Social media stocks may not have had the best of times in the stock market over the past few weeks. Well, this is in line with some of the tech stocks that have been under pressure as well. That said, this could spell an opportunity for investors keen on social media stocks. After all, we now live in a world where social media is an integral part of how we go through our lives. This is now even more apparent after the world has gone through lockdown restrictions and realized the importance of social media in keeping us all in touch. Without it, people would’ve struggled mentally even more than they already have as they were kept apart from their loved ones.

Furthermore, we could also soon see an evolution within the industry. With talks of the metaverse constantly on the rise, investors are also getting excited to see what the future holds. We saw one of the largest social media companies in the world changing its name from Facebook to Meta (NASDAQ: FB). This is suggestive of where the company’s focus is right now, the metaverse. Meta plans to spend more than $10 billion on the metaverse project just within this year. Could this be the start of something huge? With that in mind, let’s look at some of the top social media stocks in the stock market today.

Best Social Media Stocks To Watch Now

- Digital World Acquisition Corp (NASDAQ: DWAC)

- Twitter Inc (NYSE: TWTR)

- Pinterest Inc (NYSE: PINS)

- Match Group Inc (NASDAQ: MTCH)

Digital World Acquisition Corp

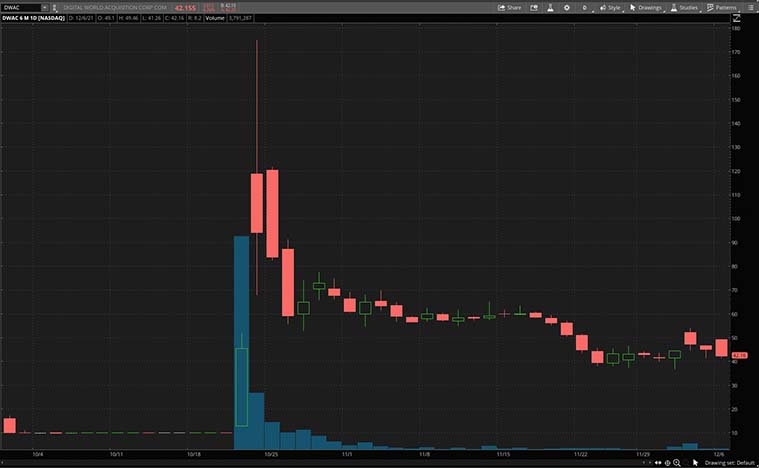

Digital World Acquisition Corp (DWAC) was brought into the limelight after an announcement back in October that it had agreed to merge with Trump Media & Technology Group (TMTG). At that point, DWAC stock skyrocketed to unprecedented levels as TMTG revealed plans of making a new social media platform known as “Truth Social”. That said, the stock subsequently plummeted after the hype faded.

However, things could be turning around for DWAC stock now. Over the weekend, DWAC announced that it has raised $1 billion in committed capital from a diverse group of institutional investors. This sends an important message as it indicates that the company is one step closer to bringing Truth Social to life.

So, as the company’s balance sheet expands, it will be in a stronger position to accelerate and strengthen the execution of its business. Of course, as the platform is still currently at an early stage, its success is far from guaranteed. Nevertheless, with the overall influence of Trump’s following, would you be keeping an eye on DWAC stock?

[Read More] Best Growth Stocks To Buy? 4 E-Commerce Stocks To Watch

Another top social media company grabbing the headlines recently would be Twitter. In detail, the company offers products and services for users, advertisers, developers, and data partners. Its Twitter platform is used by many for public self-expression and real-time conversations. While TWTR stock has been moving sideways for most of the year, could its recent development prompt investors to reconsider?

Last week, analysts from Bank of America reiterated a buy rating for TWTR stock. This comes a day after Jack Dorsey stepped down as the company CEO, with Parag Agrawal taking his place. It should be noted that he is not leaving his CEO position at Square (NYSE: SQ). That said, investors should be aware that it will likely take time for Mr. Agrawal to work his magic.

His experience as a member of the tech team and then as a chief technology officer would likely be a positive for the company. It also didn’t take long for him to make some structural changes at the very top. Last week, the company announced that engineering head Michael Montano and design head Dantley Davis will be stepping down at the end of the year. Could these changes be a step in the right direction? Only time will tell. With that in mind, would you be watching TWTR stock?

[Read More] 4 Top Semiconductor Stocks To Watch In December 2021

Pinterest is a visual discovery engine company. The company offers several types of Pins on its platform to people and helps them take action, including Standard Pins, Product Pins, Collections, Video Pins, and Story Pins. With 450 million monthly active users as well as an impressive advertising system in place, could investors be starting to show interest in PINS stock at its current valuation?

In November, Pinterest announced a new initiative to help the company increase its pace of innovation. It is the all-new, in-house, experimental products team called TwoTwenty. It comprises engineers, designers, and other product experts who will research and test new features. Hence, successful products will be handed off to other teams within the company to take to scale.

In fact, the team already had its hands in some of the company’s latest launches. Its first exploration was with the live-streamed creator events, which later included features such as the ability to rewatch live streams and support for shopping product recommendations. These are now part of Pinterest’s recently announced product, “Pinterest TV”. All things considered, do you believe PINS stock will make a comeback soon?

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

Match

To sum up the list, we will be looking at Match. The company provides dating products through its portfolio companies which are available all around the globe. Some of these include Tinder, Match, Meetic, OkCupid, Hinge, Pairs, and other brands designed for users to find a connection.

Last week, there were some exciting developments announced by CEO Renate Nyborg in an interview at the Reuters Next conference. It appears that there have been talks about a Tinderverse internally. Its dating app Tinder is now exploring how to blur the boundaries between offline and online worlds. The company CEO cited the company’s newly launched Explore feature. So, interactive events like “Swipe Nights” allow users to choose their own adventures and match with others with similar choices.

While the pandemic may have shown us that it is possible to feel connected by only using the internet, real-life connections are still something valued by many. Thus, the company will still be focusing on helping people meet in real life. Well, from a user’s perspective, having more options to connect would be a bonus. With these developments, would you add MTCH stock to your portfolio?