Are These 2 Top Car Rental Stocks On Your Watchlist For July?

The crash of the stock market from February to March was not friendly to rental car stocks. Most people rent cars while traveling, and travel has been a dead industry. People are scared of getting the virus during the current outbreak. This means that traveling is at an all-time low. This also means rental car sales are at an all-time low as well. People are barely leaving their homes let alone going places. The risk of catching the virus is too high with millions of cases around the world.

When reopening news comes out, top rental car stocks tend to trend upwards. Customers will return to rental car companies once traveling becomes mainstream again. The return of traveling could cause the recovery of rental car stocks. The future is still uncertain but it can be expected for rental car stocks to go up once travel is back.

Back in February and March when the market crashed, rental car stocks were among the most hit. Some rental car stocks dropped to new lows for the companies. As businesses have continued reopening it has brought us closer to traveling once again. The issue is fears of a second virus wave. So it is clear that rental stocks are in a volatile place. This does not mean that rental car stocks can’t rise though. Let’s look at two rental car stocks that have managed to grow in the market despite dark economic times.

Read More

- Are These 2 Top Tech Stocks A Buy In 2020?

- Are These The Best Consumer Stocks To Buy In July 2020?

- Is Nikola The Next Tesla, Or Better?

Top Car Rental Stocks To Buy [Or Sell] In July: Avis Budget Group

The first rental car stock, Avis Budget Group Inc. (CAR Stock Report) is an American rental car company. It was founded in 2006 and is one of the largest rental car companies in the United States. Avis was the first rental car business to be located directly at an airport. This started a trend for the rest of the rental car companies. It purchased a car-sharing company Zipcar in 2013 for $491 million. Avis is in fact the leading general use vehicle rental company in multiple places. This includes North America, Australia, and New Zealand.

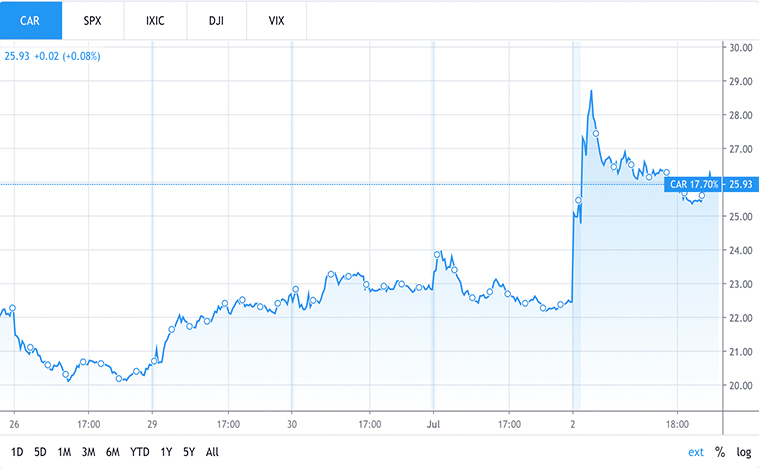

Shares of CAR stock fell hard like the rest of rental car stocks in February and March. In February CAR stock price was at $50 a share on average. Then CAR stock fell as low as $7 a share in March. Since then, CAR stock price has gone up to $25 a share as of July 3rd. This could mean that CAR stock is on its way back up. It is still half of the price it once was but CAR stock price has been on the rise. If the travel world begins to make a comeback it is possible for CAR stock to as well.

From July 1st to July 2nd there was a 27% increase in CAR stock price. This is due to used car sales rising up. Since Avis also sells used cars, this is good news for them. Consumers have still been purchasing cars during the pandemic. So it is possible for CAR stock to rise even higher in the future.

[Read More] 2 Automotive Stocks To Watch In 2020: Ford Vs. Ferrari

Top Car Rental Stocks To Buy [Or Sell] In July: HyreCar

The next rental car stock to watch is HyreCar Inc. (HYRE Stock Report) which could be on the road to recovery. HyreCar rents out cars to people who drive for Uber (UBER Stock Report) or Lyft (LYFT Stock Report). The company was founded in 2014 and is based in Los Angeles. As a relatively new company, it seems to be doing alright in the market.

Before the market crashed shares of HYRE stock were at $3.95 a share. Once it crashed HYRE stock price fell as low as $0.94 a share. This 76% decrease was bad for HYRE stock. But since then, HYRE stock price has rose back up to $2.98 a share on average as of July 3rd. This means that HYRE stock could be on the road to recovery. If it can continue offering its services to more people HYRE stock price will go up.

Bottom Line

It is clear that there is potential for some rental car stocks. HYRE stock and CAR stock are seeing what could end up being recovery. This makes these companies two potential rental car stocks to buy. As travel opens up more it is possible for these rental car stocks to go higher, or even reach new heights.