Are These Top Retail Stocks On Your September Watchlist?

Many retail stocks have been down in the market. This is due to the coronavirus pandemic causing closures all over the world. A lot of retail stores had to close at some point with some closing for good. On the other hand, many retail stores were able to stay open and thrive like Walmart Inc. (WMT Stock Report) and Target Corporation (TGT Stock Report). For some retail stores though, there seems to be no signs of reopening in sight.

With cases of the coronavirus still being high in a plethora of places, locations are remaining closed. The future of the economy is unknown at the moment. E-commerce is standing above retail because of the closures and people staying home. So it can get confusing when deciding which top retail stocks to buy or sell right now. So today, we are going to look at this compiled list of 3 retail companies to watch now that we have entered September.

Read More

Top Retail Stocks To Buy [Or Sell] In September 2020: Best Buy

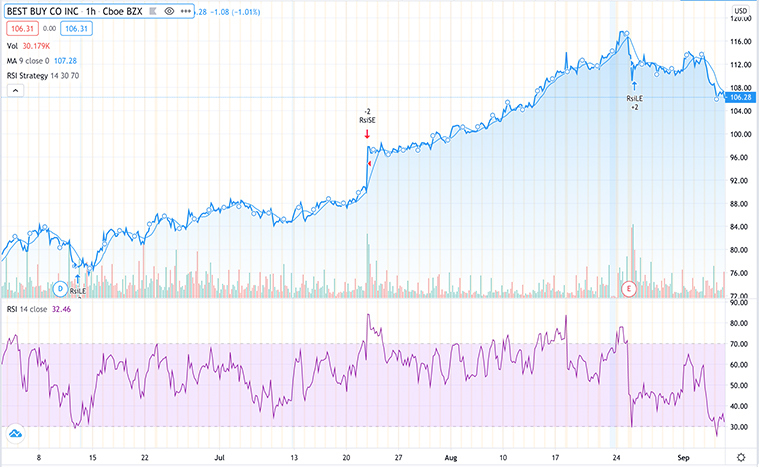

The first retail stock to watch is Best Buy Co. Inc. (BBY Stock Report). Best Buy is a retail electronics store chain based in the United States. The company sells things like cell phones, computers, televisions, and much more. The electronics retailer has grown to be one of the largest in the United States. Best Buy is listed at number 75 on the Fortune 500. On August 25th, this company released its quarterly results.

In Best Buy’s quarter results, its income was 81% higher year over year at $432 million. BBY stock has gone up around 120% higher than it was in February. At its 2020 low point, BBY stock price was at $50 a share. Now as of September 4th, it has gone up to $106 a share on average. This is higher than the $82 a share that BBY stock started 2020 at as well. This means that Best Buy has been able to make a full recovery in the stock market.

Top Retail Stocks To Buy [Or Sell] In September 2020: Foot Locker

The next retail stock to watch is Foot Locker Inc. (FL Stock Report). Foot Locker Inc. is a retail company that sells shoes in many locations throughout the world. Foot Locker currently operates more than 3300 stores across the globe. Foot Locker has been reopening stores and improving over the last few months. On August 23rd, Foot Locker released second-quarter results. The company’s revenue grew 17.1% year over year which was more than expected by analysts. Foot Locker had a 173% surge in direct-to-consumer sales as well. These increases are due to Foot Locker’s growth in digital sales.

The CEO of Foot Locker, Richard Johnson said, “Despite the challenging backdrop of the pandemic, and social unrest, we achieved strong second-quarter results, led by our digital business, with a return to growth in both the top and bottom line. As the COVID-19 situation continues to evolve, we believe we have the right strategies and strong leadership in place to strengthen our customer connectivity, deepen our strategic relationships with our vendors, navigate the challenges ahead, and emerge from this period better positioned than ever.” The week of August 31st, FL stock is up more than 10% to $32 a share on average.

[Read More] Should Investors Buy Tech Stocks As They Dip?

Top Retail Stocks To Buy [Or Sell] In September 2020: Urban Outfitters

Lastly, let’s talk about Urban Outfitters Inc. (URBN Stock Report). Urban Outfitters is a retail company that sells apparel, shoes, and more for both genders. The company operates many stores in locations all around the world. On August 25th, a second-quarter earnings report came out from Urban Outfitters. New digital customers increased 76% year over year while its retail sales fell. Net sales fell 16.5% year over year but were higher than expected. The company’s retail sales fell due to the ongoing pandemic, which seems obvious.

When 2020 started, URBN stock was at $27 a share on average. Then, URBN stock price went down to $13 a share and stayed in the $15-$20 range consistently. Now as of September 4th, URBN stock is at $24 a share. From August 4th to September 4th, URBN stock is up 33%. That is why URBN stock is on this list of retail stocks to watch.

Bottom Line

While many retail stocks have recovered and some are on their way, there is still a problem. The pandemic is not going away anytime soon it seems. Until there is a vaccine or a treatment it is unlikely that things will open to normal capacity in the near future. That is why some retail stocks are struggling. Only time will tell how these retail stocks are able to perform in the future.