The Pfizer Vaccine Candidate Could Revitalize The Airline Industry

Airline stocks have taken quite a beating in 2020 because of the COVID-19 pandemic. No industry has felt the squeeze from this untimely health crisis more than the airline industry. With the U.S. reporting 100,000 new COVID-19 cases last Wednesday, systemic lockdowns throughout the country appear to be the next best course of action. Logically, this would mean that top airline stocks have continued to plummet, right?

On the contrary, the airline industry appears to be making a slow but steady return. The U.S. Global Jets Exchange Traded Fund (ETF) (JETS Stock Report) has seen a 4% rise as of last week’s closing. In line with the general trend seen by airline stocks, JETS stocks have also seen astonishing gains of 54% in the last six months. Similarly, the American Airlines Group Inc (AAL Stock Report) is seeing a six-month gain of 32%%. Another example would be United Airlines Holdings Inc (UAL Stock Report) which is currently at a 70% gain in the last six months.

It is no surprise that people are likely restless from not being able to travel. With Thanksgiving and the holiday seasons around the corner, more flyers could contribute to this recovering industry. Furthermore, recent news regarding Pfizer’s (PFE Stock Report) vaccine may also provide much-needed aid to the airline industry. Pfizer is on track to ask regulators to approve its vaccine candidate for treating COVID-19 by the end of the month. This news comes as late-stage trials show a 90% effectiveness in preventing infection. Although it is too early to say when this pandemic will end, airline stocks appear to be making an unexpected return. With all that said, here is a list of top airline stocks that could be chartered for a rebound.

Read More

- Are These The Top Biotech Stocks To Watch This Week? 1 Could Be A Winner Of The Vaccine Race

- Are These The Top Tech Stocks To Buy Before The End Of This Month?

Best Airline Stocks To Watch Now: Delta Air Lines, Inc.

Delta Air Lines (DAL Stock Report) jumped more than 15% rise as of 1.10 a.m. ET. Delta is one of the major airlines in the U.S. and is a legacy carrier. The airline company is based in Atlanta, Georgia, and was founded in 1925. Before COVID-19, the airline veteran offered more than 5,000 flights to 325 destinations across six continents. It is also ranked as the second-largest airline in the world.

Admittedly, Delta did not have a good Q3. The company lost $5.4 billion (compared to a profit of $1.5 billion a year ago). The pandemic caused an 83% drop in passengers, which is expected. In tough times like this, investors often look at one aspect of a company. That is its position in terms of liquidity. Delta currently has a massive $21.6 billion in liquidity. Moreover, decreasing cash burn rates since June allows the company more room to prep for a passenger surge this holiday season. Additionally, Delta reported that its net cash sales improved throughout the most recent quarter. It rose from the range of $5 million to $10 million per day to approximately $25 million to $30 million at the end of Q3 2020.

The company has also taken numerous cost-cutting initiatives this year. It managed to repay a $3 billion term loan and a $2.6 billion credit facility. This serves to show that Delta is in control of its finances even in trying times. In its Q3 earnings call, company president Glen Hauenstein explained Delta’s strategy moving forward. Hauenstein said, “With a slow and steady build in demand, we are restoring flying to meet our customers’ needs while staying nimble with our capacity in light of COVID-19.” With all this in mind, could DAL stocks be worth adding to your portfolio?

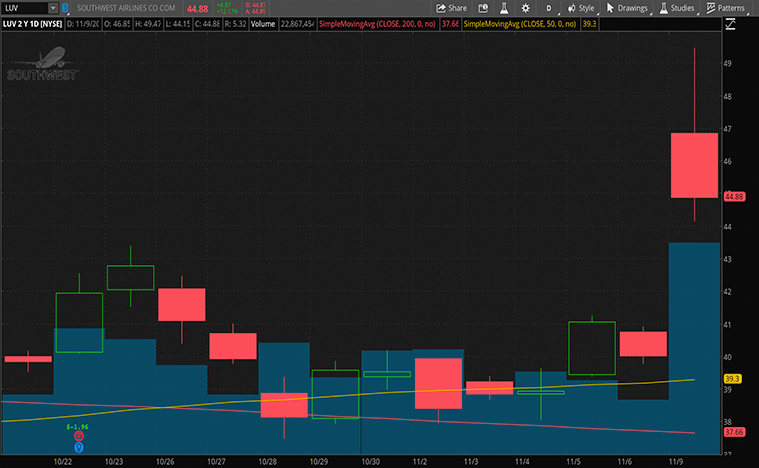

Best Airline Stocks To Watch Now: Southwest Airlines Co

Next up on this list is Southwest Airlines (LUV Stock Report). Southwest Airlines is a major American airline based in Texas. It is also known as the world’s largest low-cost carrier. In Q3, the company saw a net loss of $1.2 billion. This was followed by revenues of $1.8 billion. Like Delta, the company ended Q3 2020 with massive liquidity of $15.6 billion. CEO Gary Kelly mentioned that this consisted of “cash and short-term investments of $14.6 billion and a fully available secured revolving credit facility of $1 billion.”

Kelly went on to explain the company’s strategy towards managing its cash burn. He said, “Since March, we have reduced annual 2020 cash outlays and spending by approximately $8 billion compared with original plans.” He also emphasized that the average core cash burn was approximately $16 million per day in the third quarter of 2020. This is a sequential improvement from the average core cash burn of approximately $23 million per day in fiscal Q2 2020. This could be because of improving revenue trends seen by the company between waves of COVID-19.

Surprisingly, Southwest has seen a 14% surge in share price as of this week’s opening. This marks a 6-month high for the company. This is likely due to the famously all-Boeing (BA Stock Report) carrier potentially turning to Airbus. Southwest will decide whether to buy more Boeing 737 or opt for Airbus A220s next year. The Airbus A220 is considered more fuel-efficient than the standard Boeing 737-700 used by the company. Most would say that this is a long-overdue change for Southwest. The company appears to have its finances in check and plans to further streamline its operations. With a vaccine around the corner, could LUV stocks be a top airline stock to watch?

[Read More] Could These Top Tech Stocks Benefit From A Biden Presidency?

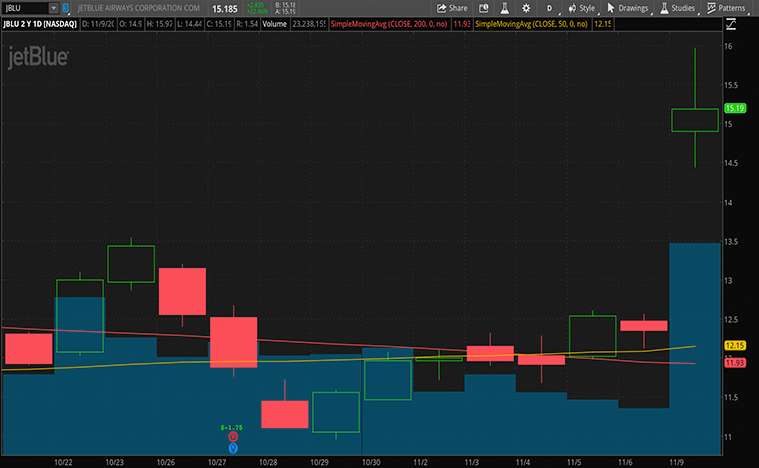

Best Airline Stocks To Watch Now: JetBlue Airways Corporation

The final spot on this list goes to JetBlue Airways Corporation (JBLU Stock Report). JetBlue is a major American low-cost airline. It is the seventh-largest airline in the United States based on passengers carried. The company is based in New York with offices in Utah and Florida. It operates over 1,000 flights daily and serves 100 domestic and international network destinations in the U.S., Mexico, the Caribbean, Central America, and South America.

In Q3, its revenue declined by 76% which was marginally better than the expected 80%. The company reduced its overall capacity by 58% year-over-year. This has helped with managing cash burn and protecting liquidity. Furthermore, JetBlue successfully lowered operating expenses by 45% year-over-year. The company is currently seeing a 25% increase at this week’s opening of the stock market. This is most likely due to the COVID-19 vaccine breakthrough. With a vaccine distributed to the masses, the airline industry could make a comeback as early as next year.

In the company’s financial outlook, JetBlue expects an improvement in sequential revenue with Thanksgiving and the December holidays around the corner. JetBlue is shifting its focus on rebuilding its margins as well. The company is taking an aggressive approach to improving cost structure and better aligning its fixed and variable cost base. As JetBlue is effectively managing its finances, should investors be on the lookout for JBLU stock?