Are These The Best Battery Stocks To Buy Or Sell Now?

The gradual shift toward electric vehicles (EV) has put battery stocks onto investors’ radar. We’ve seen renewed interest in battery stocks following the meteoric gains posted by Nio (NIO Stock Report) and Tesla (TSLA Stock Report). Of course, the EV trend has been around for some time now. According to Statista, the demand for lithium will more than double over the next 5 years. And where is that lithium going? You’ve got it right. Much of the lithium will be for EV batteries.

Many on Wall Street have been anticipating the electrification of the automobile industry. But without the right battery technology, the EV industry wouldn’t be able to push further. It’s interesting to see that many investors were skeptical when Tesla first came to the stock market a decade ago. And today, there seems to be a new headline every other day about an automaker touting its upcoming EV. I don’t know about you, but I am certainly tempted to buy every top electric vehicle stock out there in the stock market today.

If you have been following our site, you would know that we are big fans of EVs. Perhaps, you too have been trying to pick the winners from the losers in the increasingly competitive space. Perhaps some investors rather take a blanket approach. If that describes you, you may want to check out the Global X Lithium & Battery Tech ETF (LIT Stock Report). The ETF captures the performance of a basket of battery and lithium stocks. The ETF saw an increase of nearly 210% since March, easily outperforming the S&P 500 and Nasdaq Composite. The big question here is, is it too late for investors to be buying top battery stocks now? If you believe the EV boom is going to take place, now might be the time to jump in. I certainly plan on jumping in.

Read More

- Looking For Top Tech Stocks Right Now? 1 Reporting Earnings Today

- Making A List of Autonomous Vehicle Stocks To Watch? 3 Making Big Moves This Week

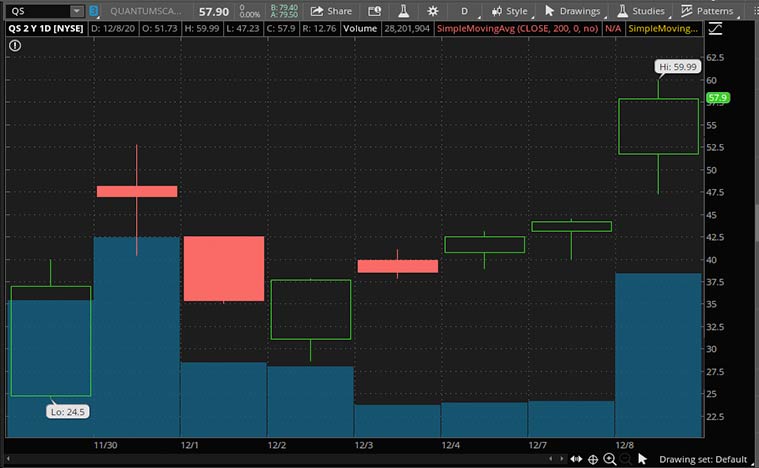

Best Battery Stocks To Buy [Or Avoid] Now: QuantumScape

Recently listed via the special purpose acquisition company (SPAC) route, QuantumScape (QS Stock Report) has been the center of attention on Wall Street lately. The company is looking to disrupt the world of batteries and all things electric. If there’s one thing the EV industry needs, it would be more range. And battery technology determines range.

The company claims its batteries will store over 80% more energy than existing lithium-ion competitors while reducing costs substantially. Sure, 80% improvement at a lower cost is strong claims for any product in pretty much any industry. To put this into perspective, the world’s largest EV maker Tesla announced a few months ago breakthroughs in battery manufacturing that should deliver up to 54% additional range in two years. So, you could imagine how big QuantumScape’s news is to the EV industry. If the claims turn into reality, we could be looking at something big. You could charge the batteries to 80% in under 15 minutes and then drive for over 300 miles. What’s more, an EV with the new battery could be as cheap as an existing gasoline car.

If these aren’t enough to entice you to take a closer look. The company has also attracted investments from Volkswagen (VWAGY Stock Report). Volkswagen is arguably one of the most committed to leading the EV transition, along with General Motors (GM Stock Report) and Ford (F Stock Report). Of course, we don’t know for sure how long it takes for QuantumScape’s solid-state batteries to appear in vehicles en masse. Until then, with so much optimism surrounding the company, make sure you include QS stock on your watch list.

Best Battery Stocks To Buy [Or Avoid] Now: Albemarle

Albermale (ALB Stock Report) develops and manufactures chemicals and is among the largest producers of lithium globally. Albemarle has a significant lithium business that develops a broad range of lithium compounds. These products are used in manufacturing various products such as batteries used in consumer electronics and electronic vehicles. By now, investors should be able to recognize the impact of EV production in driving up lithium demand in the long term. ALB stocks have nearly doubled in price since the start of the year.

With the production of EV beginning to pick up the pace, could ALB stock follow suit? The demand for ALB’s lithium is expected to be supported by improving deliveries in EV. Besides, lower costs for lithium-ion batteries, increasing battery performance, and favorable policies toward renewable energy usage also help. The company has long-term supply agreements with customers that make it a preferred global lithium partner. This allows the company to leverage its advantage of low-cost resources to its benefits.

The company has a market capitalization of $15.3 billion and a PE ratio of 40.21. That’s not cheap by the industry’s standard. On a side note, the company’s long term contract model has also protected the company from fluctuation in lithium prices. For these reasons, ALB stock appears to be one of the best bets when it comes to investing in battery stocks.

[Read More] Looking For The Best Biotech Stocks To Buy Now? 2 Up By Over 300% YTD

Best Battery Stocks To Buy [Or Avoid] Now: Sociedad Química y Minera de Chile

Next up, Sociedad Quimica y Minera de Chile (SQM Stock Report) emerged as one of the best battery stocks to buy recently. That’s considering its strong commercial-scale supplies capability. Now, many may have reservations given the foreign name. But make no mistake. This is no startup. Let’s take a look at why many believe SQM is in a strong position to be able to meet the rising demand for lithium.

As the name implies, the company is based in Chile. Chile has the world’s largest lithium reserves. The country has 8.6 million metric tons of lithium, according to Statista.com. That amount is three times the reserves of the next country, Australia. It is perhaps a no-brainer then, to suggest that Chilean companies or at least companies with a strong Chilean presence are likely to be frontrunners of this lithium race.

Admittedly, SQM stock isn’t cheap considering it has a P/E ratio of over 75 times. Besides, it has a stronger balance sheet with lower debt than even Albemarle. SQM has annual sales of $1.8 billion, putting it ahead of many rivals in the industry. The company has generated positive free cash flows every year for at least 10 years now. Given its strong track record, there is little doubt of the company’s ability to scale up and meet the rising demand for lithium batteries. With that in mind, is Sociedad Quimica y Minera the best battery stock to buy and hold for the long term?