Are These 3 Top Gold Stocks On Your Watchlist?

Lately, gold stocks have been moving according to the momentum of the gold price. While this is good news when gold prices go up, it’s not that great when they go south. Gold has been well regarded as one of the safe-haven assets to hold when there’s an economic turmoil. So, when there’s increasing optimism regarding the reopening of the U.S. economy, gold and gold stocks would usually find it difficult to climb.

Stock futures jumped on Monday evening, pacing toward advances on Tuesday when traders return from the Memorial Day holiday weekend in the U.S. Meanwhile, Asian equities rose today, with the Nikkei rising 2.6% and the Hang Seng Index rising 2%. Markets are finding a lesser need for safe-haven investments – for now. Gold is currently trading higher at $1,729 after Monday’s sharp drop to $1,718 around 9.40am EST. This week would be crucial for investors in gold stocks when the Fed releases the summary of economic activity over the past month. One highlight for us to take note of will be the consumer confidence figures.

That said, any slight pessimism from the Fed could fuel gold prices. No doubt, the coronavirus pandemic has put a huge dent in global economic growth. Both Hong Kong and Singapore, Asia’s top financial hubs are expecting to record the sharpest economic contraction for the first time in many years. Thus, we think gold prices will stay elevated for the time being. With full economic recovery unlikely in the near-term, could any of these few gold stocks be a good investment?

Read More

- 3 Coronavirus Stocks To Watch Right Now; One Up Over 500% In April

- Should You Buy Disney (DIS) Stock At This Price?

Gold Stocks To Watch: Kirkland Lake Gold Mines

Kirkland Lake Gold Mines (KL Stock Report) is one of the highest-growth gold stocks in this article. Shares in the Canadian gold miner have lost 12.7% since the start of the year, creating an investment opportunity in the leading gold miner at an attractive valuation. What makes Kirkland Lake stand out in a capital-intensive industry is its strong balance sheet. This came as the miner finished the first quarter with $531 million in cash. Also, the company has no long-term debt other than long-term lease obligations and provisions of $161 million.

Kirkland Lake reported some solid first-quarter 2020 results, attesting to the quality of its assets. Remarkably, its gold production shot up by 43% year over year to 330,864 ounces. That allowed Kirkland to take full advantage of the high gold prices at over $1,730 an ounce. The company was able to reap considerable operational margin when their cash costs of gold was only $440 per ounce.

Kirkland’s flagship Fosterville mine in Australia is a world-class mine responsible for 48% of the company’s gold production. It is reported that the gold produced at Fosterville mine had an impressive ore grade of 42.4 grams of gold per tonne of ore (g/t). That is the highest grade of any Kirkland Lake’s existing mines. We also have to bear in mind that most of the company’s mines are in Canada and Australia. These are some of the most politically stable environments. This makes Kirkland one of the best gold stocks to buy right now.

Gold Stocks To Watch: Barrick Gold

Barrick Gold (GOLD Stock Report) is one of the gold stocks to watch this week. The company is in major focus after it was finally able to ship gold concentrate containers out of Tanzania. The containers have been sitting at Dar es Salaam Port for three years due to a dispute over taxes between the country and Barrick’s defunct subsidiary, Acacia Mining.

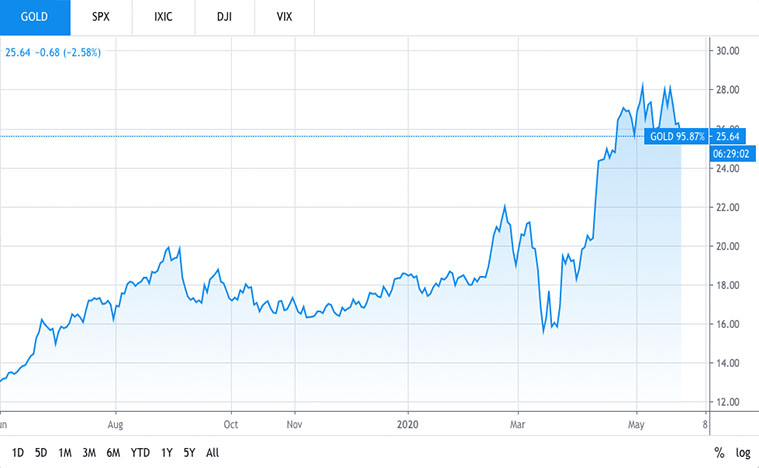

When it comes to some of the top gold stocks, Barrick can’t be left out of the picture. Shares of Barrick Gold dropped to a low of $12.65 on March 16. Over a span of a few weeks, GOLD stock jumped to highs of $28.50. Compare that to the jump in gold price. Barrick Gold stock has exploded 125%. For a large-cap gold stock, such breakout shall not be dismissed by stock market participants. Barrick Gold stock is currently trading at $26.32. Will we see a breakout this week or is another slide coming?

Gold Stocks To Watch: Kinross Gold

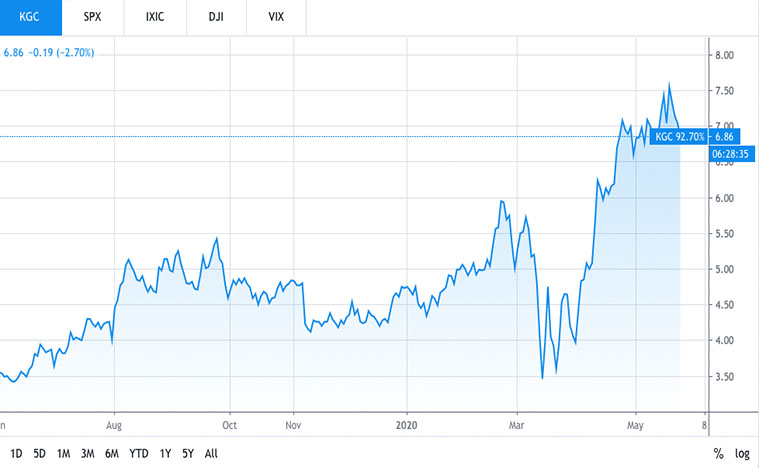

Kinross Gold Corp (KGC Stock Report) is a large-cap gold producer with assets in Russia, Africa, Chile, Brazil, and the United States. Kinross may be a large-cap stock, but it’s still significantly smaller and more volatile than Barrick. The company is a low-cost producer, Thus, it sees a considerable benefit to sales from higher gold prices.

On May 21, KGC stock reached lows of $6.94. The next day, Kinross gold stock traded mostly sideways hovering around $7 for most of the trading session. The slide could have something to do with the strike by unionized employees at its Tasiast mine. This strike came after the mine was suspended at the request of the Government of Mauritania. That said, the recent shutdowns are not expected to materially affect 2020 production since the company has production sites in 6 other countries.