Are These Consumer Stocks Strong Enough To Withstand The Storm From The Pandemic?

A trending sector in the stock market in recent weeks has been the consumer stocks. The unprecedented global health crisis in modern history is crashing many businesses globally. With consumer behavior suddenly altered at such a drastic pace, many consumer brands are proving that they are well prepared for the digital age. Consumer stocks with huge online presence are one of the most attractive consumer stocks to buy. Many investors believe that top consumer stocks to watch are about to rebound sharply this round. The online presence is giving these consumer stocks a good hedge, in case the situation turns out to be not as hopeful as it seems.

Consumer stocks have been a mixed bag during these uncertain times. That’s because certain consumer stocks have held up better than their industry peers, while others suffer. Almost certainly, companies that provide consumer staples are more coronavirus-proof than those who are not. For instance, Procter & Gamble (PG Stock Report) has been one of the best stocks to buy now as it is showing strong sales growth despite the pandemic.

Many consumer stocks are also trading at a discount, making them the cheap stocks to buy. The underlying growth prospect of companies might have become weak. But some have made a huge pivot in their operations and are faring just fine. That’s to say, the market may think that the growth prospects, or even the fundamentals are weak, but in reality, they aren’t. With all that being said, are these two consumer stocks on your watchlist?

Read More

- Are These The Top Epicenter Stocks To Watch This Week?

- 2 Top Trending Consumer Stocks To Watch This Week

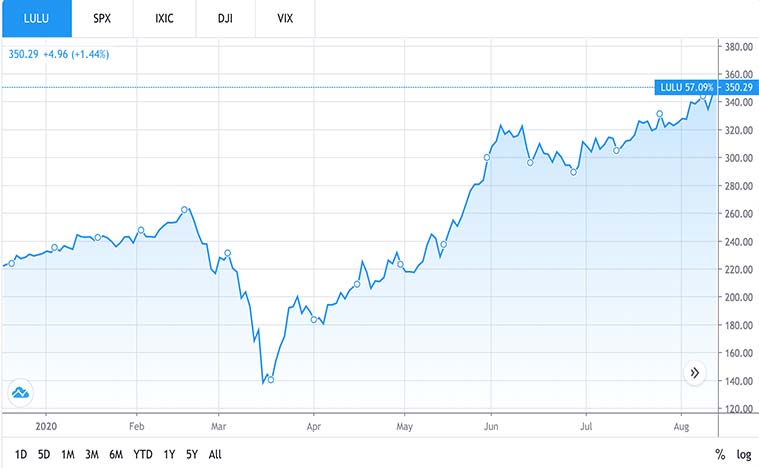

Top Consumer Stocks To Buy Now [Or Sell]: LuluLemon Inc.

Lululemon Athletica (LULU Stock Report) has experienced enormous growth over the years. This is due to its niche appeal in the athletic space. Also, the company is a more superior consumer stock to own compared to big names like Nike (NKE Stock Report) or Adidas (ADDYY Stock Report). Nike and Adidas have to write off their off seasonal items, whereas Lulu’s apparel are essentially suitable for all seasons. On top of that, Lululemon has also successfully branched out to other categories. They include outerwear, lifestyle and apparel for golf.

More importantly, Lululemon adapted well during store closures in North America and Europe. The direct-to-consumer revenue, including sales through the company’s website surged 68% year over year in the last quarter. When many companies turn to online stores to continue their offering, they would claim that the online spending has “spiked” during the pandemic.

But the truth is, it still makes up only a small portion of their total sales. Unlike its industry peers, Lululemon’s e-commerce made up an astonishing 54% of total revenue in the most recent quarter, up from 28% in fiscal 2019. This is a testimony to the company’s resilience.

[Read More] Apple & Tesla Announced Stock Splits; Here’s How It Could Impact Your InvestmentsTop Consumer Stocks To Buy Now [Or Sell]: Skechers

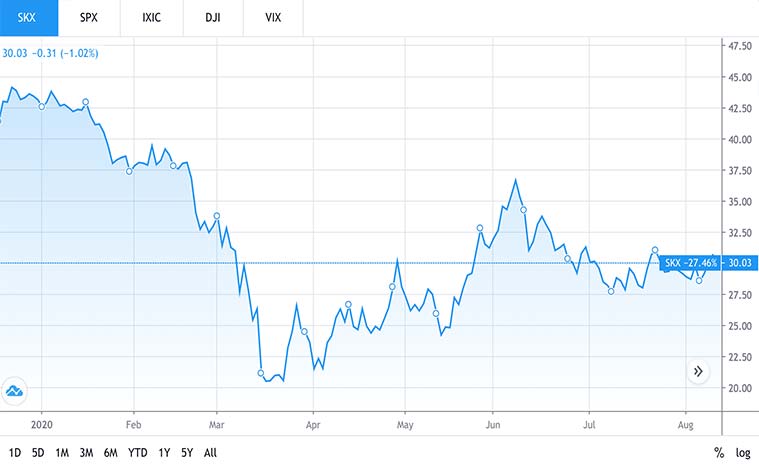

Skechers (SKX Stock Report) has rapidly emerged as the fastest-growing shoe company in the US. The company has also been steadily building a loyal customer base, especially in its international markets. The company’s international wholesale and retail businesses accounted for about 58% of its 2019 sales.

Although second quarter sales declined 42% year-over-year to $729.5 million, this was better than what many analysts feared. But there are some silver linings here despite the impact of the pandemic. They were the 11.5% growth in China and 428% surge in e-commerce sales. Skechers could be in a great position to capitalize on a global economic recovery. For investors who are looking for an expanding global brand, Skechers looks like one of the best stocks to buy and hold for the long term