Do You Have These Top Cybersecurity Stocks On Your Watchlist? 3 In Focus

In the age of digital acceleration, cybersecurity stocks have become top performers in the stock market. This is due to the ongoing pandemic keeping most of the general population stuck at home. The way we carry out work has fundamentally changed as digital offices become the new norm. Aside from work, even our leisure activities have shifted towards the digital space. All this has and continues to contribute to the meteoric growth of the cybersecurity industry over the past year. Seasoned investors are aware of this and have been flocking to the top cybersecurity stocks accordingly. Take Zscaler (NASDAQ: ZS) for example, ZS stock is looking at gains of over 245% in the past year. The cloud security company continues to step up to meet rising demands in the sector.

Not forgetting, there is also an ongoing investigation into a hack targeting U.S. government agencies just last month. Cybersecurity company SolarWinds (NYSE: SWI) was alerted to the breach in its systems by FireEye (NASDAQ: FEYE). Earlier this month, it was reported by the New York Times that the scale of the attack was much larger than initially thought. Some 250 federal agencies and businesses have been breached and the list is still growing. With the likes of Microsoft (NASDAQ: MSFT) and Intel (NASDAQ: INTC) getting hacked, one thing is apparent. Cybercrime is on the rise and is constantly evolving. Likewise, cybersecurity companies have kicked into high gear to bolster their services. Additionally, Cybersecurity Ventures projects that cybercrimes will be the cause of $6 trillion in annual losses this year.

By and large, this does set up an interesting opportunity for investors. With all the recent scares, companies would likely want to strengthen their online security. With that in mind, do you have these cybersecurity stocks on your watchlist this week?

Read More

- Top Tech Stocks To Buy According To Analysts; Up To 45% Upside

- Should Investors Buy DraftKings (DKNG) Stock As More States Legalize Sports Betting?

Best Cybersecurity Stocks To Watch Right Now

- Crowdstrike Holdings (NASDAQ: CRWD)

- Tufin Software Technologies (NYSE: TUFN)

- Palo Alto Networks (NYSE: PANW)

Crowdstrike Holdings

Crowdstrike is a name many software investors are well-aware of by this point. For the uninitiated, the company is a leader in cloud-delivered endpoint and workload protection. CRWD stock has had a fantastic run on the stock market seeing gains of over 300% in 2020. Notably, this could be thanks to its key role in helping SolarWinds with the aforementioned U.S. government hack last month. On the same note, it recently made another breakthrough in the investigation on this matter.

On January 11, Crowdstrike’s intelligence team identified the strain of malware that was used to “create the opening” for the attack to occur. Yet again, the company has shown its prowess in the field and continues to deliver. This could bode well for the company as potential clients and investors take note of its work. On top of that, the company also made an interesting play in the form of a $750 million senior notes offering. The company stated that it “intends to use the net proceeds of the offering for general corporate purposes, which may include, among other things, acquisitions, capital expenditures, and working capital.” Given all this news, CRWD stock could be on investors’ radars at the moment.

Interestingly, the company reported ending its recent quarter with over $1 billion in cash on hand. The company’s management expects its cloud cybersecurity market to grow to $38.7 billion by 2023. Investors could be looking at long-term growth as the company deepens its pockets for more plays moving forward. Whether it is new acquisitions or bolstering existing services, Crowdstrike seems to be firing on all cylinders. Do you think this means CRWD stock will have another stellar year?

[Read More] Will Magnite (MGNI) Stock Be The Next Trade Desk In The Making?

Tufin Software Technologies

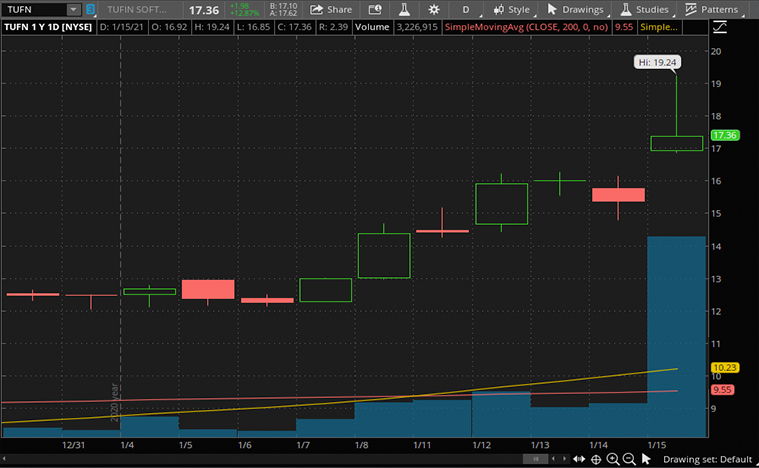

Next up, we have network security company Tufin. The company simplifies network management and does so in some of the largest networks in the world. This is important as once companies make the shift to the digital space, they will need the means to manage their data. TUFN stock appears to reflect this trend as it is currently looking at gains of over 35% in January alone. In fact, it surged by over 12% during Friday’s trading session. This came after its recent financial guidance update.

On January 14, the company raised its fourth-quarter revenue bottom-line outlook by over 27%. Adding to that it also appointed a new Chief Revenue Officer, Raymond Brancato. CEO Rubi Kitov said, “I’m confident that Ray’s deep experience directing global sales strategy and execution in the software industry will be a strong asset as we work to scale up significantly in the coming years.” With Brancato’s 27-years of experience in revenue management, it seems that Tufin is gearing up for a busy year ahead. In light of that, I can see why investors were quick to jump on TUFN stock.

Based on its recent quarter fiscal, the company appears to be picking up speed as it recovers from pandemic-related impacts. Kitov explained, “We are seeing positive signs in the marketplace as demand for our core products is growing, driven by the accelerating trends of automation and Zero-Trust. At the same time, SecureCloud, which we launched in the first quarter this year, is gaining traction as large enterprises move into the cloud. Due to actions taken earlier in the year, our costs are lower, and our balance sheet is strong.” All in all, will TUFN stockholders be in for a great 2021 ahead? You tell me.

[Read More] How To Start Investing In Stocks

Palo Alto Networks

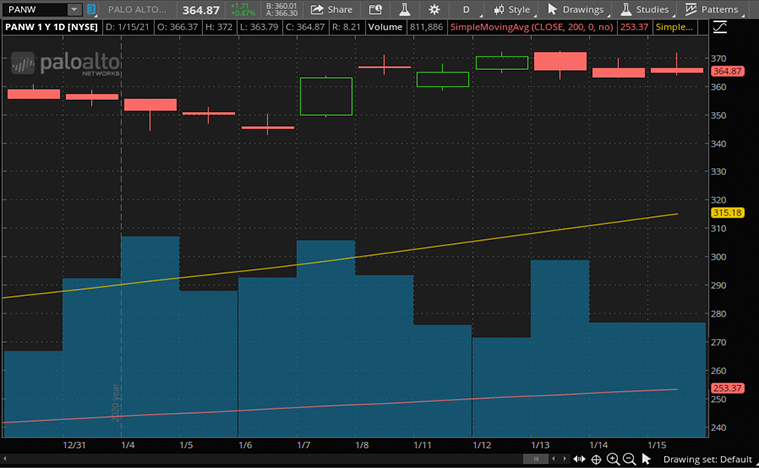

Third, we have multinational cybersecurity company Palo Alto Networks. The company focuses on advanced firewalls and cloud-based solutions which are accessible via its proprietary platform. With growing adoption of the cloud and rising cybersecurity demands, Palo Alto seems well-positioned to make the most of the current pandemic tailwinds. For one thing, PANW stock is seeing gains of over 170% since last March. This is great news, but investors could be wondering what the company is doing to keep up with the competition in such a fast-paced industry.

Just last week, the company launched a new cloud location in Australia. The new facility provides local customers with access to its wide array of cybersecurity services. Regional VP Steve Manley mentioned that Australia was a prime location thanks to its “mature cloud market and reliable infrastructure”. This move complements the recent launch of its Prisma solutions in the region. As Palo Alto expands its reach in Australia, could investors have another reason to watch PANW stock?

In November, the company reported its first-quarter fiscal. Palo Alto raked in $946 million in total revenue. Adding to that, it also saw a 69% year-over-year surge in cash on hand to the tune of $2.14 billion. The company also raised its total revenue guidance for the fiscal year 2021 estimating 21% year-over-year growth at the top-line. CEO Nikesh Arora explained, “We introduced several significant product enhancements across the portfolio and were recognized by industry analysts as a leader in two Gartner Magic Quadrants as well as Zero Trust.” Given the busy quarter it has had, Palo Alto’s confidence is not unwarranted. Could this translate to big gains for PANW shareholders in the long run? Your guess is as good as mine.