The tech sector, in simple terms, is like the engine room of our modern world. It encompasses a range of companies that create computers, software, electronics, and other products or services related to technology. These companies often lead the charge in innovation, regularly introducing us to groundbreaking gadgets, apps, or platforms that transform how we live, work, and play.

For those interested in the stock market, tech stocks can be both exciting and challenging. These stocks represent businesses at the forefront of tomorrow’s biggest trends, from AI to 5G connectivity. When you invest in tech stocks, you’re essentially placing a bet on the future, hoping these companies will continue to grow and dominate their fields.

However, because technology changes rapidly, these stocks can also be unpredictable. Still, with the right research and understanding, tech stocks offer the potential for significant growth and returns. Considering this, let’s look at three large-cap tech stocks to keep an eye on in the stock market today.

Tech Stocks To Buy [Or Avoid] Today

- Microsoft Corporation (NASDAQ: MSFT)

- Apple Inc. (NASDAQ: AAPL)

- Amazon.com Inc. (NASDAQ: AMZN)

Microsoft (MSFT Stock)

First, Microsoft Corporation (MSFT) stands as a global technology leader, offering a broad suite of products and services, including its renowned Windows operating system, Microsoft Office suite, and cloud solutions through Azure. Its advancements in AI, machine learning, and enterprise solutions position it as a key player in the modern tech landscape.

Back in July, Microsoft shared its financial results for the fourth quarter of 2023. The company reported a revenue of $56.19 billion and earnings of $2.69 per share, surpassing the anticipated predictions of analysts’ which stood at earnings of $2.54 per share and revenue of $55.44 billion. Additionally, this represents an 8.34% increase in revenue when compared to the same timeframe the year prior.

In the last month of trading, shares of MSFT stock are trading higher by 3.02%. Meanwhile, during Tuesday’s trading session, Microsoft stock is trading lower off the open by 1.23% so far, trading at $333.75 a share.

[Read More] Best Stocks To Invest In Right Now? 2 EV Stocks For Your September List

Apple (AAPL Stock)

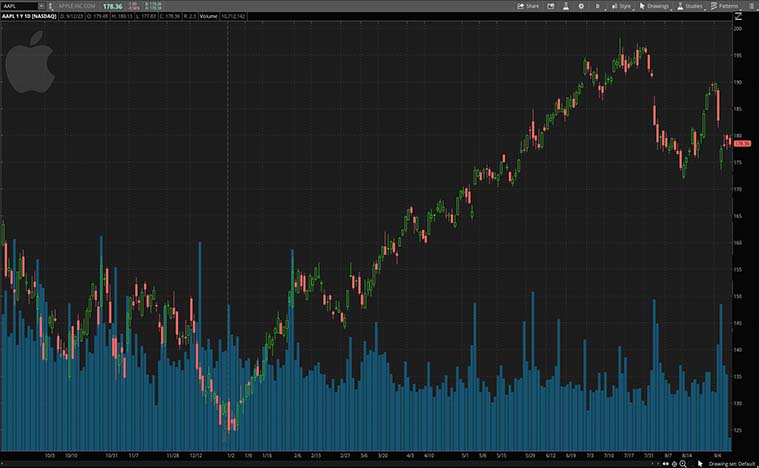

Next, Apple Inc. (AAPL) is recognized for its innovative consumer electronics and software. With products like the iPhone, iPad, and the Mac, the company continues to shape the tech industry, complemented by its software ecosystem which includes iOS, macOS, and the App Store.

Last month, Apple reported better-than-expected third-quarter 2023 financial results. In detail, the company announced earnings of $1.26 per share, with revenue of $81.80 billion. This is compared with Wall Street’s consensus estimates for the quarter which were earnings of $1.19 per share and revenue of $72.81 billion.

Looking at the last month of trading action, shares of AAPL stock are pulled back modestly by 1.57%. With that, during Tuesday morning’s trading session, Apple stock opened the day down by 1.45%, trading at $176.76 a share.

[Read More] 3 Blue Chip Stocks To Watch In The Stock Market Today

Amazon (AMZN Stock)

Last but not least, Amazon.com Inc. (AMZN) has transformed from an online retail platform into a global e-commerce and cloud computing powerhouse. Its expansive range of services now includes AWS, one of the leading cloud service providers, Prime Video for streaming, and a plethora of consumer-focused technologies and services.

Just today, Tuesday, Amazon announced its new “Supply Chain by Amazon” at its annual Accelerate conference. This all-in-one service provides sellers with a streamlined process to transport products from manufacturers directly to global customers. Amazon will handle logistics, including international shipping, customs, and storage. This allows sellers to concentrate on product development and business growth, while Amazon ensures quick deliveries and cost-efficient operations, benefiting both the seller and the end customer.

Over the last month of trading action, Amazon stock is trading slightly higher by 0.50%. While, on Tuesday morning, shares of AMZN stock opened lower by 1.28%, currently trading at $141.31 a share.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!