Are These The Best Tech Stocks To Buy This Week?

Tech stocks have been volatile in the stock market across the first half of this year. And I wouldn’t be surprised if there’s more of that in the near term. However, no matter what happens, there’s a good chance that top tech stocks can continue to bring gains to anyone investing in the stock market. As long as you do your research and identify the competitive edge of the company, you’re likely to benefit in the long term.

Despite their long-term growth potential, many tech stocks are still lagging behind the broader market in terms of year-to-date gains. It is easy to forget that these stocks have experienced a few sell-offs this year. Now, it seems that a number of tech stocks are coming back to life in the stock market today. Many investors appear to be placing their bets on these growth names again. After all, the growth story for tech companies remains a solid one given the fast-paced nature of the industry. With tech stocks showing pulse again, do you have these stocks on your watchlist today?

Top Tech Stocks To Watch This Week

- Paysafe Ltd. (NYSE: PSFE)

- Micron Technology Inc. (NASDAQ: MU)

- Teladoc Health Inc. (NYSE: TDOC)

- Palantir Technologies Inc. (NYSE: PLTR)

- Cloudflare Inc (NYSE: NET)

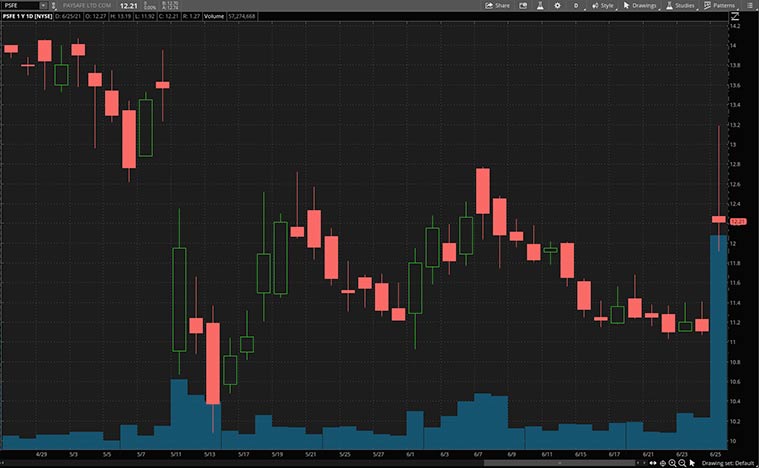

Paysafe Ltd

Paysafe is a leading specialized payments company that offers similar services to PayPal (NASDAQ: PYPL). However, one thing that separates Paysafe from some of the digital payment providers is its adoption of iGaming. What many saw as a niche and risky industry to be in, Paysafe saw it as an opportunity. And now, the company’s digital wallet serves pretty much all forms of digital gambling. Since getting a boost from David Tepper’s new position in the company last month, PSFE stock has been relatively flat.

However, Paysafe stock has shown quite a bit of momentum lately, and that’s because Reddit crowds are betting on a big short squeeze of Paysafe. This kind of momentum may not last. But if you are looking closely at what the company has to offer, the iGaming sector is a segment you would want to dig deeper into. It is worth mentioning that the company has notable clients including Amazon’s (NASDAQ: AMZN) Twitch and Bet365. With many major clients under its belt and a potential short squeeze from Reddit crowds, is now the time to place your bet on PSFE stock?

Read More

Micron Technology Inc.

Micron Technology is a company that designs, manufactures, and sells memory and storage products worldwide. Its memory technology is also used in various applications such as 5G, automotive, mobile, and networking. For the past year, MU stock was among the top performers in the stock market and has gained at least 60% during this period. The chipmaker reported a strong second-quarter fiscal report, and management was also optimistic with its guidance.

The company is slated to report its third-quarter report on Wednesday afternoon. If anything, the company has been taking full advantage of the stellar demand for memory chips and other products. The question that many investors have in mind right now is how fast can Micron ramp up its production capacity in order to meet higher demand. It is a risky endeavor to bet on any stock ahead of their earnings report. That said, if you are confident of what the company has achieved and has an optimistic outlook on MU stock, would you invest in Micron stock right now?

[Read More] Top Stocks To Buy This Week? 4 Health Care Stocks To Watch

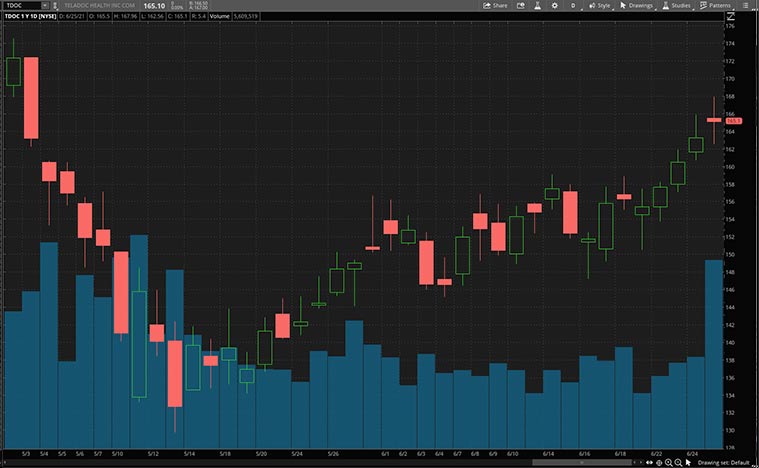

Teladoc Health Inc.

Teladoc Health is one of the companies riding on the pandemic tailwinds. This came as no surprise seeing that the company’s plethora of telehealth services remained a vital service when social movement restrictions were put in place. Considering it has shed around 40% of its value since peaking in February, many investors are seeing this as an opportunity to buy TDOC stock. In fact, the stock has gained approximately 10% over the past month. The company reported its first-quarter financials on April 28. In it, it raised full-year guidance as first-quarter revenue came in 151% higher year-over-year to a record $453.7 million.

One reason why investors are bullish is that Teladoc is slowly creating cheaper remote alternatives to the inconvenient, inefficient health care system we have today. Also, consulting firm McKinsey & Company projects that the U.S. virtual care market could approach $250 billion annually after the pandemic is over. The fact that more players are getting into telemedicine is a validation of the market potential here. Teladoc’s strategic maneuvers in the past years have cemented its position as a leader in its space. Therefore, it seems to me that TDOC stock has a potentially long growth runway ahead.

[Read More] Good Stocks To Buy Right Now? 4 Advertising Stocks To Watch

Palantir Technologies Inc.

Palantir is a software company that specializes in big data analytics. To put it simply, Palantir allows institutions to make the best use of their data. The company may have grabbed headlines as a meme stock, but its pipeline of new deals and partnerships are the things you might want to consider when making an investment in Palantir stock.

From its recent partnership with augmented intelligence firm DataRobot, it will focus on bringing demand forecasting solutions to retailers. This is exciting news for many retailers considering that traditional supply chains weren’t able to keep up with the pace of change in consumer demand and shipping logistics. This framework will utilize Palantir’s existing software to optimize many business operations. The meme stock popularity may have improved stock prices, but the partnership with DataRobot could be a better reason if you are considering investing in PLTR stock right now.

Cloudflare Inc

Cloudflare is a content delivery network (CDN) provider. Its aim is to build a better and safer internet. Some of the company’s potential growth drivers include serverless computing, internet of things (IoT), and 5G. These present massive opportunities for the company to tap into. With more businesses moving their operations to the cloud, Cloudflare could see explosive growth in this burgeoning cybersecurity industry. That’s because of its role in safeguarding and speeding up the internet. If anything, Cloudflare is ramping up to be able to take market share from cloud hosting companies rather than the other way around.

Of course, the strong bullish sentiment is mainly due to the company’s dominance in the CDN market. Admittedly, there may be speculations of tech giants jumping into the CDN bandwagon and stealing market shares. But Cloudflare stock is still a relatively safe bet with excellent long-term growth prospects for now. From the company’s first-quarter earnings, revenue came in 51% higher year-over-year to $138.1 million. With CDN continuing to grow in importance, is NET stock the best tech stock to buy right now?