Stock Market Futures Marginally Higher Despite Concerns Over Lackluster Earnings And Rising Bond Yields

Stock market futures are rising in early morning trading today. All in all, this is amidst the ongoing volatility in stocks now. Between soaring bond yields, inflation, expected interest rate hikes, and less-than-ideal earnings figures, there remains plenty of pressure on the stock market now.

Speaking on all this is Citi (NYSE: C) Global Wealth chief investment officer, David Bailing. Bailing states, “I think it’s definitely a repositioning of the market to deal with really what the Fed has done. And the Fed has basically created some certainty around the fact that there will be rate rises.” He continues, “What we’re seeing now is a broad-based reevaluation of the highest growth shares, which obviously are the most sensitive to interest rates. But what’s happened is it’s taking place across the board.” Amidst all of this, the CIO believes that there will be “a buying opportunity in areas like fintech, in areas like cybersecurity where you have very steady growth, you have increased cash flows and potentially profitability, as opposed to the more speculative shares.”

Regardless of whether or not you share the same views as Bailing, there remains plenty of stock market news on deck today as well. As of 7:14 a.m. ET, the Dow, S&P 500, and Nasdaq futures are trading higher by 0.20%, 0.28%, and 0.39% respectively.

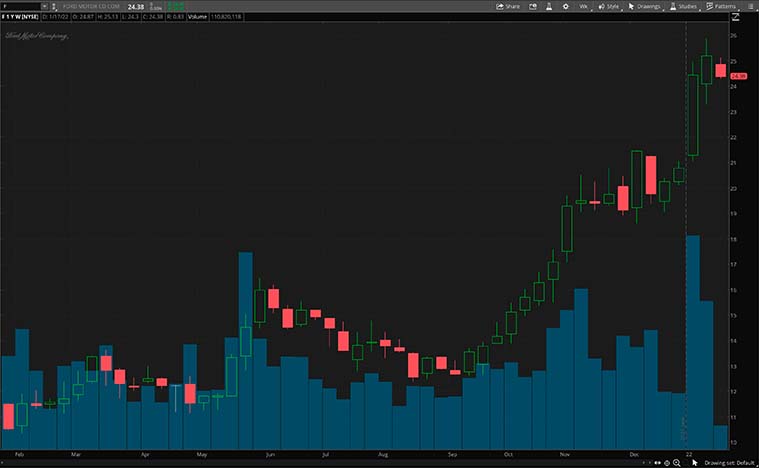

Ford Set To Rake In $8.2 Billion In Gains From Rivian Investment; Teams Up With ADT On Vehicle Security Venture

In the news today is the Ford Motor Company (NYSE: F) or Ford for short. Notably, this is thanks to the company’s latest updates on its current investments. According to Ford, it will be recording a whopping $8.2 billion in gains from its equity investments in Rivian Automotive (NASDAQ: RIVN). Namely, this would be thanks to Ford owning a stake of about 12% in Rivian. Furthermore, the company will also be reclassifying its $900 million first-quarter 2021 non-cash gain on the Rivian investment as a special item. This, of course, would weigh on Ford’s full-year adjusted earnings. The likes of which it forecasts to be within the range of $10.5 billion and $11.5 billion.

Alongside this, the company is also working with ADT (NYSE: ADT), a provider of home and business security and alarm monitoring solutions. The duo have launched a joint venture (JV) known as Canopy. Through this JV, Ford is looking to identify vulnerabilities in existing vehicle security systems. For now, Canopy is planning to offer an aftermarket car accessory to be attached to vehicles. Upon doing so, the device can monitor the car’s surroundings and alert owners of potential thefts or vandalism. As such, I could see investors looking out for F stock in the stock market today.

[Read More] Best Stocks To Buy Right Now? 4 Consumer Discretionary Stocks To Know

SoFi Surges On Regulatory Nod To Become Bank; Mastercard Lands NFT Payments Deal With Coinbase

Elsewhere, there seems to be plenty of news to consider in the fintech sector today as well. On one hand, personal finance firm SoFi (NASDAQ: SOFI) is making waves in the stock market now. For the most part, this is thanks to news regarding the company passing its last regulatory step in becoming a bank. As a result of this, SOFI stock is skyrocketing by over 16% during pre-market trading today. Now, all this comes from SoFi receiving approval from the Office of Comptroller of the Currency, and the Federal Reserve. In turn, it can now be a bank holding company.

On the other hand, Mastercard (NYSE: MA) is currently working with Coinbase Global (NASDAQ: COIN). Through the partnership, Coinbase users can use Mastercard credit and debit cards to purchase non-fungible tokens (NFTs). These transactions will mostly take place on Coinbase’s upcoming NFT marketplace. In doing so, both firms stand to benefit from the growing adoption of NFTs among other crypto-related consumer trends. Not to mention, through its alliance with Mastercard, Coinbase would be simplifying the NFT purchasing process for consumers.

In fact, all of this would also play into Mastercard’s ongoing push into the world of crypto. Since last October, it has been and still is working with Bakkt, facilitating crypto-related services across its financial service networks. Because of all this movement in the fintech space now, it would not surprise me to see investors considering fintech stocks.

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

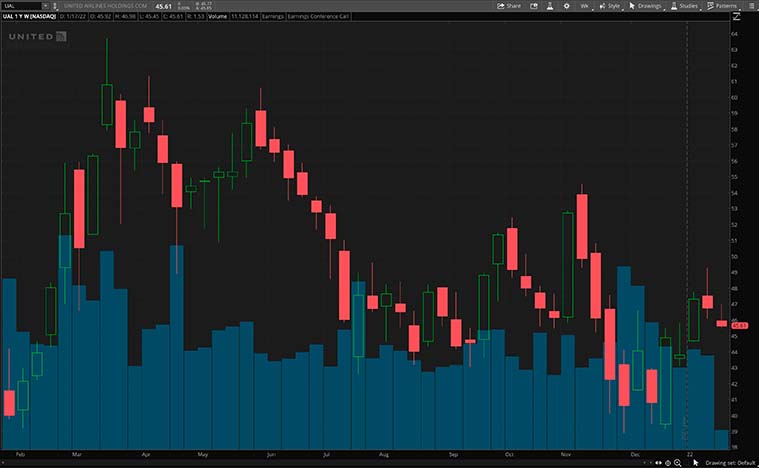

United Airlines Earnings On Tap After The Closing Bell

On the earnings front, we have United Airlines (NASDAQ: UAL) set to report after today’s closing bell. Before that, investors could be wondering what are the current estimates for the firm. For starters, Wall Street analysts are currently eyeing a loss per share of $2.09 for the quarter. Should this be the case, it would mark a significant 70.1% year-over-year improvement. Moreover, consensus forecasts for revenue are now at $7.96 billion, suggesting a whopping 133% year-over-year surge. In the larger scheme of things, it seems that analysts expect UAL to continue its recovery from the pandemic.

For reference, many are likely looking towards UAL’s industry peer Delta (NYSE: DAL). Just last week, the airline operator exceeded estimates in its fourth-quarter earnings report. Despite Delta’s reservations about the current quarter on rising Omicron variant concerns, the firm is projecting solid profits in the following quarter. Sure, all of this would be depending on improving pandemic conditions following the current wave of infections. However, with the highly infectious yet less severe variant seemingly slowing down, investors may be looking towards airline stocks now. With that in mind, UAL stock could be worth keeping an eye on later today.

Notable Earnings To Consider In The Stock Market Today

Aside from all that, it is also important to remember that the fourth-quarter earnings season is upon us. With that, comes a huge collection of companies reporting quarterly figures this week. Whether it is pre-market earnings or post-market earnings, this is apparent. Before the opening bell today, we have several big banks in focus. This includes Bank of America (NYSE: BAC), Morgan Stanley (NYSE: MS), and US Bancorp (NYSE: USB). Additionally, the likes of UnitedHealth Group (NYSE: UNH), Procter & Gamble (NYSE: PG), Fastenal (NASDAQ: FAST), and ASML Holdings (NASDAQ: ASML) are hosting earnings calls as well.

Alternatively, those focusing on earnings in the post-market hours also have many prominent firms to note. This includes but is not limited to Alcoa (NYSE: AA), Kinder Morgan (NYSE: KMI), Discover Financial Services (NYSE: DFS), and First National Bank (NYSE: FNB). From corporate updates to quarterly earnings, there is no shortage of activities to keep investors occupied in the stock market today.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!