Are These The Best 5G Stocks To Buy Right Now?

After years of huge investment, the long-awaited switch to 5G technology is well underway. This prompts many investors to search for 5G stocks to buy in the stock market today. 5G networks are up to 100 times faster than 4G. The expansion of 5G should therefore be a boost for smartphone makers, carriers, suppliers, and internet companies which could benefit from higher bandwidth. According to a report from Grand View Research, the global 5G services market will be worth $41.5 billion this year and grow at a compound annual growth rate (CAGR) of 43.9% between next year and 2027.

Now that Apple is jumping into the fray with its 5G-enabled iPhone 12 models, the buzz about 5G is only going to get louder. That’s even if consumers in places like the US aren’t exactly clamoring for 5G devices. The tech giant isn’t well known to be the first to introduce new technology. In fact, it was at least a generation behind in adopting 3G and 4G LTE cellular capabilities.

You could say the same thing is happening with 5G today. But once it jumps in, Apple tends to dominate and shape the market in ways other mobile phone makers can’t. With Apple (AAPL Stock Report) finally unveiling its first 5G iPhone this week, is AAPL stock on your list of top 5G stocks to buy now?

5G Technology Is Here Now, But It Has Yet To Unleash Its Full Potential

It would be unrealistic to expect lighting speed from the 5G technology immediately. We don’t often get a major transition like this. And with major transitions like this, it takes time to reach perfection. For example, even though 4G has been around for some time, there are still locations where the connection is spotty. Chances are we will only see a gradual rollout of 5G.

For investors looking to bet on some of the best 5G stocks like Nvidia (NVDA Stock Report), and Nokia (NOK Stock Report), that means you might not see breakouts right out of the gate. But that’s fine. We are in it for the long term. With careful selection and a healthy dose of patience, investors might just find 5G stocks to be very potent indeed. With all that in mind, are these 5G stocks in the driver seat for the shift in telecommunications technology to reward investors handsomely?

Read More

- 3 Top Cloud Stocks To Watch In October; 2 Making Big Moves This Week

- Are These The Top Tech Stocks Worth Buying Despite Their High Valuations

Top 5G Stocks To Buy According To Analysts: Micron Technology

The 5G era is just getting started, which should mean bigger and better demand for memory and storage demand for the foreseeable future. Micron Technology (MU Stock Report) is one of the three largest producers of DRAM memory and one of the six largest producers of NAND flash storage. This positions MU stock phenomenally to capitalize on that opportunity. Micron Technology has been making big moves again this week after Deutsche Bank upgraded the stock to “Buy” and raised its price target to $60 per share. That implies a 15.7% increase from Tuesday’s closing.

Deutsche Bank analyst Sidney Ho cited DRAM inventory accumulation as a catalyst for the upgrade. The analyst believes that the memory market is heading into a multi-quarter correction. But channel checks suggest that DRAM demand has increased in smartphone and server markets, and the fourth quarter could mark a trough in the cycle.

If you are looking to play into the big tech megatrends of 5G, AI, and the Internet of Things, MU stock is perhaps one of the cheapest options in the stock market. The management explained how the deployment of 5G technology will have a major positive impact on its various businesses during the latest earnings conference call. The potential huge jump in shipments of 5G smartphones could lead to a huge demand for its mobile NAND and DRAM. With all that being said, is MU stock the best 5G stock to buy right now?

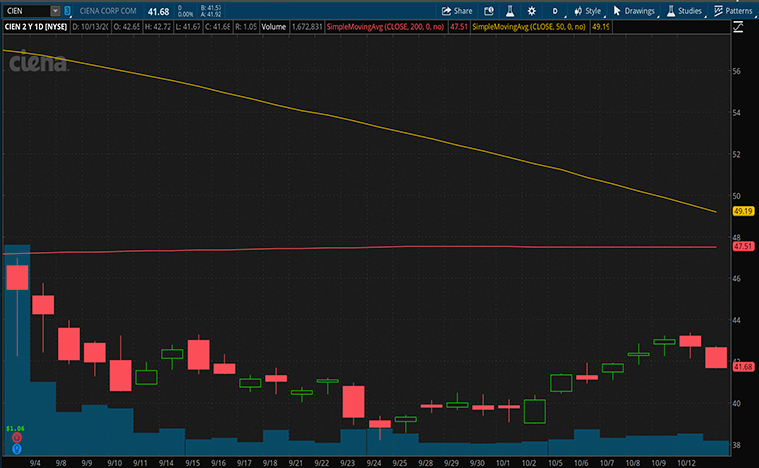

Top 5G Stocks To Buy According To Analysts: Cinea

Ciena (CIEN Stock Report) provides solutions for network operators to adopt communication architectures and deliver services. Like most of its industry peers, CIEN stock has been hurt by the slowdown caused by the coronavirus pandemic. The past month was the month investors would like to forget. That’s because the company lost nearly a third of its value in September. The plunge in CIEN stock was triggered by a mixed set of fiscal third-quarter results. Many savvy investors would have picked up the stock on the cheap when there’s blood in the markets. After all, this is a company that can benefit from major tailwinds from 5G technology. Investors that took a closer look at the company like it a lot given its attractive valuation and long-term potential.

At a trailing price-to-earnings (P/E) ratio of just 18, Ciena is trading at a much cheaper valuation than it was a few months ago. And it is certainly lower than its average multiple of over 50 in the past 5 years. Furthermore, Ciena’s strong balance sheet is reassuring. At the end of the fiscal third quarter, the company had $1.16 billion in cash and slightly over $850 million in debt. The strong cash position will tide Ciena over any short periods of uncertainty. In the same quarter, the company saw $160 million in free cash flow. That figure has gone up steadily in the past few quarters.

Of course, we shouldn’t buy Ciena stock just because it is cheap. But rather it’s because of the solid fundamentals and opportunities ahead. For instance, the company has entered into partnerships with telecom operators globally to lay optical transport networks. Such networks are crucial for 5G rollout due to the higher bandwidth and lower latency. No matter how you slice it, the long-term opportunity remains intact. Like it or not, the 5G networking infrastructure will be booming in the coming years. Considering the opportunity to take advantage of such prospects, would you agree that CIEN stock is a top 5G stock to watch in the long run?

[Read More] Should Investors Consider These Top Streaming Stocks Now That Disney Is Restructuring?

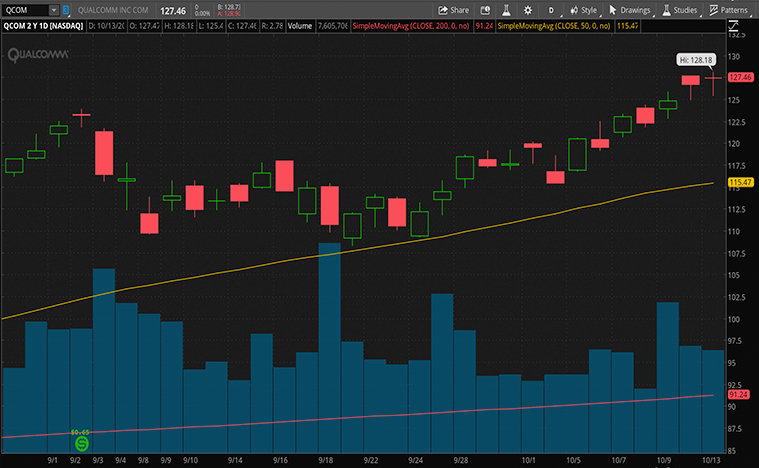

Top 5G Stocks To Buy According To Analysts: Qualcomm

Qualcomm (QCOM Stock Report) is a semiconductor leader that supplies and collects royalties on wireless devices and infrastructure. Qualcomm is well-positioned for revenue and earnings growth as it sells more 5G chips at higher-margin prices in the next several years. The company beat Wall Street’s estimates by $100 million with total revenue of $4.89 billion. From the fiscal report, Qualcomm also provided guidance for its next quarter with a prime focus on the global deployment of 5G. We don’t need an expert to tell us that the Huawei deal is huge.

One of the biggest roadblocks to Qualcomm’s success was a tussle with the U.S. Federal Trade Commission (FTC). And when a company has issues with the government, that is enough to shake off some investors. The company has been lobbying the U.S. government to allow it to export chips to Huawei. Should the export restriction be lifted upon getting the license, that would be a big boost for Qualcomm’s business. And from there, we could potentially see another breakout in QCOM stock.

With the new 5G iPhone from Apple, investors could expect QCOM stock to make another jump. The higher the iPhone sales, the higher the chip sales for Qualcomm. Unless you have been living under a rock, you would know that the stock is gaining significant momentum. Now that the stock is almost 43% higher year to date, could this rally continue to climb into the following year and beyond?