4 Renewable Energy Stocks To Have On Your Radar Now.

The future of energy generation likely rests on renewable energy companies. As a result, some of the top renewable energy stocks have grown considerably throughout the past year. Why? Well, our current means of producing energy is unsustainable, to say the least. On top of that, renewable energy players would stand to benefit from growing government investments into clean energy tech. Similar to growth stocks, renewable energy stocks could be looking at more gains amidst the current state of the world. In fact, the International Energy Agency projects that oil demand should plateau in the 2030s. Subsequently, this would likely see oil only accounting for 20% of global energy consumption by the 2040s. With renewable energy positioned to take a majority of the multi-trillion-dollar energy industry, I can understand the hype.

To illustrate, we could take a look at solar energy companies like SunPower (NASDAQ: SPWR) and Daqo (NYSE: DQ). Both companies’ shares are looking at gains of over 900% in the past year. This is despite their stocks being hit by the recent pullbacks in the broader tech industry. Sure, investors have momentarily shifted their focus towards reopening plays that could flourish post-pandemic. But, eagle-eyed investors looking towards long-term gains would likely look towards the renewable energy sector regardless. If you are one of those investors, here are four to add to your watchlist now.

4 Top Renewable Energy Stocks To Watch

- Brookfield Renewable Partners (NYSE: BEP)

- Bloom Energy Corporation (NYSE: BE)

- Chart Industries Inc. (NYSE: GTLS)

- First Solar Inc. (NASDAQ: FSLR)

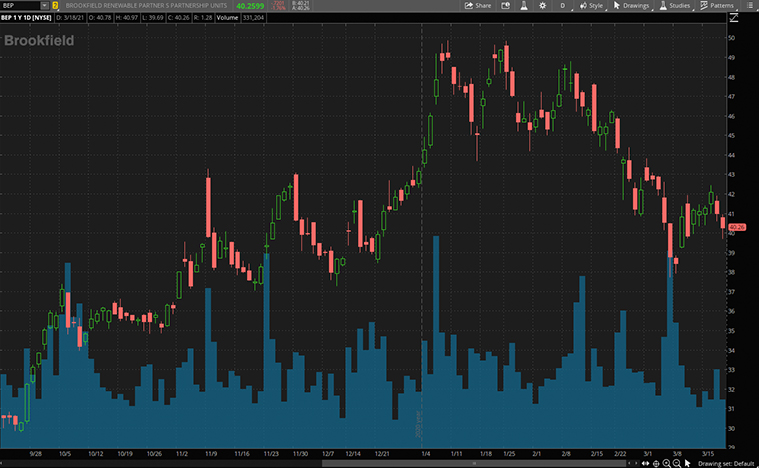

Brookfield Renewable Partners

To begin with, we will be looking at Brookfield Renewable Partners (BEP). BEP operates one of the largest renewable energy platforms globally. The company boasts a massive portfolio with over 20,000 megawatts (MWs) of capacity. Notably, this is thanks to its over 5,000 generating facilities across the U.S., Europe, and Asia. Given the scale of its operations, most renewable energy investors would know of BEP stock. As it stands, BEP stock has more than doubled in value over the past year. Regardless, the company continues to bolster its existing services.

Yesterday, BEP’s Ireland division, Brookfield Renewable Ireland (BRIL), launched a new cloud platform. The likes of which serve to manage its customer billing systems in the Irish energy market. Namely, the company is collaborating with Power Costs Inc., a leading provider of customer support and energy trading software to do so.

According to BRIL Chief Commercial Officer Ciaran O’Brien, the new billing system will be “transformational” for the division’s business. O’Brien cites increased payment flexibility and the system’s scalability as the key benefits here. Given all of this, BRIL can now provide customers with on-demand access to energy data and enhanced reporting. To this end, even an industry giant like BEP can still find means of improving its offerings. Could this make BEP stock worth watching now? You tell me.

[Read More] Looking For Top EV Stocks To Buy? 4 To Watch

Bloom Energy Corporation

California-based Bloom Energy manufactures and markets solid oxide fuel cells that produce electricity on-site. Particularly, Bloom’s cells deliver highly reliable always-on clean electric power. The likes of which are cost-effective and ideal for microgrid applications. In terms of clientele, Bloom caters to many Fortune 100 companies which are leaders in their respective industries. Several of its notable customers include Google (NASDAQ: GOOGL), AT&T (NYSE: T), and NASA. Seeing as organizations require energy to operate in most scenarios, demand for Bloom’s offerings could continue to grow. Likewise, BE stock is thriving with gains of over 800% in the past year.

Aside from its growing microgrid business, the company is also in the commercial hydrogen fuel cell market. Through an ongoing collaboration with SK Group’s engineering division, Bloom is working towards commercializing hydrogen-powered fuel cells and hydrogen-producing electrolyzers. At this point, most would consider Bloom a budding name in the hydrogen fuel market.

Rightfully so, the company is one of the founding members of the “Hydrogen Forward” coalition in the U.S. alongside Shell (NYSE: RDS.A) and Cummins Inc. (NYSE: CMI). Specifically, the coalition will highlight hydrogen as a means of decarbonizing the U.S. economy. This would line up with President Joe Biden’s vision for a net-zero emissions nation by 2050. Given Bloom’s role in all of this, will you be watching BE stock?

Read More

- Making A List Of The Best Retail Stocks To Buy? 4 To Consider

- Best Stocks To Buy Now? 4 Tech Stocks to Watch

Chart Industries Inc.

Following that, we have Chart Industries. To summarize, Chart is a leading independent global manufacturer of highly engineered equipment servicing the energy and industrial gas markets. The company’s comprehensive portfolio is employed at every phase of the liquid gas supply chain. From upfront engineering and service, to even repair solutions. Above all, this makes Chart a leading provider of tech-related to the liquefied natural gas, hydrogen, and biogas industries.

Moreover, the company operates out of 25 facilities across the U.S., Asia, Australia, and Europe. More importantly, GTLS stock continues to outpace most of its peers in the industry as well. The company’s shares have more than doubled in value over the past six months. Based on its latest sale, it seems that Chart plans to keep up its current momentum.

Yesterday, the company closed a deal with hydrogen fuel cell company, Plug Power (NASDAQ: PLUG). In detail, Plug placed an order for two 15 ton per day liquefaction plants. Said plants will enable Plug to build its first-of-a-kind green hydrogen generation network in the U.S. Impressively, Chart’s tech continues to empower leading names in the hydrogen fuel market. Given all of this, will you be adding GTLS stock to your watchlist?

[Read More] Should Investors Buy These Top Entertainment Stocks?

First Solar Inc.

First Solar, as the name suggests, is a key player in the growing solar energy industry. Generally, the company manufactures solar panels and also provides utility-scale photovoltaic (PV) power plants. Regarding its power plant products, it also offers related supporting services such as finance, construction, maintenance, and end-of-life panel recycling. Through its integrated clean power solutions, First Solar offers an economically attractive alternative to fossil-fuel electricity generation today.

All in all, First Solar would stand to benefit from renewable energy tailwinds in the long run. This would be the case as the company basically facilitates the adoption and upkeep of solar power plants. Given FSLR stock’s current value, could it be worth investing in now?

In this case, looking at First Solar’s recent earnings figures may help paint a clearer picture. On February 25, the company posted total revenue of $609 million for its fourth-quarter fiscal. This was followed by massive year-over-year surges of 294% in net income and 292% in earnings per share. Additionally, the company also ended the quarter with over $1.2 billion in cash on hand. CEO Mark Widmar mentioned that First Solar’s 2020 momentum has continued in 2021 with solid year-to-date bookings so far. Not to mention, the company received its largest aggregate order for its latest PV solar modules the day after its earnings were announced. With First Solar kicking into high gear, could FSLR stock follow suit? The choice is yours.