Top Tech Stocks To Buy Or Sell As They Dip

Tech stocks have been powering the Nasdaq and S&P 500 to record highs this year amid the coronavirus pandemic. But the saying of “what goes up must come down” couldn’t be more true this week. The tech stocks are facing a “Minsky moment” this week. For those who are new to the term, it refers to a sudden market collapse following an unsustainable bull run. This partly is due to the “easy credit” environment created from the unprecedented fiscal and monetary stimulus measures. The tech giants or the FAANG stocks that have powered the U.S. stock market to all-time highs are in the red.

Big Tech Tumbles

Tech heavyweights such as Tesla (TSLA Stock Report) and Nvidia Corp (NVDA Stock Report) both tumbled 9% and 9.3% respectively. The tech sell-off came after mixed US economic data on Thursday. That included a report showing slower services sector growth in August. This is in addition to the higher than anticipated unemployment rate and unexpected big trade deficit in July. Now, the fall in the latest weekly initial jobless claims was higher than many expected. But the figures remain high. While the rally in tech stocks may not be over, Thursday’s market rout serves as a good reminder to investors that stocks can move in two directions.

Read More

- Should Investors Buy These Electric Vehicle Stocks As Tesla Extends Its Pullback?

- Are These 3 Cruise Line Stocks Ready To Sail?

Tech Stocks Could Deliver Strong Growth For Years To Come

Although volatility like what we saw on Thursday and today could be unnerving, investors should also bear in mind that the tech sector has been very resilient amid the coronavirus pandemic, at least for the past 5 months.

So why the outperformance you ask? First, the work-from-home trends benefit the tech stocks tremendously. Secondly, the Fed’s decision to keep interest rates low for an extended period means these high tech companies could borrow cheaply and expand their operations. That said, these environments are actually very conducive for tech stocks to thrive. With that in mind, here are 3 fast-growing tech stocks that could be a good buy amid their recent dips.

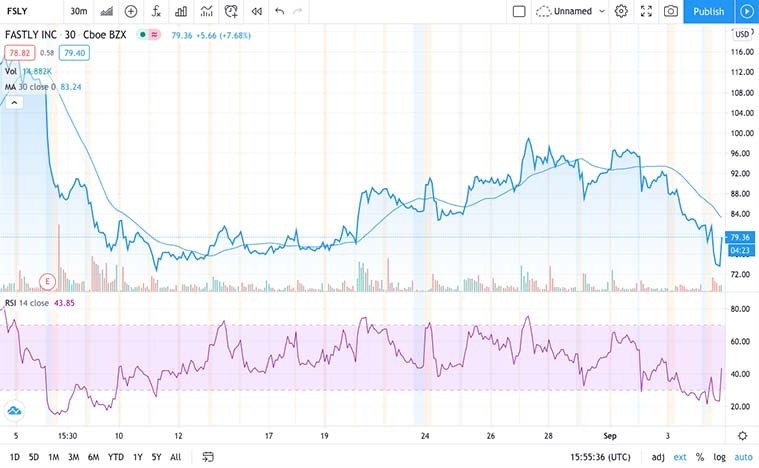

Tech Stocks To Buy [Or Avoid] Amid The Tech Sell-Off: Fastly

Despite a strong second quarter, shares of Fastly (FSLY Stock Report) have dropped nearly 30%. That was after it reached its all-time high of $118 per share. Even though the company was already generating substantial sales growth prior to the pandemic, the push to remote work environments has made Fastly’s offerings more important than ever.

Although it is far from the size of Amazon Web Services or Microsoft’s (MSFT Stock Report) Azure, Fastly has become the trusted brand of some of the major tech companies in the world. Among them are Shopify (SHOP Stock Report), Etsy (ETSY Stock Report), Yelp, and TikTok, just to name a few. Analysts that take a closer look at Fastly like it a lot, and they justify its lofty stock price. I don’t know about you, but I do believe there’s a great chance that FSLY stock would rise. It could serve as a long term growth investment after the recent market rout.

[Read More] Top Bank Stocks To Buy According To These Analysts

Tech Stocks To Buy [Or Avoid] Amid The Tech Sell-Off: Apple

Apple (AAPL Stock Report) has had a nice rally in the past month. This comes after the 4-for-1 stock split announcement earlier last month. The largest tech company saw its shares slide 8% on Thursday, a decline of $180 billion in market value. That’s the largest one-day loss in its market value as a public company. However, Apple doesn’t appear to be at risk of losing its $2 trillion market capitalization, which sits at over $2.1 trillion even after AAPL stock tumbles.

After its recent surge, it’s easy to call Apple stock overvalued. But it is also true that Apple is a clear leader in its product offerings. While many skeptics believe that the company’s high growth days are behind it, investors chose to bid up AAPL stocks in anticipation of the first 5G iPhone. Besides, there is also the subscription bundle, which could boost Apple’s already booming services segment. But the recent gains seem to have predominantly come from stock splits.

Suddenly, the lessons from the dot-com era, which show how a stock-split-driven boom can end in disaster, have never been more relevant. All in all, if you truly believe in the potential of what the company may bring to the table, you wouldn’t mind paying a dollar more or less today. Because in the long run, it would just keep going higher if all things go well.

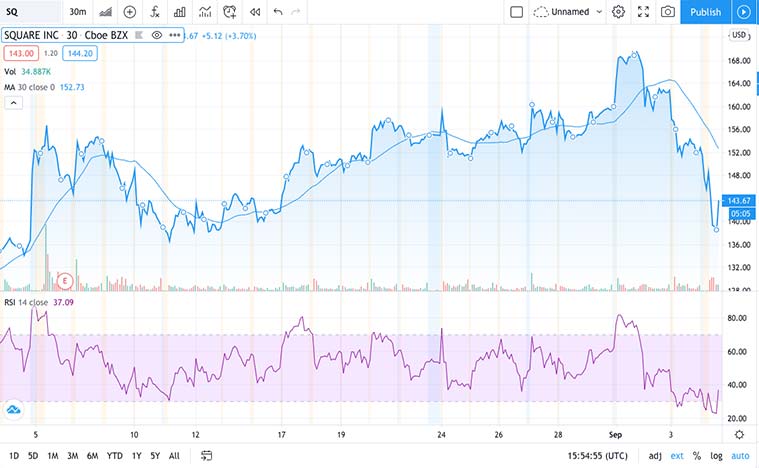

Tech Stocks To Buy [Or Avoid] Amid The Tech Sell-Off: Square

Among the fastest-growing fintech stocks to buy, Square (SQ Stock Report) tops the list. Most consumers are probably familiar with Square for the company’s seller ecosystem. For years, Square has been aggressively expanding its offerings with small businesses by providing payment processing devices and solutions. Over a span of seven years since 2012, gross payment volume (GPV) crossing Square’s network skyrocketed from $6.5 billion to $106.2 billion.

No doubt, the coronavirus crisis has accelerated contactless payments, and in the case of Square, its Cash App has fueled considerable growth. Cash App’s monthly active users rose from 7 million over 2 years ago to over 30 million now. Given the strong growth from Cash App, it’s not surprising to see Cash App become the main profit driver for the fintech company in the years to come.