Should Investors Buy These Tech Stocks If The Market Crashes?

Tech stocks are easily one of the best performing sectors this year. The Nasdaq Composite has risen more than 20% year-to-date. Since the index consists mainly of technology companies, investors shouldn’t be surprised that top tech stocks have been driving the monstrous rally in the stock market this year. We saw the market off to a good start this week after rather choppy trading in the past week, which has weighed on tech companies despite some reporting blow out results. With the recent pull-back, investors were questioning whether it was the gravity of fundamentals or the gravity of market conditions? The latter appears more likely if you ask me.

The volatility we see with the stock market today could simply be because we are in the run-up to the U.S. presidential election. Speaking about excellent fundamentals, big tech companies like Microsoft (MSFT Stock Report) and Alphabet (GOOGL Stock Report) have reported huge solid numbers in their third-quarter earnings. But investors weren’t popping their champagne bottles. Instead, after reporting earnings, some appear to be taking a breather after a massive rally this year.

Tech Stocks Continue To Deliver Strong Numbers In Q3 2020

Tech is quite a broad term these days. The pandemic-driven lockdown created a wave of digitization, including cloud computing, digital payments, and e-commerce. Undoubtedly, the pandemic has sent tech stocks to sky-high valuations as their business prospered, while oil stocks and travel stocks suffered.

Looking for trading activity amid major events such as the presidential election and the pandemic is not something you can master easily, even for the most experienced investors. That said, investors with a longer-term horizon of a year or more might want to try to avoid timing the market. That way, it would be easier to find a few stocks that are worth buying now and that is worth holding in the long run. Staying invested over time usually won’t make investors lose money, considering the stock market’s return on average is about 10% annually. With all that in mind, do you have a list of top tech stocks to buy to prepare for the potentially huge growth over the next decade?

Read More

- Top E-Commerce Stocks To Watch Before Black Friday

- Are These The Best Marijuana Stocks To Watch In November 2020?

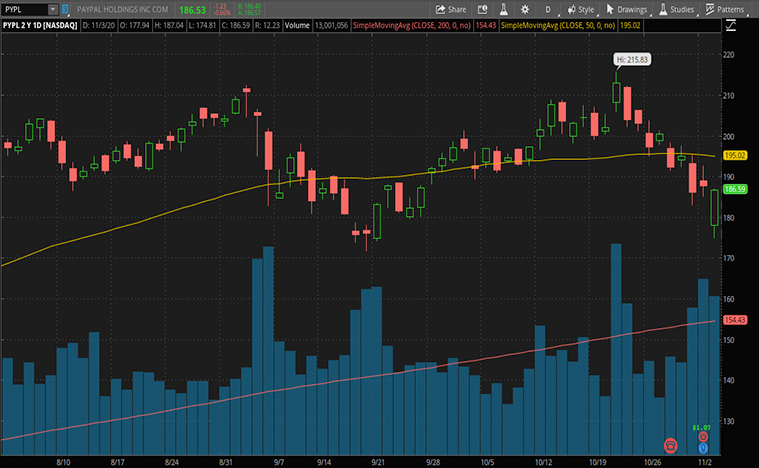

Top Tech Stocks To Buy [Or Sell] Right Now: PayPal Holdings

First up the list is payment processing giant PayPal (PYPL Stock Report). The company’s third-quarter net income more than doubled on 25% higher revenue, crushing analysts’ estimates. But the stock was slumping 6.4% after hours to $177.20 a share. It appears that fourth-quarter guidance implies growth is leveling off.

The company saw a boost of demand in electronic payments as consumers have been avoiding physical cash. That’s to curb the spread of the novel coronavirus. And this trend contributed significantly to PayPal’s business. On top of that, the company has reached record growth for new accounts this year. By introducing new services and products such as QR codes for payments, PayPal is diversifying its revenue sources. It also recently launched an installment payment program called Pay in 4, which allows customers to pay in installments, interest-free. That brings PayPal head to head with “buy now, pay later” companies like Affirm and Afterpay which have gained a lot of attention in recent years.

The company also said on October 21 that it launched a service enabling customers to trade cryptocurrencies directly from their PayPal accounts. It said it planned to “significantly increase cryptocurrency’s utility by making it available as a funding source for purchases at its 26 million merchants worldwide.” No doubt, PayPal is at the forefront of digital finance. Its services range from mobile commerce to peer-to-peer transfers. And now, offering cryptocurrencies on its platform could lead to asymmetric returns. If crypto becomes fully established and regulated, PayPal could stand to benefit hugely. All these areas that the company is looking at are large markets worth over $100 trillion in total market size. PayPal’s ability to benefit from the pandemic tailwinds does not diminish its future prospects. As the top dog among fintech stocks, is PYPL stock a long term growth driver to bet on?

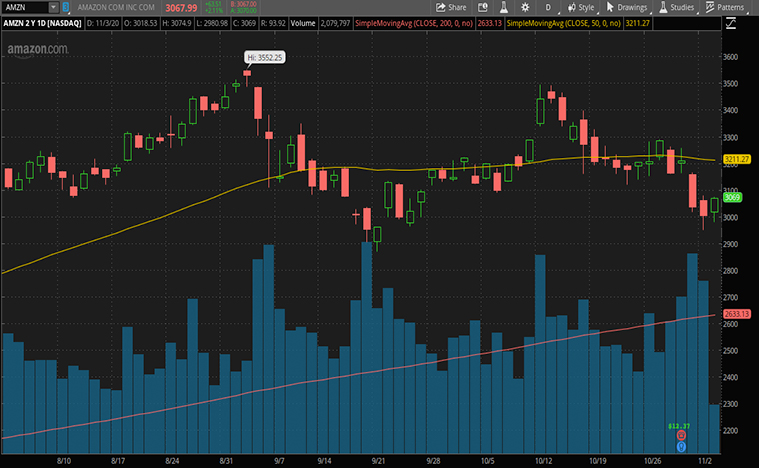

Top Tech Stocks To Buy [Or Sell] Right Now: Amazon Inc.

Amazon (AMZN Stock Report) reported better than expected third-quarter results after last week. While the numbers were great, the sentiment in the stock market isn’t. As you can see from the past 5 trading sessions, AMZN stocks have plunged nearly 7% due to weak market sentiment. No matter how you put it, the earnings report has crushed many analysts’ estimates with some mind-blogging numbers. That’s despite the company’s massive size. Its sales increased by $26 billion, or 37% in the third quarter from a year earlier. In addition, the company has added 50% more staff over the past year. And don’t be surprised if the number will be even bigger in the following quarter.

“We’re seeing more customers than ever shopping early for their holiday gifts, which is just one of the signs that this is going to be an unprecedented holiday season,” Amazon CEO Jeff Bezos

The world’s largest e-commerce company continues to be one of the biggest beneficiaries of the pandemic. This came as consumers flocked to the site for essential goods, groceries, and other household items. With the holiday season just around the corner, shoppers are likely to do the bulk of their gift buying online as the coronavirus cases continue to climb. On top of that, the company’s Amazon Web Services generated sales of $11.6 billion for the quarter. That’s up 29% and in line with analysts’ estimates. With such promising growth, won’t it be exciting to have a piece of the company amid the recent dip?

[Read More] Are These The Best Stocks To Buy Amid The Resurgence Of COVID-19?

Top Tech Stocks To Buy [Or Sell] Right Now: Square Inc.

Square Inc. (SQ Stock Report) is the only company yet to report earnings on this list. Despite having gained more than 140% in its stock price year-to-date, many experts continue to believe that there’s more room for growth with Square. If you saw what’s happening with PayPal, you could sort of guess how Square would perform in its third quarter. The acceleration of digital payments in the U.S. and globally is real. Digital payments could be worth $910 billion this year, jumping to $1.5 trillion by 2024, according to estimates. And Square is poised to benefit from such a shift.

Most consumers are probably familiar with Square for the company’s seller ecosystem. For years, Square has been aggressively expanding its offerings with small businesses by providing payment processing devices and solutions. For starters, the company’s popular peer-to-peer (P2P) payment app, Cash, has over 30 million monthly active users. Revenue from the app skyrocketed 140% in the second quarter to $325 million.

Of course, high growth stocks like these don’t come cheap. With recent market choppiness and fear of another tech bubble bursting, the stock could see some volatility. Now that SQ stock appears to be taking a breather in the run-up to its third-quarter earnings, would now be a good time to buy? You be the judge.