Are These Gold Stocks On Your Watchlist This Week?

Gold stocks have been on investors’ radar recently. It’s not difficult to understand why investing in the gold industry has been so popular recently. That’s because gold has turned out to be a safe haven during this coronavirus pandemic. There are many benefits from having some of the top gold stocks in your portfolio. The main draw is that these mining companies offer the potential of leveraged upside to the price of gold. When gold prices bounce higher, these companies can then increase their gold production and gain stronger profit margins.

Perhaps you are wondering if we are in a “gold bubble”. Typically, investors use gold to hedge against market volatility and inflation. This year, the stock market crash and excessive stimulus are prompting investors to look for the best gold stocks to buy to ensure their portfolio is protected.

Now that gold is trading around $1,960 an ounce. Let us go back to our main question, is there a bubble in gold? Well, even if you don’t mention it, the question probably pops up quite often in your mind. However, the good news here is, the Federal Reserve is expected to maintain interest rates at dovish levels for several years as indicated by Fed officials. As these monetary policies are more accommodating of inflation, these policy decisions are likely to continue to support gold prices in the near-term.

Read More

- Should Investors Buy These Cloud Stocks Ahead Of Snowflake’s IPO?

- 3 Top Entertainment Stocks To Buy Or Sell In September? 2 Making Big Moves This Week

Best Gold Stocks To Buy [Or Sell] Now: Barrick Gold

The second-largest gold mining company by market capitalization, Barrick Gold (GOLD Stock Report) gained popularity after Berkshire Hathaway (BRK.A Stock Report) (BRK.B Stock Report) built a position worth $546 million in the company. Having Warren Buffet as a substantial holder boosts the credibility and potential of the gold mining company. After all, it was the Oracle of Omaha who made the acquisition. The legendary investor once stated:

“Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

The company also made significant progress on several projects despite the challenges of COVID-19. These include the expansion of Pueblo Viejo in the Dominican Republic and the development of the Goldrush project at Cortez in Nevada. Developing these projects successfully will help the company replenish its gold reserves. With a strong management team and highly attractive dividend yield, Barrick remains a top gold stock to watch in the near-term.

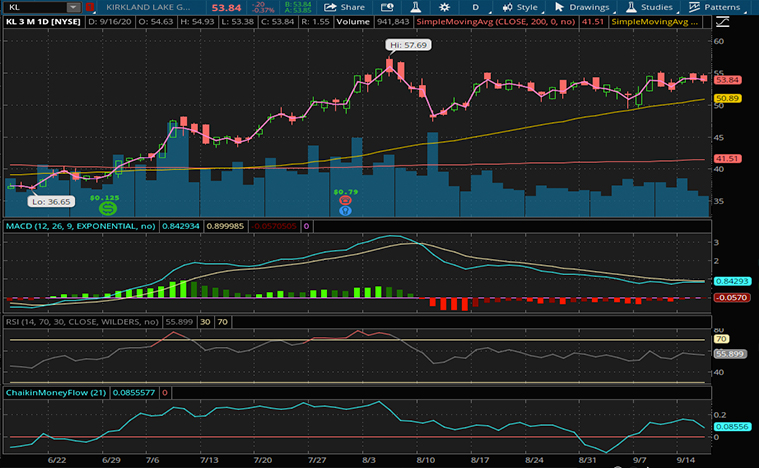

Best Gold Stocks To Buy [Or Sell] Now: Kirkland Gold

Canadian gold miner, Kirkland Lake Gold (KL Stock Report) is one of the highest-growth gold stocks in the market. The company has recently announced that it has entered into a non-binding term sheet with Wallbridge Mining (WLBMF Stock Report). From the terms of this joint venture, Kirkland can earn a 75% interest in Detour East by making expenditures totaling $35 million on the property.

Kirkland Lake generated $418 million in free cash flow in the first half of 2020, helped by the acquisition of Detour Lake earlier this year. The company sees a strong second half as operations ramp up at Macassa. One important metric to look at for gold stocks is a company’s cash flow generation.

Kirkland’s ability to make money from gold can’t be said for some other gold mining companies which are short of cash. It excels in comparison to industry peers like Kinross Gold (KGC Stock Report), making KL stock an attractive gold stock to buy.

[Read More] Are Investors Bullish On These Top Consumer Stocks Right Now?

Best Gold Stocks To Buy [Or Sell] Now: Franco-Nevada

Franco-Nevada (FNV Stock Report) is a streaming and royalty company. Shares of FNV have been rising consistently since the stock market rout earlier this March. The company has agreements covering gold, silver, the platinum metals group, and oil and gas. However, most of its revenue comes from gold. If surging gold prices have attracted investor attention in the gold stocks, management’s optimism about growth opportunities should leave investors with even more to look forward to.

Franco-Nevada generates loads of cash from streaming and royalty contracts. It has the financial strength to make new investments. Its dividends have grown every year since the company went public in 2008. Franco-Nevada has no debt on its balance sheet. That isn’t very common among mining companies.

Franco-Nevada’s focus on royalties and streaming means it can avoid operating cost overruns, an issue that affects many in the industry. Yet, the company still benefits from the same upside as a miner. With the upside but not the downside, perhaps there is free lunch in this world after all. FNV stock has outperformed the gold and the mining sectors historically. And that makes it an ideal gold mining stock.