Do You Have These Top Solar Stocks On Your Watchlist For 2021?

With President Joe Biden making climate change a priority in his administration, solar stocks could see brighter days ahead. Recall that the President laid out a $2 trillion clean energy and infrastructure plan, with a target for zero net emissions by 2050. The President has been rather loud and clear with his intentions to go green. Rejoining the Paris Climate Accord was one of the signals from the White House. Additionally, the president signed an Executive Order that would combat the climate crisis both nationally and internationally. One example of this initiative coming to fruition is to replace all government cars and trucks with electric vehicles.

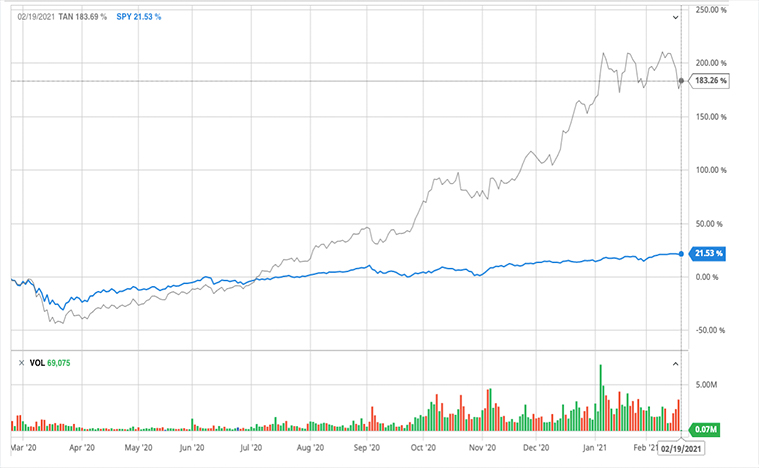

Apart from the change in administration, reduced costs and technological innovation within the solar industry are a couple of tailwinds sending top solar stocks higher. One of the best ways to dive into a specific industry would be buying an industry exchange-traded fund (ETF). The growing demand was evident in the parabolic rise of the Invesco Solar ETF (NYSE: TAN), which tracks renewable energy stocks.

But what if you are only looking to invest in some of the best-performing stocks in the solar industry and not an ETF? SunPower Corporation (NASDAQ: SPWR) and Enphase Energy (NASDAQ: ENPH) easily top the list. Both have reported their earnings recently. And if you believe that the renewable energy sector is unlikely going to slow down anytime soon, then these two solar stocks are worth a closer look.

Read More

- Best Stocks To Buy In February? 4 Trending Tech Stocks To Know

- Could Twilio (TWLO) Stock Continue To Defy Gravity As Everything Move Towards The Cloud?

SunPower Corporation

SunPower is a California-based solar energy company. In brief, the company designs and manufactures PV cells and solar panels. SPWR stock has been on a tear for the past year, rising by more than 1,000% since the market sell-off in March.

It is still a ten-bagger stock despite falling by double-digit percentages on Thursday. The drop in SPWR stock came after the company reported its fourth-quarter earnings.

At first glance, investors would have thought that SPWR did well, posting a 65% increase in commercial and industrial installations compared to its previous quarter. However, revenue came in 15% lower year over year. Earnings per share fell 40% from the year-ago period. With strong expectations from investors, it is not surprising to see why they might feel disappointed.

Increased Demand For Residential & Commercial Storage Solutions

An acceleration of solar adoption in the U.S. has been predicted with the new administration. This includes growth in solar-storage solutions in which the company participates in. The company said it expects to record losses during the first quarter of 2021. Nevertheless, it is confident that its full-year 2021 result will be able to meet or exceed guidance.

The company’s massive run-up in its stock price is not unwarranted. To some consumers, the company offers some of the best digital solutions that empower homeowners to design and manage their own solar systems without leaving home. Being number 1 in durability and providing a 25-year complete system warranty certainly instill consumer confidence in the company. Residential and commercial solar will continue to grow rapidly as consumers and companies alike continue to transition to renewables.

To top it all off, the company also grabbed headlines towards the end of December, by securing a $56 million project at JFK Airport in New York. This marks the largest solar canopy power project in the state to date.

[Read More] Do You Have These Top Health Care Stocks On Your Watchlist? 4 Making Waves

Enphase Energy

Enphase is a name most renewable energy investors are familiar with. For the uninitiated, the company designs and manufactures home energy solutions. The company has shipped over 30 million solar microinverters and approximately 1.3 million home energy systems to over 130 countries.

Clearly, Enphase is no newcomer to solar energy. ENPH stock sitting at gains over 600% since the market sell-off in March 2020.

The top dog in solar energy reported a strong quarterly report last week. Revenue came in 26.09% higher year over year to $264.84 million which easily beat the estimate of $254.8 million. In addition, the earnings per share also increased 30.77% year over year to $0.51, handily topping the estimate of $0.4. The strong financials together with the growing partnerships and clientele appear to suggest that ENPH may be a long-term buy.

A Growing Solar Inverter Market To Bode Well For ENPH Stock

According to Market Research Institute, the solar inverter market is forecasted to rise 15.45% at a compound annual growth rate. Enphase made a name for itself in June 2008 when it developed the first microinverter system. In laymen’s terms, microinverters sit below solar panels and convert sunlight to electricity for homes and other buildings. Unsurprisingly, they are crucial to the solar energy industry.

Considering the fact that solar homes are now mandated in California for new home construction (possibly more states moving forward), one could expect a surge in these microinverters in the foreseeable future. For investors, this could mean big gains as more people turn to the company for their home energy needs.

[Read More] ExxonMobil (XOM) vs BP (BP): Which Is A Better Oil Stock To Buy Right Now?

SPWR Stock Or ENPH Stock?

Given the strong industry tailwinds and continued federal policy support, you can never really go wrong with either SunPower and Enphase Energy. That said, both are top solar stocks to buy if you have a long-term horizon and don’t mind the volatility along the way. For long-term investors, the dip in SPWR stock may be a great buying opportunity. Of course, the company’s top line may be less encouraging today. But if you are comfortable and have lots of patience, SPWR stock could be attractive.

However, if we are to look at its recent quarterly reports from both companies, ENPH stock seems to be the clear winner. As its microinverter continues to gain traction, it’s not surprising if the stock continues to climb in the near-term. Although the profit margin looks quite a bit slimmer than the numbers in 2020, its company’s revenue projections are stellar, with a potential 41.5% growth in the current quarter. As the stock was taking a little dip along with the broader market, would you be picking up some ENPH stock for its long runway ahead?