Check Out These 4 Top Value Stocks In The Stock Market Today

As we approach the end of another trading week, the stock market continues to be under pressure. As of today, the Nasdaq Composite is already down around 10% since the year started. All this shouldn’t come as a surprise considering that many expect the Federal Reserve to start raising rates multiple times this year.

As a result, many hyper-growth names could continue to trade sideways heading into the Fed’s meeting next week. Against the backdrop of a rising rate environment, perhaps it’s a good idea to have some exposure to value stocks. Sure, value stocks may not be as exciting or provide significant returns in a short period of time. Yet, many investors might want to diversify into value stocks as a potential hedge if you believe the downturn could continue.

It’s worth noting that some of the best growth stocks to buy during the pandemic have seen a reversal of fortune. On Thursday, we saw Peloton Interactive (NASDAQ: PTON) slid by a massive 23%, wiping roughly $2.5 billion in market valuation. This landslide came after rumors of the company temporarily halting production of its fitness products as consumer demand wanes. Separately, streaming giant Netflix (NASDAQ: NFLX) predicted that growth would suffer much more than expected in the first quarter of 2022. This sent NFLX stock plummeting around 20% in the pre-market trading today. Considering that many of the top growth stocks continue to trade lower, it might just be a good time to put up a list of top value stocks to buy in the stock market today.

Top Value Stocks To Watch Today

- General Motors Company (NYSE: GM)

- Meta Platforms Inc. (NASDAQ: FB)

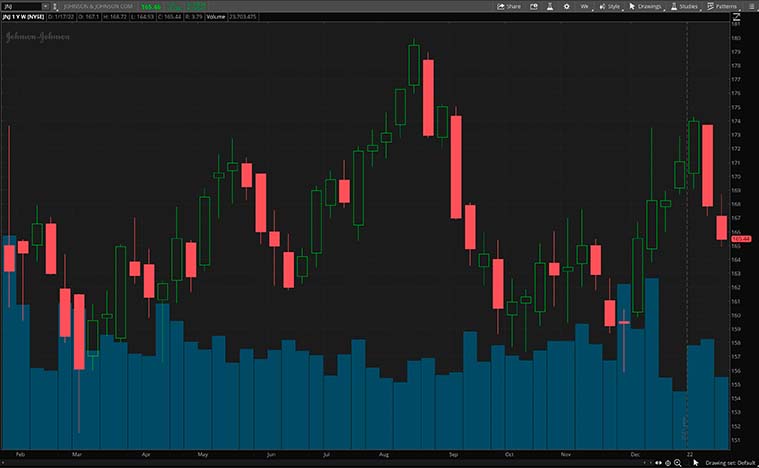

- Johnson & Johnson (NYSE: JNJ)

- Starbucks Corporation (NASDAQ: SBUX)

General Motors

First, on the list, we have General Motors (GM), one of the leading automotive manufacturers in the world. In short, the company designs, builds, and sells trucks and cars worldwide. Its car brand portfolio consists of famous brands such as Chevrolet, Buick, GMC, and Cadillac among others. Recently, the automotive titan has been focusing on switching towards having a fully electrified product line. As such, GM has committed itself to launch 30 new EVs by 2025.

Earlier on Wednesday, the company announced plans to broaden its electrification strategy. Namely, it announced new commercial applications of its HYDROTEC fuel cell tech. The projects which leverage upon this fuel cell technology are still in the works. Specifically, these projects include heavy-duty trucks, aerospace, and locomotives, but GM plans to use this tech beyond vehicles for power generation. Ultimately, GM’s fuel cell tech could replace gas and diesel generators with lower emissions at worksites and buildings to name a few. Besides that, last week, Deutsche Bank raised the price target for GM stock from $67 to $71. With this innovative fuel cell tech at play, would you add GM stock to your portfolio?

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

Meta Platforms

As its name suggests, Meta Platforms is shifting its focus on building and expanding the metaverse. At the same time, the company boasts a portfolio of social media platforms used by billions around the world. These include Facebook, Instagram, and WhatsApp. It also owns Oculus, a company that produces virtual reality (VR) headsets, facilitating entry into the metaverse.

Yesterday, it was reported that Meta is working on plans to allow users to create and sell non-fungible tokens (NFTs), joining the other slew of companies rushing to capitalize on the NFT craze. Supposedly, teams at Facebook and Instagram are working on a feature that will allow users to display their NFTs on their social media profiles. Additionally, the company is working on a prototype to help users create their own NFTs. According to several people familiar with the matter, the company is also in talks to launch a marketplace for users to buy and sell NFTs. However, it is important to note that these are early-stage efforts that could change. Given this news of Meta diving into the NFT scene, will you be putting FB stock on your watchlist?

[Read More] Best Monthly Dividend Stocks To Buy Now? 5 For Your List

Johnson & Johnson

Johnson & Johnson, or JNJ for short, is a legacy healthcare company that develops medical devices, pharmaceuticals, and consumer packaged goods. It has been around for more than a century and is one of the largest and most broadly-based health companies in the world. Seeing that JNJ has long been viewed as a bellwether stock for other health care companies, its early slot in the earnings calendar will set the tone for other health care companies. On January 25, the company is expected to reveal its fourth-quarter earnings. Investors will also be paying attention to their newly-appointed CEO Joaquin Dato, and what he has to say about the direction of the company.

In other news, last week, it was found that a JNJ COVID-19 booster shot is 85% effective in protecting against the Omicron variant. Once the booster shot is administered, it will protect against being hospitalized by the variant for 1 to 2 months. The findings were reported by the South Africa Medical Research Council (SAMRC). With that being said, will you be keeping an eye on JNJ stock ahead of its quarterly earnings next week?

[Read More] Top Stock Market News For Today January 21, 2022

Starbucks

Finishing off our list of top value stocks to buy is Starbucks. This company needs little introduction seeing that it is the largest coffeehouse chain in the world. It serves on average, about 4 billion cups of coffee a year globally. Through its global network of 34,000 stores, the company serves high-quality arabica coffee to its customers.

Earlier this week, the company expanded its delivery and online services in China. It did so by partnering up with Meituan, the biggest food delivery platform in China. Accordingly, customers can use Meituan’s app to order drinks as well as book activities such as coffee-tasting experiences at their local Starbucks chain. This partnership came about as Starbucks faces increasing pressure from well-funded domestic tea and coffee chains in China such as HeyTea and Manner. In the last quarter, Starbucks reported a revenue of over $8.1 billion, a 31% year-over-year increase. Besides that, diluted earnings per share increased to $1.49 from $0.33 the year before. On that note, would you consider buying SBUX stock?

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!