Should Investors Buy These Cannabis Stocks Ahead Of The Election?

The stock market has had a rocky start to the week. While the major indexes such as Dow Jones Industrial Average and S&P 500 have weighed down 1.44% and 1.63% respectively, the cannabis stocks are somehow popping. In fact, October has been a good month for the Cannabis industry, with the Horizons Marijuana Life Sciences (HMMJ Stock Report) up about 6.46% thus far against the S&P 500’s 4.45%. This in effect led investors looking for top pot stocks to watch on hopes for decriminalization.

Many marijuana stocks surged to levels they haven’t reached in months. These include Canopy Growth (CGC Stock Report) and Curaleaf (CURL Stock Report). Sure, there is no question that investors are counting on cloud computing, electric vehicles, and telemedicine to be the major growth drivers in the U.S. stock market this coming decade. But hey, don’t count out marijuana yet.

Some of the top cannabis stocks to buy have been on a roller coaster ride and hit new lows. But many experts believe not all hope is lost for the industry. Of course, many have yet to reach profitability, but at least the revenue has improved for some companies. And now that decriminalization is on the table, you could expect some price volatility among cannabis stocks in the coming weeks.

Decriminalizing Marijuana Could Be A Major Boost To The Industry

In the blink of an eye, the U.S. presidential election is just less than one month away. Investors are understandably paying close attention to top pot stocks in the stock market today. Of course, Joe Biden is still leading the 2020 US election polls. Therefore, marijuana stock investors are beginning to feel more hopeful about the prospects of the industry. Now, decriminalization is not the same thing as making pot legal. But it does seem to be a way for states to work around the Supremacy Clause of the United States Constitution. With all that being said, let’s take a closer look at these marijuana stocks that could benefit from the U.S. developments at the federal level.

Read More

- Top Pharmaceutical Stocks To Capitalize On U.S. Vaccine Hopes

- Top 5 Things To Know In The Stock Market This Week

Top Cannabis Stocks To Watch: Aurora Cannabis

Canadian pot company Aurora Cannabis (ACB Stock Report) started the week with a wild swing. The company’s stock price dipped below $4 per share before bouncing back strongly to close 16.8% higher. With its net revenue expanding at a compound annual growth rate of 144% between the beginning of 2017 and the end of 2019, it’s natural why some investors are putting this pot stock on their watchlist. So with such a strong growth rate, why did ACB stock lose 80% of its value this year? That’s because the company is nowhere close to being a profitable company despite strong revenue growth.

Sure, the year 2020 hasn’t exactly been rosy for the company. But Aurora is making some aggressive moves. These include shutting down unprofitable facilities and reducing staff. The company is hoping to achieve positive earnings by the second fiscal quarter of 2021. Like other capital intensive industries, Aurora will have to see how the cost-cutting strategies pan out in the next few quarters.

It is now important for Aurora to achieve profitability. Earlier this year, the company told investors that it was going to achieve positive EBITDA by the third calendar quarter this year. That goal has since been bumped back to the second quarter. However, the company may need another 3 years to achieve the sales volume needed to hit break-even adjusted EBITDA. That’s according to Tamy Chen from BMO Capital Markets. And that is assuming selling, general, and administrative expenses do not increase in that period.

“Because new management is trying to shift from value to more premium, we do not expect growth on a volume basis over the next 3 years until the company settles into a steady-state market share, which we define as low-to-mid-teens %… If ACB is successful in this shift, there should be revenue-dollar growth. Pending further visibility into ACB’s success in premium categories, our model currently projects modest dollar growth.”- Tammy Chen, Analyst at BMO Capital Markets

Top Cannabis Stocks To Watch: Constellation Brands

Yes, I get that Constellation Brands (STZ Stock Report) is not exactly a marijuana company. Rather, it is a producer and marketer of alcoholic beverages. But it’s large stake in Canopy Growth makes it a less risky approach for many investors who want some exposure to the cannabis industry. So far, the equity stake in Canopy Growth has been an earning drag for the company. And it will likely remain so in the future. However, any improvement in the outlook of the cannabis sector could easily give STZ stock a boost.

The company’s stock price is down about 4% year-to-date. However, that metric tells only half the story. Since the lows hit in early spring, the stock is up about 80%. The valuation is not exactly cheap at a forward price-earnings ratio of 20.9 times and price-sales ratio of 4.8 times. If I were to buy this stock on the dips, I would take a wait and see approach to see if it falls further.

Nevertheless, the company holds a large portfolio of beverage brands. This makes it one of the fastest-growing consumer discretionary companies out there. With that in mind, if you like CGC stock minus the volatility, STZ stock might just be the one to keep an eye on.

[Read More]Are These The Best Social Media Stocks To Buy Before The End Of 2020?

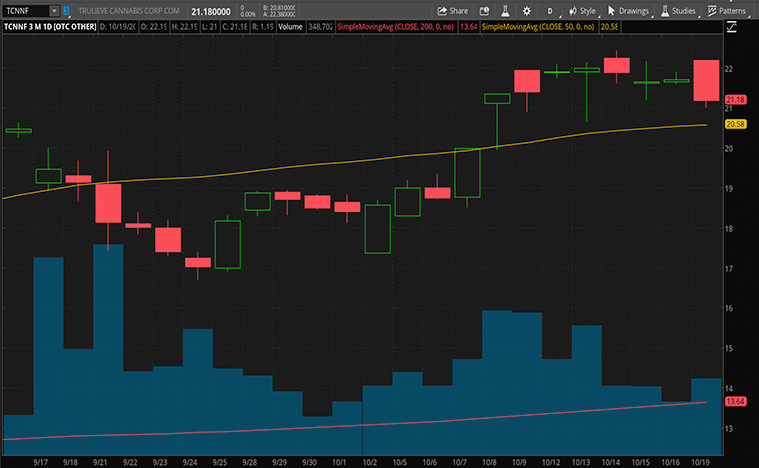

Top Cannabis Stocks To Watch: Trulieve Cannabis

If you are looking for one of the most profitable cannabis stocks in North America, Trulieve Cannabis (TCNNF Stock Report) should be on your list of best pot stocks to buy. Recently, the company announced the launch of the Cultivar Collection. This is a line of high-quality cultivar strains which is now available at select Trulieve stores started on October 17th.

“Innovation is what drives us as a company. We’re constantly looking for additional ways to bring new products, new strain profiles, and even new flavors of classic favorites to patients, ensuring every patient can find the relief they’re looking for,” said Trulieve’s chief marketing officer Valda Coryat. “Each strain in the Cultivar Collection is created using unique genetics. We’ve paid close attention to every aspect of these cultivars, from their base strains to their terpene profiles. The Cultivar Collection will offer an elevated experience to our Truliever community.”

From its most recent quarter results, Trulieve reported $120.8 million in net sales. That represented a 109% improvement from the prior-year period. The company’s massive success continues to center on the Florida market. The company is absolutely firing on all cylinders in its home market. According to the company’s own estimates, Truelieve controls 51% of Florida’s medical marijuana sales. But it’s not just Trulieve’s market share that’s impressive.

The company has opened 55 out of 57 dispensaries in Florida. Yet, Trulieve has been able to keep its marketing and operating expenses reasonably low. But the question here is, can Truelieve replicate its success outside the Sunshine State? Should the company indeed be successful in expanding its operations outside Florida, TCNNF stock would be one of the best pot stocks to buy today.