As Marijuana Stocks Continue Their Bullish Trend, Are These Stocks On Your Radar?

With a great deal of hype surrounding cannabis stocks, news like legalization can provide the booster jab to the industry. Although the marijuana sector can be a bit tough to invest in. That’s considering how volatile it is, it can play out in one’s favor if we stick and familiarize ourselves with the industry. Some traders like to flip top marijuana stocks because their price movement is rather volatile. Therefore, it could create many opportunities for traders and investors.

Investors are putting up a list of the best cannabis stocks to buy as the marijuana space is benefiting from steps towards legalization. For the uninitiated, March seems like a good time to profit from the pot industry. This comes as more states are planning to launch their recreational marijuana markets. Following this, it’s likely that major federal cannabis reform could take place as well.

With all this in mind, buying pot stocks right now could provide investors an opportunity to potentially score big gains. According to research company BDSA, the global legal cannabis market will be worth $55.9 billion by 2026. To reach that size between now and then, it will have to grow at a compound annual rate of more than 17%. As things continue to progress with the pot industry, some analysts feel the industry could be seeing a strong rebound. Amongst them, Tilray (NASDAQ: TLRY) and Cresco Labs (OTCMKTS: CRLBF) appear to be among the top cannabis stocks to watch in March and beyond. But the question here is, which is the better bet?

Read More

- Looking For Top EV Stocks To Buy? 4 To Watch

- Best Stocks To Buy Right Now? 4 Health Care Stocks To Know

Tilray (TLRY)

Tilray is a pharmaceutical and cannabis company that is incorporated in the U.S. with primary operations headquartered in Ontario. The company was the first licensed producer of medical cannabis in the world to receive a Good Manufacturing Practices (GMP) certified in accordance with European Medicine Agency standards.

For those unfamiliar, it is one of the top marijuana companies in the world. And once its merger with Aphria (NASDAQ: APHA) completes later this year, Tilray could become a more exciting stock to have.

The company may have made some investors very rich back in 2018. That was when TLRY stock skyrocketed from below $25 to above $200. But the hype was short-lived for the company and the broader marijuana industry. After languishing in the single digits for pretty much all of 2020, TLRY stock has begun to show signs of life. It has shown a year-to-date gain of nearly 240%. That is even after the stock lost over half its value since its peak early last month.

Here’s How Tilray Could Potentially Bring Big Gains To Investors

Both Tilray and Aphria currently have a significant presence in the European market. Tilray’s low-cost cultivation and manufacturing facilities in Portugal are a strong point for the company. By growing and processing its cannabis in an EU country, Tilray could avoid tariffs that apply to imported products. On top of that, the merger could lead to the creation of the largest adult-use marijuana company globally in terms of revenue.

More importantly, as Tilray’s brand recognition becomes stronger over time and consumers become more loyal, it won’t necessarily need to fight for a larger market share. Considering the positive synergy effect from the merger, the combined entity would not only achieve improved operating efficiency. What’s more, it will also have more cash to penetrate into new markets or develop new products compared to other industry players. All of the above would go a long way toward supporting earnings growth.

[Read More] 4 Top Tech Stocks To Watch This Week

Cresco Labs (CRLBF)

A vertically integrated marijuana company, Cresco Labs is one of the largest multistate operators in the U.S. The company tops the rank as the largest wholesaler of branded marijuana products.

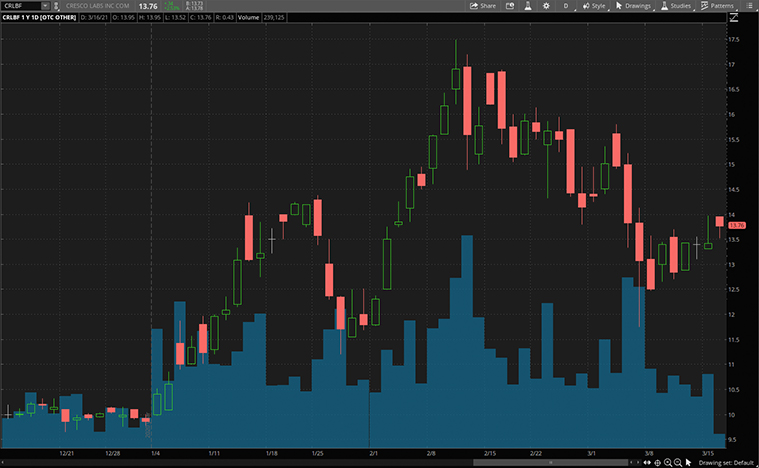

From medicinal marijuana to premium cannabis products for the discerning botanical enthusiasts, you name it, they have it. The past year has seen an amazing ride for CRLBF stock.

The company posted great third-quarter numbers through September 30. The company saw a revenue of $153.3 million. That’s an increase of 63% sequentially and 323% from a year ago. It also had a record $46.4 million in adjusted EBITDA, a rise of 182% over the prior quarter. The company will be reporting its fourth-quarter numbers on March 25.

Why Cresco Labs Is Ready To Go Higher

Marijuana has historically been a criminal substance on the federal level. This has made it difficult for Cresco Labs and the broader industry to operate profitably. Not to mention, these marijuana companies also need to pay an effective 80% tax rate due to 280E taxes. That said, as tough as the regulatory environment may be, Cresco Labs was actually able to scale its businesses in the U.S.

The company believes that its wholesale focus will enable it to maximize profits over the long term. And building out its wholesale distribution network has been the utmost priority. Adult-use legalization has already occurred in Arizona. In addition, legalization efforts are also underway in New York. In fact, Governor Cuomo mentioned that the state is ‘very near’ to legalization. Things are certainly looking up for Cresco Labs. And with the acquisition of Bluema Wellness (OTCMKTS: BMWLF), this would certainly help Cresco Labs to gain massive exposure to the Florida market. Recall that Democratic and Republican senators in Florida have filed for the legalization of adult-use sales this year. Therefore, it is not surprising why investors are bullish with CRLBF stock in the stock market today.

[Read More] Best Crypto Stocks To Buy Right Now As Bitcoin (BTC) Breached $60K?

Bottom Line: TLRY Stock Vs CRLBF Stock

All in all, both companies are great cannabis companies with strong potential. Cresco, as a thriving vertically integrated marijuana company, is well-positioned to take advantage of the increasing legalization, allowing more marijuana sales. Judging from its financials in the recent quarters, it seems to me that there’s still plenty of upside in CRLBF stock.

On the flip side, if you want to bet on the medicinal marijuana niche, then TLRY stock may be a better choice. Instead of strong sales and profit numbers in the near term, the company has the most to gain only if the U.S legalizes marijuana. The question is, do you believe the full legalization of marijuana will take place in the short term? If yes, then by all means take a chance on TLRY stock. The choice is yours.