Are These The Best Streaming Stocks To Buy Ahead Of Christmas?

Among other things, 2020 has been a banner year for streaming stocks in the stock market. If you don’t agree, ask yourself, do you love paying expensive bills that have access to hundreds of channels and commercials? If your answer is ‘No’, then perhaps you are like millions of Americans, who are switching to streaming services that are more suitable for your needs and most importantly, affordable.

The companies that once dominated TV for decades are seeing their markets go to the clouds. This includes Walt Disney (DIS Stock Report), which owns ABC, and ViacomCBS (VIAC Stock Report), which owns CBS. And if you are not familiar with ABC or CBS, these were the big broadcasting names we had. You could almost say they were the Netflix (NFLX Stock Report) of their time.

Streaming Stocks Have Been Big Winners In The Stock Market Today, Can This Continue?

Sure, we have seen the positive developments from the coronavirus front. Many investors would think twice before buying top streaming stocks now. But many households continue to subscribe to streaming platforms, with some subscribing to a few at the same time. The growth runway is still far from over, that’s if you are skeptical when looking for best-streaming stocks to buy.

Why? Because most of us still haven’t cut the cord. According to Leichtman Research Group, 60% of U.S. households still pay for cable TV. And you probably know why that’s the case. Admittedly, many of us enjoy live TV shows, news, and live sports. Thus far, major streaming services do not offer such content. But that’s all changing. Now, we can finally watch everything we want without needing a cable. And you can now safely cut the cord. With all that in mind, do you have a list of top streaming stocks to buy before Christmas?

Read More

- Should Investors Buy Epicenter Stocks This Week Amid Moderna’s EUA?

- Are These The Best Cybersecurity Stocks To Buy After News Of U.S. Government Hacks Last Week?

Best Streaming Stocks To Buy [Or Sell] Now: FuboTV

Sports-centric streaming platform FuboTV (FUBO Stock Report) has been on fire. The company’s stock has been skyrocketing since the beginning of last week. And in just one week, FUBO stock nearly doubled. This emerging, hypergrowth live TV streaming company whose platform is the closest analog to cable TV today could be the best pure-play in the sports live streaming market. And yet, despite the recent spike, the stock is not showing signs of slowing down anytime soon.

FuboTV is currently the only sports-first live TV streaming service. Admittedly, having only 455,000 paid subscribers do not sound that impressive if you are comparing it with the big names. But that’s a 58% jump in subscribers from a year ago. The company also intends to expand into the online sports wagering market, which would be a nice complement. That’s beside providing an additional stream of income, of course.

The company reported its recent quarter fiscal in November and it appears to be thriving. FuboTV saw its strongest quarter to date with a 47% year-over-year increase in revenue. In addition, it recorded jumps of 58% in paid subscribers and 83% for total content hours streamed in the same period. Could all this be the beginning of a bountiful 2021 for FUBO stock? You be the judge.

Best Streaming Stocks To Buy [Or Sell] Now: Roku Inc.

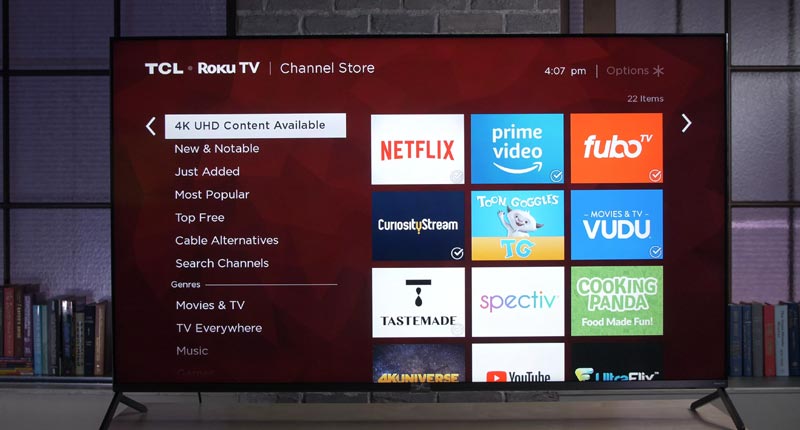

Roku (ROKU Stock Report) has definitely been on investors’ radars this year. Rightfully so, as the company’s share prices have been making new highs, having risen by 158% this year. The manufacturer of digital media players (DMP) has provided a lot of consumers with video streaming hardware this year. On top of that, its advertising platform has been pulling steady numbers at the same time.

On December 16, there was an announcement that AT&T’s (T Stock Report) HBO Max will finally be coming to Roku. Roku users will be able to install the HBO Max application on their Roku devices. This is an amazing deal for Roku in particular as HBO Max has a total of 57 million subscribers worldwide. Existing HBO Max subscribers will now have Roku’s hardware as a possible upgrade for their streaming setups. This is a strategic play by the company as it comes just ahead of the incoming holiday seasons. Clearly, it is an interesting time for the company and investors appear to think so as well.

Besides, the company has had an outstanding performance in its recent quarter fiscal. In it, Roku saw a 73% leap in total revenue year-over-year. The company’s advertising platform did spectacularly well as it saw a 78% rise in revenue over the same period. It seems to me that Roku is kicking into full gear and has no plans of slowing anytime soon. Would you say the same about ROKU stock?

[Read More] Are These The Best Biotech Stocks To Buy This Week? 3 Names To Know

Best Streaming Stocks To Buy [Or Sell] Now: Magnite Inc.

I know what you are thinking, Magnite (MGNI Stock Report) isn’t exactly a streaming stock. But with the seismic shift we see in ad spending, Magnite is definitely worth a closer look. It is the world’s largest independent sell-side advertising platform which operates across numerous channels and formats, including ads on streaming TV. The company’s share prices are through the roof with gains of over 433% since the sell-off in March. Magnite is the result of a merger between digital advertising company Rubicon Project and software company Telaria. Ever since the company has clearly been doing something right as it hits its all-time high as of Monday’s closing.

So, what happened? The jump in MGNI stock could simply be due to the positive commentary from analysts. Needham analyst Laura Martin has reportedly raised MGNI stock price to $30 per share. This implies around 15% upside from Monday’s closing. The price target is in line with that of Susquehanna analyst Shyam Patil as the firm initiated coverage on Magnite. If you are encountering this stock for the first time, you may be excited about the company’s potential. For a start, why not look at its financials?

In the most recent quarter, the company raked in $60.98 million in revenue. For the most part, it saw a 51% rise in connected TV revenue year-over-year. The reason for this could lie behind the massive rise in internet video streaming content this year. In turn, it creates a scenario whereby content producers could be relying on Magnite more to monetize their content. Ultimately, this sets up the stage for Magnite in a world dominated by streaming services. The real question remains, can Magnite make the most of these tailwinds to solidify its long-term growth prospects? Regardless, investors appear to be watching MGNI stock closely. Will you be doing the same?