89 a share on average. But in May and June, FIT stock price dipped once again. As of July 10th, FIT stock is at $6.64 a share which makes it higher than it was before the pandemic. While it’s not near the $6.89 recent high it reached in April, FIT stock has still recovered after the crash.

Since November, there has been an acquisition deal between Google (GOOGL Stock Report) and Fitbit in the works. The reason it has not closed is due to debates about what Google will do with people’s fitness data. Google wants to figure it out however they can, due to the magnitude of the deal. The intention is for Google to acquire Fitbit at $2.1 billion. Regulators for the EU have set a July 20th deadline for the next decision about the deal. This means that July 20th could be a sink or swim day for FIT stock. This is why you should keep your eye on this fitness stock to watch as it may see a lot more movement this month.

[Read More] Zoom Vs. Slack: Who Will Win The Workplace Collaboration Supremacy?

Top Fitness Stocks To Buy [Or Avoid] In 2020: Peloton

This next fitness stock to watch, Peloton Interactive Inc. (PTON Stock Report) has shown no signs of slowing down. Since the pandemic began, people need to work out from home. Peloton offers the perfect solution for people with this desire. Peloton is a New York company that sells fitness equipment and fitness media. Founded in 2012, Peloton launched its services in 2013 by using a Kickstarter funding campaign. Peloton sells a stationary bicycle that can stream Peloton classes on its screen. Consumers are able to watch these classes by paying a monthly fee. Peloton reported that during the pandemic it saw a new high of 23,000 concurrent viewers on just one class stream.

Shares of PTON stock were trading around $25 a share before the coronavirus pandemic began. Peloton is a perfect example of a coronavirus stock success. Shares of PTON stock were around $27 a share before the pandemic. When the stock market crashed, PTON stock price went down below $20 a share. Since that low, it has been a constant rise for PTON stock. In April PTON stock price reached $31 a share. Then in May PTON stock reached $42 a share on average. By the end of June PTON stock price arrived at over $57 a share. And as of July 10th, PTON stock is at $65.10 a share on average. From PTON stock low, it has gone up more than 225% in share price. From its price before the pandemic PTON stock price is up over 141%.

With Peloton partnering with ESPN to stream its courses on TV, it could see PTON stock rise even more. Peloton seems to be making all the right moves when it comes to handling the pandemic. That is why PTON stock is a fitness stock to watch. The recent recovery of FIT stock makes it a fitness stock to watch as well. These two fitness stocks have been on the rise. This means they could be potential fitness stocks to buy for investors.