Do You Have These Top Renewable Energy Stocks On Your May 2021 Watchlist?

Renewable energy stocks have been in high demand in the stock market, largely due to policy changes and growing adoptions. These policy changes reward businesses for switching to renewables and incentivize research and development into alternative energy. Also, topics surrounding climate change and carbon neutrality have become more of a serious discussion in recent years. On top of that, renewable energy production and adoption have increased due to fossil fuels causing health problems and global warming. Ultimately, in time, they will run out. If alternative energy is not found, we may not be able to maintain our power consumption in due time. Therefore, companies within the industry would likely play a big role in shaping a cleaner and healthier future.

Even tech giants such as Tesla Inc (NASDAQ: TSLA) act as one of the frontrunners when it comes to transition to renewable energy. Last week, Tesla stated that its Supercharger networks will be fully powered by renewable energy by the end of this year. This would make driving a Tesla even more environmentally friendly. Other automotive companies are also shifting their focus to electric vehicles to promote the usage of clean energy. All this coupled with President Joe Biden’s plan to invest $400 billion over the next ten years in clean energy and innovation, the long-term prospect of the industry looks bright. So if you’re on board, here are four top renewable energy stocks in the stock market today.

Renewable Energy Stocks To Watch In May

- Renewable Energy Group, Inc (NASDAQ: REGI)

- NextEra Energy Inc (NYSE: NEE)

- SunPower Corporation (NASDAQ: SPWR)

- Enphase Energy, Inc (NASDAQ: ENPH)

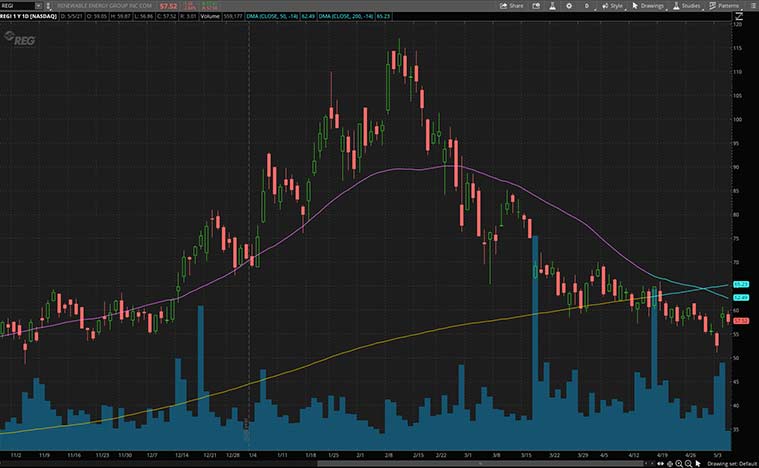

Renewable Energy Group, Inc

First, we have Renewable Energy Group (REG). The company focuses on providing cleaner, lower carbon intensity products, and services. It is a producer of biomass-based diesel in North America. REG is meeting the growing global demand for lower-carbon fuels and leading the way to a more sustainable future. REGI stock jumped by over 12% on Tuesday after the company announced its Q1 earnings report. Revenue was at $540 million, up 14% year-over-year, while net income available to common stockholders was $39 million.

On the same day, REG also announced a proposed offering of $500 million for green projects. The company intends to use the net proceeds to finance or refinance new and/or existing eligible green projects. This includes the expansion of REG’s Geismar, Louisiana biorefinery. REG believes that there are signals of growing demand for lower-carbon fuels and that it is well-positioned to help drive the energy transition and deliver additional value to its customers and shareholders. So with that in mind, would you consider buying REGI stock on a dip?

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

NextEra Energy Inc

Next up, we have a leading clean energy company, NextEra. The company owns Florida Power & Light Company, which is the largest rate-regulated electric utility in the U.S. In detail, Florida Power & Light serves more than 5.6 million customer accounts and supports more than 11 million residents across Florida. NEE stock has been trading sideways since the start of the year. However, this could be a buying opportunity for investors who believe in clean energy in the long term. In April, the company announced its first-quarter earnings. The company continues to generate solid results fueled by renewable energy.

It generated $1.33 billion of adjusted earnings in the first quarter. This is an increase of nearly 14% from the year-ago period. In particular, its renewable energy business, NextEra Energy Resources, contributed $598 million in adjusted earnings, up from $529 million in the first quarter of last year. On top of that, the company along with OPAL Fuels announced plans to build Minnesota’s first renewable natural gas facility. In particular, NextEra will work with OPAL to replace the existing power generating facility with a new production facility. This could produce over 6 million gas gallon equivalents of renewable natural gas per year. With these developments, would you consider investing in NEE stock now?

Read More

SunPower Corporation

SunPower Corporation is a provider of distributed generation storage and energy services. The company designs an all-in-one residential and commercial solution for customers. It boasts industry-leading customer services and also one of the most comprehensive warranties. This will allow residential customers to complete the system installations and to ensure always-on connectivity so homeowners can access the data anytime, anywhere. SPWR stock has risen over 500% over the past year.

The company will be posting its first-quarter 2021 results today after the market closes. Investors will be on the lookout for the company’s financial figures as they could be boosted by the company’s residential retrofit and new homes businesses. Now let’s revisit its fourth quarter 2020 financial results. The company reported an impressive 65% growth in its commercial and industrial solutions segment. On top of that, it posted a net income of $412 million during the quarter. This goes to show SunPower’s strong execution to deliver a healthy financial performance. Considering this, is SPWR stock worth adding to your portfolio?

[Read More] Stocks To Watch This Week? 4 Health Care Stocks To Know

Enphase Energy, Inc

Last but not least, we have the global energy technology company, Enphase Energy. The company is the world’s leading supplier of microinverter-based solar-plus-storage systems. Also, it has an intelligent platform that delivers smart, user-friendly solutions that connect solar generation, storage, and energy management. The stock has been trading sideways since the start of the year. However, with President Joe Biden putting emphasis on a transition towards cleaner energy sources, this could benefit the company in the long run. After all, such sentiments may partly explain why the stock almost tripled in value over the past year.

Now, surely the biggest question now is whether the company could sustain this growth moving forward. One thing is certain, the company is not resting on its laurels. Last week, Enphase announced an expanded collaboration with Palomar Solar, a leading solar energy installation company. Palomar has also integrated Enphase Storage with its full suite of customer services. On top of that, Enphase also announced its Q1 2021 financial figures last week. Enphase saw revenue grow nearly 47% year-over-year to $301.8 million. With its potential for further growth, would now be a good time to bet on ENPH stock?