Are These The Top E-Commerce Stocks To Buy This Week?

E-commerce stocks are among the clear benefactors from the coronavirus pandemic on the stock market. While brick-and-mortar stores were forced to close, the e-commerce industry boomed. Because of this, the top e-commerce stocks now have brought monstrous returns for investors. African e-commerce giant Jumia (NYSE: JMIA) is a clear example of this. Similarly, businesses have also flocked to e-commerce facilitators to set up their own systems to accommodate e-shoppers. For example, Shopify (NYSE: SHOP) has and continues to facilitate this massive movement. SHOP stock had one of its best years in the stock market so far with gains of 179% in 2020. In light of these eye-catching figures, it would be natural for investors to question if these trends are here to stay.

Several factors suggest it could just be the beginning of the e-commerce uprising. Firstly, the coronavirus pandemic is still a long way from ending. The logistical nightmare of transporting vaccines in pristine conditions is one that requires resources and time to pull off. Throughout this process, e-commerce will continue to be a vital service that many consumers rely on. Another tailwind for the industry could be in the form of Joe Biden’s $1.9 trillion stimulus package. This would increase the current economic aid to $2000 per person. With stimulus checks in hand, it creates a perfect storm for the best e-commerce stocks to buy in the stock market today.

Taking all this into consideration, I can understand if you are keen to invest in the e-commerce industry. Given its current trajectory, the industry does seem to have plenty of room for growth. Some would even say that as the general population gets familiarized with e-commerce, it could become the new norm. For now, here is a list of the top e-commerce stocks for you to consider adding to your portfolio.

Read More

- Are These Tech Stocks Good Investments Right Now? 3 For Your List

- Is BlackBerry (BB) The Best Big Data Stock To Buy Right Now?

Best E-Commerce Stocks To Buy [Or Sell] Now

- Kaspien Holdings Inc. (NASDAQ: KSPN)

- Etsy Inc. (NASDAQ: ETSY)

- eBay Inc. (NASDAQ: EBAY)

Kaspien Holdings Inc.

Firstly, Kaspien provides a platform of software and services to help brands grow their online distribution channels on digital marketplaces. The company plays an important role as the online growth partner of brands. Therefore, it is not surprising that KSPN stock has attracted investors’ attention. Similarly, the company’s shares reflect this as it is seeing gains of over 1100% in the past year. With such impressive gains, could there be more room for it to grow?

In its recent quarter fiscal reported last month, the company saw a 35% rise in total revenue year-over-year. This amounts to a total of $38.91 million for the quarter. On top of that, the company also ended the quarter with $2.4 million in cash on hand. Kaspien also saw a phenomenal 127% year-over-year increase in gross merchandise value. Understandably, as more businesses turn to the company to bolster their e-commerce infrastructure, this would be the case. Should Kaspien be able to scale its core business to meet rising demands, KSPN stockholders could be in for a treat.

In recent news, the company announced a new partnership with Levin Consulting. The partnership with Levin will be focused on providing consumer brands with omnichannel sales strategies and services. The omnichannel aspect of this partnership is important as it provides an integrated service for clients that encompasses online and physical marketplaces. In theory, Kaspien and Levin will be servicing each other’s clients. Kaspien customers would be able to access Levin’s industry-leading strategy consultations. Despite its fantastic performance last year, Kaspien appears to be maintaining its momentum. Could this spell big gains for KSPN stock in the next few months? That remains to be seen.

[Read More] Top 5 Things To Watch In The Stock Market This Week

Etsy Inc.

Another top e-commerce stock in focus now would be Etsy. The company mainly operates via its proprietary e-commerce website which offers handmade or vintage items and craft supplies. Considering how its wares cater to the needs of consumers at home, the company has thrived throughout the pandemic. To point out, ETSY stock has quadrupled in value over the past year. It even jumped by over 11% during last week’s trading session. Incoming stimulus package aside, this could be related to its recent search result figures post.

Last week, the company wrote in a blog post about its Valentine’s Day search statistics. The company’s search figures indicate that demand for its wares is still going strong over these last three months. Most impressive of all searches for DIY cocktail kits skyrocketed by over 1,183%. This was followed by a 165% increase in searches for food-related DIY kits. Evidently, people are turning to Etsy for their home entertainment and hobby-related needs more than ever. With this in mind, I’m not surprised to see investors flocking to ETSY stock.

It is great that people are turning to Etsy more in these times. But, the company will also need the proper funds to facilitate and scale its business accordingly. On this matter, the company seems to be doing alright as well. Etsy saw green across the board in its third-quarter fiscal reported in October. This includes year-over-year leaps of 128% in total revenue and a 519% rise in net income. All this coupled with cash on hand of $1.14 billion should set the company up for the long run. After considering all this, will you be adding ETSY stock to your watchlist?

[Read More] Will Magnite (MGNI) Stock Be The Next Trade Desk In The Making?

eBay Inc.

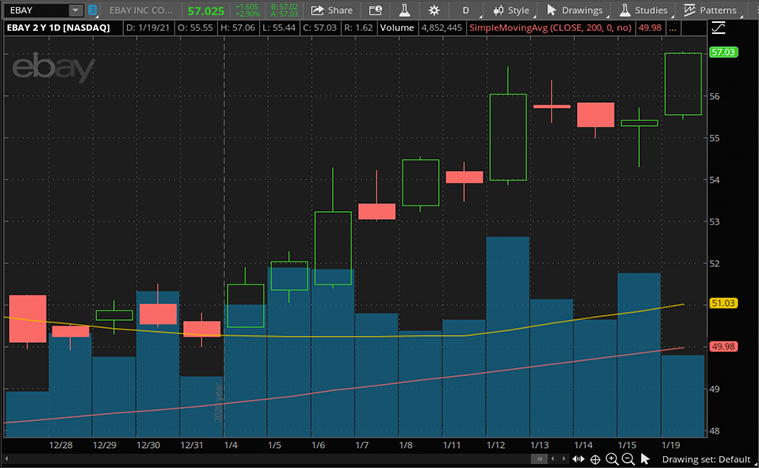

Third, we will be looking at e-commerce veteran eBay. Similar to our previous entries, the company had a fantastic year on the stock market due to coronavirus-related tailwinds. As more people turned to e-commerce, the company saw an influx of buyers and sellers throughout the year. Paired with the company’s efforts to streamline its business, eBay has come out as one of the winners of 2020. This is clear as EBAY stock is up by over 100% since the March lows. Based on its latest announcement, investors could be watching it even more closely.

Over the long weekend, the company announced that it will take up managing payments for sellers in Greater China. This is a fantastic play by eBay as it works towards modernizing and streamlining its customer experience. With this, the company is providing buyers with more flexibility in terms of payment. Additionally, sellers will have one less thing to worry about on their end. In the bigger picture, this could contribute to the overall buyer and seller growth in its marketplace. Clearly, eBay has no plans to fall behind amidst the current e-commerce trends.

Furthermore, the company appears to have healthy financials as its foundation as well. eBay raked in $2.61 billion in total revenue and saw a 114% year-over-year rise in net income. Investors were likely pleased to see that there was a 154% rise in earnings per share over the same period as well. To highlight, it reported having 183 million global active buyers back in October. eBay’s latest play indicates that it is still looking to grow that number. Should things go as planned, do you see EBAY stock hitting new all-time highs this year?