Should Investors Have These Top Communication Stocks On Their Radar This Week?

Does it come as a surprise that communication stocks have been one of the biggest winners in the stock market during the pandemic? In 2020, the importance of communication has been highlighted more than ever. We live in a world where people turn to technology for communication. Internet, cell phone service, video conferencing, video games, and streaming services act as a lifeline that allows us to keep our sanity as we fight through challenging times. Some of the biggest companies in the world occupy the communication sector, dealing with services used by millions of people every day.

Take Netflix Inc (NASDAQ: NFLX) for example. It has already been growing in popularity even before the pandemic, but the pandemic has added millions of new subscribers in a matter of months. With most people staying at home during the pandemic, streaming services such as Netflix provide an indispensable source of entertainment. The company now has a paying customer base of over 208 million subscribers in over 190 countries. But with or without the pandemic, communication stocks are here to stay. Here are some of the top communication stocks to look out for in the stock market today.

Best Communication Stocks To Buy [Or Sell] In June

- Zoom Video Communications Inc (NASDAQ: ZM)

- Snap Inc (NYSE: SNAP)

- Fox Corp (NASDAQ: FOX)

- Facebook, Inc (NASDAQ: FB)

Zoom Video Communications Inc

First, we have the communication technology company, Zoom. It offers a cloud-native platform, which unifies cloud video conferencing, online meetings, group messaging, and a software-based conference room system. This enables users to easily experience Zoom Meetings in their physical meeting spaces. ZM stock was one of the biggest winners in the stock market during the pandemic. However, it has been down by over 40% from its peak last year and in most part trading sideways this year.

Earlier this month, Zoom announced Zoom Events, an all-in-one platform that will be available this summer. Zoom Events combines the reliability and scalability of Zoom Meetings, Chat, and Video Webinars in one solution for event organizers. On top of that, it can produce ticketed, live events for internal or external audiences. This is yet another feature to meet consumers’ demands and adapt to the evolving virtual and hybrid landscape.

Given that the company will be announcing its first-quarter results on Tuesday, investors would be on the lookout for its earning results. However, it is understandable why some would be cautious when investing in ZM stock. People are slowly getting back to their workspace and classes are soon to be back to normal. And some may argue this has been factored in considering its recent lackluster performance in the stock market. So, would you buy ZM stock ahead of its earnings report?

[Read More] Best Industrial Stocks To Buy Right Now? 3 Trending Names To Watch

Snap Inc

Social media company Snap believes in reinventing the camera represents the best opportunity to improve people’s lives and communication. It is mostly known for its camera app, Snapchat. With the company slowly growing in popularity and an actively growing user base, SNAP stock has climbed by over 200% over the past year.

In April, the company announced its first-quarter earnings report. It boasted revenue of $770 million, up by 66% year-over-year. Its daily active users also grew by 22% to 280 million. In fact, this marks the company’s highest ever growth rates in both areas over the past three years. This is a testament to its relentless product innovation and shows the strength of its business.

Not only that, but the company has also finally unveiled the next generation of Spectacles earlier this month. This will be Snap’s first pair of display glasses designed for creators to overlay their Lenses directly onto the world. In addition, it also announced new augmented reality tools and camera experiences for its users. Alongside its partners, Snap is building a camera that transforms how its community interacts with the world around them. All things considered, is SNAP stock a wise investment now?

Read More

- 4 Semiconductor Stocks To Watch Right Now

- What Stocks To Buy Right Now? 5 Consumer Discretionary Stocks To Watch

Fox Corp

Fox Corporation is a news, sports, and entertainment company. It generally operates through three segments: Cable Network Programming, Television, and Other, Corporate, and Eliminations. The company was formed as a result of the acquisition of 21st Century Fox by Walt Disney Co (NYSE: DIS). Hence, the new Fox Corp was formed by assets that were not acquired by Disney. FOX stock has been steadily rising despite being affected by the global pandemic in 2020. It has risen by more than 20% over the past year.

The company reported its third-quarter fiscal 2021 earlier in May. It posted revenue of 3.22 billion but the absence of the prior year’s broadcast of Super Bowl LIV has been a primary factor. Furthermore, it reported a quarterly net income of $582 million as compared to $90 million in the prior-year quarter. Fox has also reclaimed its leadership position as America’s number one cable news network and most-watched cable network in primetime.

Last week, the company also announced that its international streaming service will be expanding into Asia. Featuring live streams of FOX News Channel and FOX Business Network along with 20 other on-demand programs, FOX News International debuted in Mexico last August and now is expanding across Europe, South America, and now across Asia. Starting May 27, the platform will be available in a total of 37 countries worldwide in the nine months since launch. Given its impressive performance, would you consider FOX stock a top communication stock to watch?

[Read More] 6 Top Dividend Stocks To Watch For Your Retirement Plan

Facebook, Inc

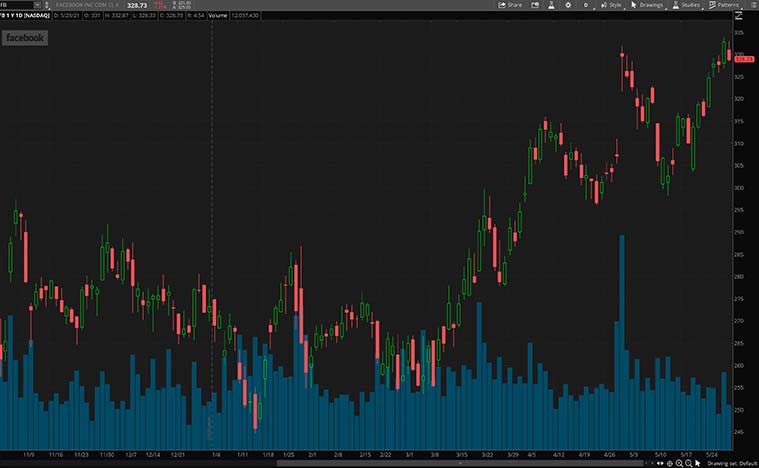

To sum up the list, we have the tech and social media giant Facebook. The company is one of the pioneers of social media as it focuses on building products that enable people to connect and share through multiple platforms. Its products include Facebook, Instagram, Messenger, WhatsApp, and Oculus. FB stock has skyrocketed by over 40% over the past year despite already being one of the biggest companies in the world.

Financially, the company is as impressive as you would expect. From its most recent quarterly report, revenue came in 48% higher year-over-year to $26.17 billion. The social media giant attributed the significant increase in revenue to a 30% year-over-year increase in the average price per ad and a 12% increase in the number of ads delivered. Also, net income grew by a whopping 94% to $9.5 billion.

Most importantly, a key number to note when it comes to Facebook would be its daily active users (DAUs). The company announced an average of 1.88 billion DAUs in its platform from its most recent report. To top it off, Facebook also cited growing e-commerce trends and shifting consumer demands as key drivers for its current momentum. So, would you consider investing in FB stock now?