To commence, technology stocks, also known as tech stocks, are shares in companies that specialize in technology-related products and services. These companies can include those in the software, internet, semiconductor, and hardware industries. Tech stocks have been some of the most popular among retail investors in recent years due to the rapid growth of technology and the increasing reliance on technology in daily life.

Investing in technology stocks can be a great way to potentially earn high returns, as many tech companies have strong growth potential. However, it’s important to note that investing in technology stocks can also be risky. These companies are often highly valued and can be subject to rapid changes in the market. Therefore, it’s important to do your own research and consult with a financial advisor before making any investment decisions.

When considering tech stocks, it’s important to look at factors such as the company’s financials, growth potential, and management team. It’s also important to consider the overall health of the technology industry and the company’s position within that industry. Additionally, it’s important to be aware of any potential risks such as intense competition and rapidly changing technology. By considering these factors and being mindful of the risks, retail investors can make informed decisions about investing in technology stocks. Now knowing this, check out these two tech stocks that reported earnings in the stock market on Tuesday.

Tech Stocks To Invest In [Or Avoid] Right Now

- Microsoft Corporation (NASDAQ: MSFT)

- Texas Instruments Incorporated (NASDAQ: TXN)

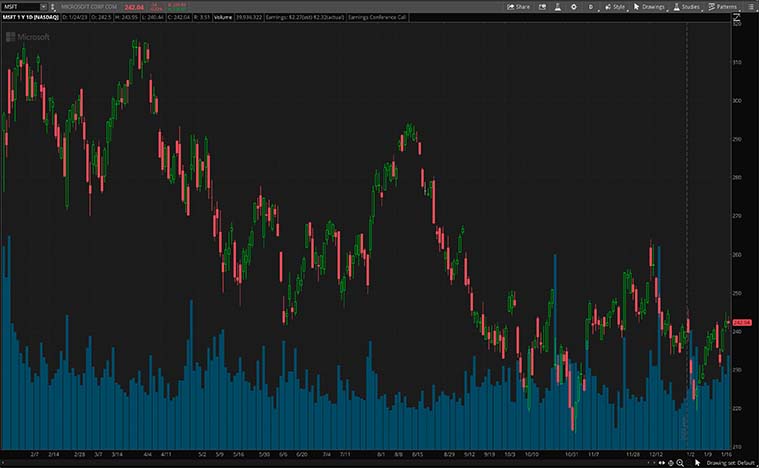

Microsoft Corporation (MSFT Stock)

First up, Microsoft Corporation (MSFT) is a multinational technology company. In brief, Microsoft develops, licenses, and sells computer software, consumer electronics, and personal computers and services. It is one of the world’s largest software makers and operates one of the world’s largest online stores.

On Tuesday, Microsoft reported its second-quarter 2023 earnings of $2.32 per share, on revenue of $52.7 billion. The earnings were higher than the expected $2.27 per share on revenue of $53.5 billion, and the revenue has grown 2% compared to the same period last year. The company also announced during its conference call that it expects its revenue for the third quarter to be between $50.50 billion and $51.50 billion.

Over the last month of trading, shares of MSFT stock have started to bounce by 2.14%. Meanwhile, as of Tuesday’s closing bell, Microsoft’s stock closed the day at $242.04 per share.

[Read More] 3 Dow 30 Stocks To Watch In January 2023

Texas Instruments Incorporated (TXN Stock)

Next, Texas Instruments Incorporated (TXN) is a technology company. The company designs manufacture and sells semiconductors to electronics designers and manufacturers globally. The company also provides other products, including digital signal processors and custom devices, as well as engineering services.

Also on Tuesday, Texas Instruments Incorporated (TXN) reported its fourth-quarter 2022 earnings of $2.13 per share, along with revenue of $4.7 billion. The earnings were higher than the expected $1.96 per share on revenue of $4.6 billion, but the revenue has fallen by 3.4% compared to the same period last year. The company also announced that it expects its first-quarter earnings to be between $1.64 and $1.90 per share and revenue to be between $4.17 billion to $4.53 billion.

Looking at the last month of trading activity, TXN stock has advanced by 8.10%. While, on Tuesday, shares of TXN stock closed the day slightly lower by 0.63% at $177.04 a share.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!