Looking For The Best Tech Stocks To Buy? 3 Names To Watch

Tech stocks are all the rage these days. You could say that top tech stocks were spared from the onslaught that was brought by the coronavirus pandemic this year. This is because tech stocks have made huge strides in the stock market. The same, however, could not be said for other industries. The automotive and airline industry was among the hardest hit earlier this year and had lost huge chunks of their market caps. Even today, these industries are still recovering and are shells of their former glory.

Despite the positive news from Pfizer’s (PFE Stock Report) and Moderna’s (MRNA Stock Report) vaccine results showing 95% efficacy and 94.5% respectively, the markets seem to have cooled down following some optimism last week. Is this because of rising coronavirus cases in the U.S. and potential logistics challenges of the vaccines? On Wednesday, the Dow had posted its biggest loss in 3 weeks, dropping by nearly 350 points. Could this be an opportunity for investors to buy on the dip?

With the average daily cases in the U.S. being above 100,000 in the last week, things certainly look bleak. However, we must remember that with more people staying at home and under lockdown restrictions, tech stocks could yet again rally further as it has in the last few months. You could say that the best tech stocks to watch this year have thrived in this coronavirus era. These companies adapted to the challenges that came with the pandemic. They were able to meet the shifting customer demands and have prospered from this opportunity. With that in mind, here are 3 top tech stocks to watch as we weather through this third wave.

Read More

- 3 Top Entertainment Stocks To Watch Before 2021; 1 Making Big Moves This Week

- These EV Stocks Are Up Big This Week; 3 Names To Know

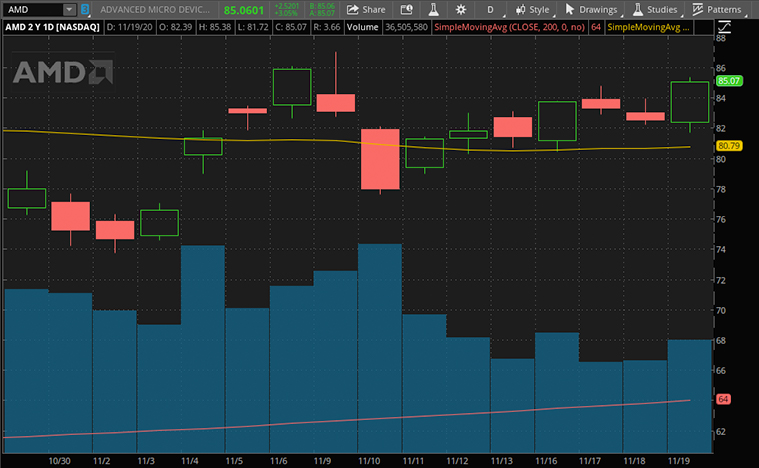

Are These The Best Tech Stocks to Buy [Or Sell]: Advanced Micro Devices Inc.

Chipset manufacturer AMD (AMD Stock Report) has had a blast this year. The company has dethroned its archnemesis Intel (INTC Stock Report) in the Central Processing Unit (CPU) division this year. The company has also beaten its rival Nvidia (NVDA Stock Report) in the Graphics Processing Unit (GPU) division. The company’s share is up by 71% year-to-date and traded at $83.98 as of 11:36 a.m. ET.

The company had just posted very impressive results in its third-quarter fiscal a month ago. AMD reported revenue of $2.8 billion and is up by 56% compared to a year earlier. This growth was driven by higher revenue in its Enterprise, Computing, and Graphics segments. This had yielded the company a net income of $390 million and diluted earnings per share of $0.32. This is an impressive feat as the company was on the brink of bankruptcy just a mere 5 years ago.

Through the guidance of CEO Dr. Lisa Su, AMD’s stock price has seen gains of over 3000% to where it is today. Through her helm as CEO, the company has just launched its Radeon RX 6000 series in the GPU sector. This series puts the company on equal or better footing against industry leader Nvidia with its own RTX 30 series. When comparing both cards together, GPU reviewers say that AMD’s Radeon RX gives a better bang for the buck. This could help AMD reach both mid-range and upper-range markets, space where Nvidia has dominated in the last few years. With all these exciting developments for AMD, will you consider AMD stock to buy?

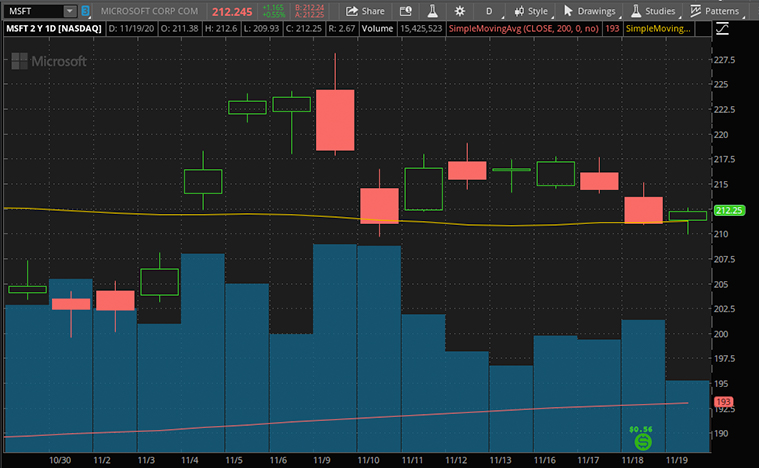

Are These The Best Tech Stocks to Buy [Or Sell]: Microsoft Corporation

Tech giant Microsoft (MSFT Stock Report) is the top performer in the Dow Jones. This is despite the broader market falling slightly as the market’s rally this month loses its momentum. The decline this time around is caused by disappointing U.S. unemployment data and rising coronavirus cases. This new wave of lockdowns however could bring Microsoft’s sales to new highs again like it did in the previous quarters. The company’s stock is up by 32% year-to-date.

The company has just posted its third-quarter results in October. Microsoft had reported a revenue of $37.2 billion and this represents a 12% increase year-over-year. The company has seen its Xbox content and services revenue increase by 30% in the last quarter. With the new round of lockdowns and holiday season approaching, Microsoft’s gaming division could see further demand. CEO Satya Nadella says it best, “The next decade of economic performance for every business will be defined by the speed of their digital transformation.” This is a given as companies like Microsoft have shown how it could adapt to the rapid changes that happened in 2020 alone. With that, it has come out of this pandemic stronger than ever.

Microsoft has recently unveiled its Pluton security processors. Pluton serves to boost the security of Windows PC. The company is working alongside AMD, Qualcomm (QCOM Stock Report), and Intel for the Pluton processor. Sensitive information such as user identities, encryption keys, and personal data will be stored in this new security chip. With that, user trust in Microsoft would improve further from the already high standards that is set by the company. With all things considered, will MSFT stock be a top tech stock to have in your portfolio?

[Read More] Top Stocks To Watch As Bitcoin Heads To New Highs In 3 Years

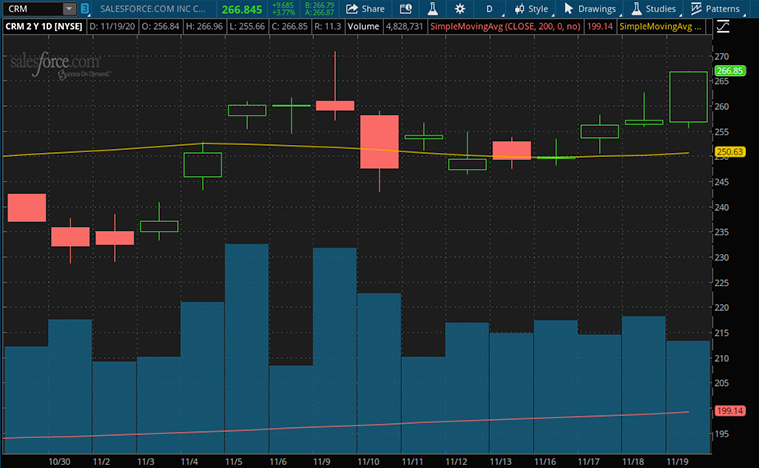

Are These The Best Tech Stocks to Buy [Or Sell]: Salesforce.com

Salesforce (CRM Stock Report) is a cloud-based software company headquartered in San Francisco. The company provides Customer Relationship Management (CRM) software to organizations and companies. This software allows companies to actively track and manage customer information. This in turn will help companies make better business decisions, close more deals, and grow their businesses.

The company share price has enjoyed gains of 110% since the March lows and traded at $263.93 as of 11:38 a.m. ET. In its latest quarter results posted in August, Salesforce is now the #1 CRM software provider worldwide by revenue for the 7th consecutive year. It has consistently delivered durable revenue growth. The company reported a revenue of $5.15 billion which is a 29% increase year-over-year. This increase is because more companies are turning to CRM services as they shift their businesses online. Salesforce also boasts the largest market share for CRM applications worldwide in 2019.

Customers from Salesforce have reported 37% more sales revenue, 45% higher customer satisfaction, and 43% better marketing ROI after using the company’s software. By connecting businesses to customers in a whole new way, Salesforce’s platform will help build more meaningful and lasting relationships. As a company understands its customers’ needs better, this will allow companies to identify new opportunities and also address any problems faster. This could play out well for Salesforce as more people turn to the company’s platform. For these reasons, could CRM stock be a top tech stock to buy ahead of its earnings report?