Top 3 Food Stocks To Watch In September

Food stocks are having a volatile run in the stock market during the economic crisis. Many restaurants were forced to close for a while. On the other hand, food companies that offer products in supermarkets like Beyond Meat (BYND Stock Report), and Kroger (KR Stock Report) saw an increase in profit. This is due to people not wanting to eat at restaurants due to the coronavirus pandemic. People are more likely to buy food at the supermarket and bring it home or get takeout.

Top food stocks to watch that are related to restaurants rise when more news regarding reopening is released. Many restaurants have already opened with social distancing guidelines in place. Food delivery services have also seen a big increase in business due to stay at home orders. People want to order food instead of going out during this pandemic. Food stocks related to delivery have seen stock prices rise and recover already. So let’s look at three food stocks that have been trending in the market in 2020.

Read More

- Top 5 Things To Watch In The Stock Market This Week

- Are The Best Stocks To Buy As The Streaming Market Grows?

Top Food Stocks To Watch In September 2020: Papa John’s International Inc.

Let’s first talk about Papa John’s Interternational Inc. (PZZA Stock Report). Papa John’s is a pizza delivery company based in the United States. Papa John’s is presently the fourth largest pizza delivery company in the United States. The company has experienced great growth during the economic crisis as many are ordering food instead of going to restaurants. Papa John’s released its second-quarter results for 2020 on August 6th.

Second quarter saw a sales increase of 5.3% during the pandemic. Excluding temporary closures, international sales increase of 13.3% as well.

The President and CEO of Papa John’s Rob Lynch said, “Faced with an unprecedented global challenge but guided by our values and purpose, Papa John’s achieved record sales in the second quarter. “Across the U.S. and those international markets where delivery-based businesses have remained open, we have safely and successfully met the needs of millions of new and returning customers who have relied on us for high-quality, delicious pizza, Papadias, and other food during the pandemic.”

Top Food Stocks To Watch In September 2020: Chipotle Mexican Grill Inc.

The second food stock to discuss is Chipotle Mexican Grill Inc. (CMG Stock Report). Chipotle is a fast food chain that offers a variety of Mexican food such as tacos, burritos, and more. This business has thousands of locations and has seen swift expansion in the last decade. Chipotle is an example of a food stock that has grown sturdy during the harsh economic climate. It offers its food on delivery services such as DoorDash, and also allows for pickup. In 2020 the company opened its ordering app to Canada allowing for business to expand even more.

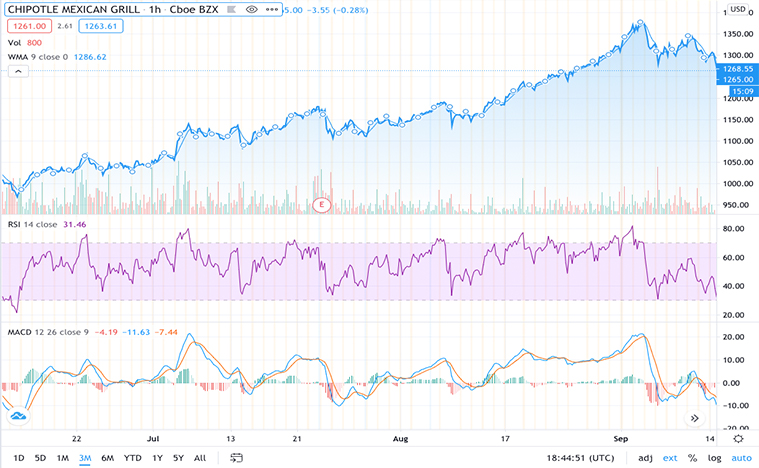

Previous to the stock market crash caused by the pandemic, CMG stock price was at $927 a share on average. CMG Stock saw a great dip like most stocks did when the market crashed. Since then, CMG stock price has been rising. CMG stock has increased by more than 51% in 2020. Furthermore, CMG stock price has gone up more than 105% as of September 11th from March 13th. Chipotle’s growth in 2020 shows that some food stocks have been able to make the most out of the pandemic situation. Chipotle’s fast option for Mexican food has allowed it to expand its growth, even more, this year.

[Read More] Top 3 Tech Stocks In Focus After TikTok Reaches New Deal

Top Food Stocks To Watch In September 2020: Grubhub Inc.

The final food stock to watch is Grubhub Inc. (GRUB Stock Report). Grubhub has grown to be one of the largest food delivery services in the United States. In 2019 Grubhub had 19.9 million active users, as well as 115,000 restaurants offering delivery and pickup on its app. GRUB stock has seen positive effects recently due to its growth during the ongoing pandemic. Initially, shares of GRUB stock dropped when the virus started, though now GRUB stock has initiated a bounce back.

In Grubhub’s second quarter results it announced that its gross food sales grew 59% year over year to $2.3 billion up from $1.5 billion. The food company also reported revenue of $459 million, a 41% year over year increase.

The CEO and Founder of Grubhub, Matt Maloney said, “Our singular focus for the second quarter was to support our restaurant partners as much as possible in their time of need. With a little help from increased demand, we are proud to announce we were able to spend approximately $100 million supporting and keeping restaurants, drivers, and diners safe during these difficult times.”

That is why GRUB stock is on this list of food stocks.