Are These Top Tech Stocks Worth Watching Now?

While 2022 may not be the best year for tech stocks so far, tech companies across the board continue to perform this earnings season. As such, investors may not want to dismiss this part of the stock market just yet. After all, as we often say here at StockMarket.com, the world of tech is ever-evolving. By extension, this would be in line with the industry’s focus on growth and innovation. Sure, growth stocks may not necessarily be the most attractive short-term plays at the moment. This would especially be the case with the Federal Reserve set to raise interest rates later this year. However, the past week in tech earnings could serve to convince investors to eye long-term gains.

Namely, we could look at the likes of Mastercard (NYSE: MA) and IBM (NYSE: IBM). To begin with, Mastercard reported an earnings per share (EPS) of $2.35 on revenue of $5.22 billion. This tops consensus estimates of $2.21 and $5.17 billion respectively. In detail, Mastercard cites steady rebounds in consumer spending for this performance with cross-border spending rising above pre-pandemic levels. Likewise, IBM also handily beat consensus estimates with an EPS of $3.35 on revenue of $16.70 billion. These are but two instances of the tech industry’s current operational momentum. With that said, could one of these tech stocks be your next big investment?

Tech Stocks To Watch Ahead Of February 2022

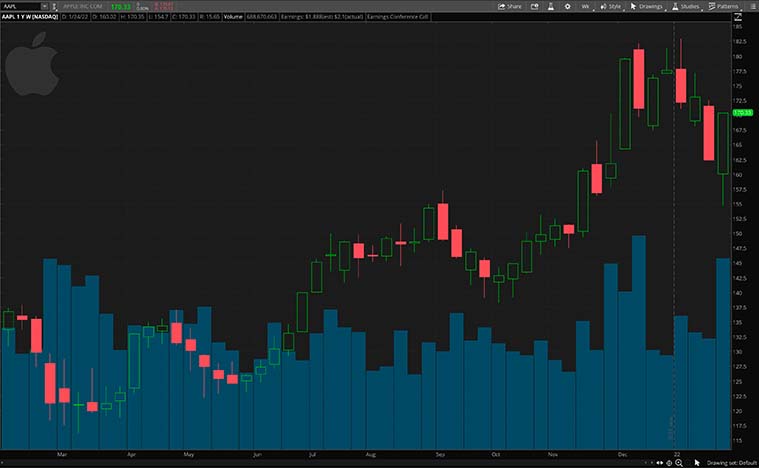

- Apple Inc. (NASDAQ: AAPL)

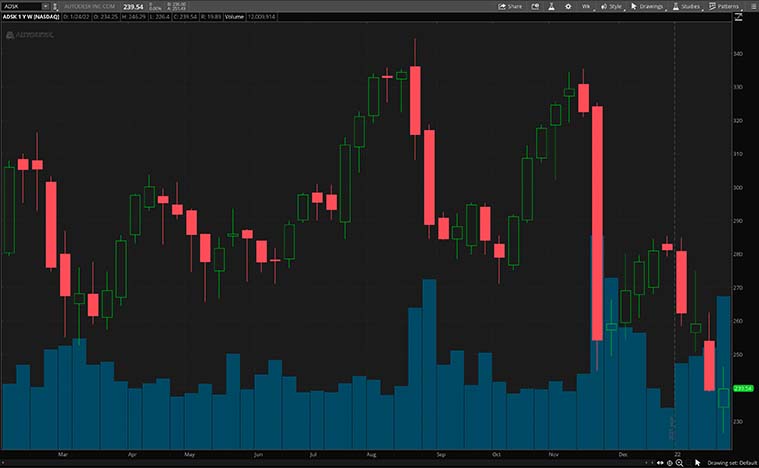

- Autodesk Inc. (NASDAQ: ADSK)

- Microsoft Corporation (NASDAQ: MSFT)

Apple

When it comes to consumer tech, few, if any businesses, can compare to Apple today. Through its industry-leading portfolio of tech offerings, the company continues to dominate the tech scene. From the latest iPhones to its MacBooks and iMacs, Apple brings cutting-edge features to consumers across the globe. At the same time, the company also provides a comprehensive suite of software solutions that complement its offerings. All of which works in tandem to form a holistic tech ecosystem providing Apple users with ease-of-use, interconnectivity, and convenience. As such, I could understand if AAPL stock is on investors’ watchlists.

Supporting all of this is the company’s latest quarterly earnings figures. Diving in, Apple posted a record revenue of $123.9 billion for its December quarter. For comparison, this is well above analyst estimates of $118.66 billion. Additionally, the company also recorded an EPS of $2.10, exceeding forecasts of $1.89. In terms of year-over-year change, this adds up to a sizable 25% increase. Not to mention, Apple’s iPhone revenue is also sitting above estimates by over $3 billion, totaling $71.63 billion for the quarter.

Speaking of specific product segments, the company saw mostly green across the board in terms of year-over-year product revenue growth. Except for its iPads, the company beat Wall Street estimates across all its core product categories. All in all, the company appears to be firing on all cylinders exiting the holiday season. According to CEO Tim Cook, the company could maintain its current momentum in moving forward as well. Cook said that Apple is expecting “solid year-over-year revenue growth,” and for supply chain constraints to lighten in the current quarter. With such strong fundamentals, would you consider AAPL stock a top watch?

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

Autodesk

Following that, we will be taking a look at Autodesk. Generally, the company’s tech focuses on creating comprehensive structures in digital spaces. In particular, Autodesk caters to the architecture, engineering, construction, media and entertainment, and manufacturing-focused industries among others. For companies looking to create infrastructure in the metaverse, Autodesk would be an option to consider. While ADSK stock has been under pressure over the past month, investors looking to jump on the current weakness in tech stocks may be interested.

Meanwhile, Autodesk is also hard at work growing its operations as well. Notably, the company made an acquisition earlier this month. Namely, Autodesk acquired Moxion, a New Zealand-based developer of a powerful, cloud-based platform used by filmmakers. Through Moxion, film industry professionals can collaborate and review camera footage on-set or remotely efficiently. In turn, they can make creative decisions immediately during the principal photography stage with high-quality image quality. To point out, Moxion was used in the making of the blockbuster film The Matrix Resurrections.

Safe to say, this buy would significantly expand Autodesk’s Media and Entertainment division. According to Autodesk, it would push its portfolio beyond post-production into the production process of filmmaking. Commenting on all this is Autodesk SVP of Media and Entertainment, Diana Colella. She noted, “As the content demand continues to boom with pressure on creators to do more for less, this acquisition helps us facilitate broader collaboration and communication, and drive greater efficiencies in the production process, saving time and money.” With all this in mind, will you be adding ADSK stock to your tech stock watchlist?

[Read More] 4 Artificial Intelligence Stocks To Watch Right Now

Microsoft

Another name to consider among the top tech stocks now would be the Microsoft Corporation. Most would be familiar with the company’s gargantuan array of tech offerings and solutions. Whether it is productivity software, gaming, or cloud computing among other cutting-edge tech fields, Microsoft often brings its A-game. Accordingly, this seems to ring true from the company’s latest quarterly earnings figures.

In its latest earnings report, Microsoft posted solid numbers all around. For starters, the company posted an EPS of $2.48 on revenue of $51.73 billion for the quarter. To highlight, this handily beats Wall Street forecasts of $2.31 and $50.88 billion respectively. More importantly, Microsoft Azure, the company’s cloud computing division, appears to be going from strength to strength. This is apparent as Azure’s quarterly revenue surged by a commendable 46% year-over-year. Overall, Microsoft continues to cater to surging demand for cloud-related services.

Not forgetting, the company also made massive waves in the gaming industry earlier this month. This would be due to its massive ongoing acquisition of Activision Blizzard (NASDAQ: ATVI). Through the $68.7 billion all-cash deal, Microsoft will become the third-largest gaming company by revenue worldwide. By acquiring Activision, Microsoft will gain access to the legendary Call of Duty gaming series among other notable IPs. With the company seemingly kicking into high gear now, could MSFT stock be a viable long-term play in your books?

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!