Top Cloud Stocks To Watch With Or Without The Coronavirus Pandemic

Cloud stocks have been stealing Wall Street’s spotlight in 2020. We know that the global health crisis has severely disrupted global economies. While that disruption has been devastating for some businesses, it has been a shot in the arm for cloud computing companies. The COVID-19 crisis has simply accelerated the cloud computing industry’s snowballing growth trajectory. One of the recent drivers for these top cloud stocks could also be because of Snowflake’s IPO this week.

As the market prepares for the high-profile Snowflake’s IPO, investors have become very enthusiastic about cloud computing stocks. The data storage software company has been one of the highest-profile unicorns in Silicon Valley for years now. Warren Buffett’s Berkshire Hathaway (BRK.B Stock Report) recently disclosed it would be buying some $570 million worth of stock upon Snowflake’s IPO and Salesforce.com (CRM Stock Report) said it would throw in $250 million. The presence of these 2 juggernauts is driving interest in Snowflake, even among those not familiar with cloud stocks.

Now, Snowflake is bumping its expected IPO price by 30% to a share price between $100 and $110. The company will be listed on the New York Stock Exchange (NYSE) under the ticker symbol SNOW. Would such an offering also send other top cloud stocks in the stock market today higher? Read on.

Read More

- 3 Trending Entertainment Stocks To Watch In September 2020

- Are The Best Stocks To Buy As The Streaming Market Grows?

Best Cloud Stocks To Buy [Or Avoid] Now: Kingsoft Cloud

Shares of Kingsoft Cloud Holdings (KC Stock Report) have performed very well, with the stock up more than 100% over the past 4 months. The Chinese cloud company continues to sign up for large companies. It continues to expand as we enter the final quarter of 2020. Many believe the recent surge in KC stock is just the beginning, with much growth runway down the road.

“We will continue to invest in technology, such as edge computing, big data, transcoding, and others,” CEO Yulin Wang said in a statement. “We are confident that our cutting-edge technology and ability to effectively execute our strategy will ideally position us to capture the growth opportunities the cloud industry will create in the future.”

The company’s revenues are continuing to increase steadily and could accelerate in the third quarter. It appears that the stock still has upside over the long run due to its conservative valuation and strong growth. From the company’s guidance, revenue in the third quarter is forecast in the range of 1.67 billion yuan to 1.74 billion yuan, which represents a growth of 67% to 74%.

Best Cloud Stocks To Buy [Or Avoid] Now: Fastly

Shares of Fastly (FSLY Stock Report) jumped 9.6% on Monday. This comes following the news that TikTok owner ByteDance reached an agreement with Oracle ahead of the deadline set by President Donald Trump. Now there’s a great chance that TikTok could continue its operation in the US. Therefore, the cloud of negativity surrounding Fastly seems to be clearing up.

Keeping TikTok as a customer would be a boon for Fastly. Even if it really doesn’t, Fastly has a scalable business model and it has lots of opportunities to go into. The company’s recent acquisition of Signal Sciences is a great example.

It will allow the company to get a slice of the high-growth and high-profit margin cybersecurity sector. Fastly currently has a market capitalization of $8.76 billion, so the company is relatively small and it has enormous room for expansion if all goes well. Whatever happens to TikTok, Fastly remains as a top cloud stock to watch over the next decade.

[Read More] Top 3 Tech Stocks In Focus After TikTok Reaches New Deal

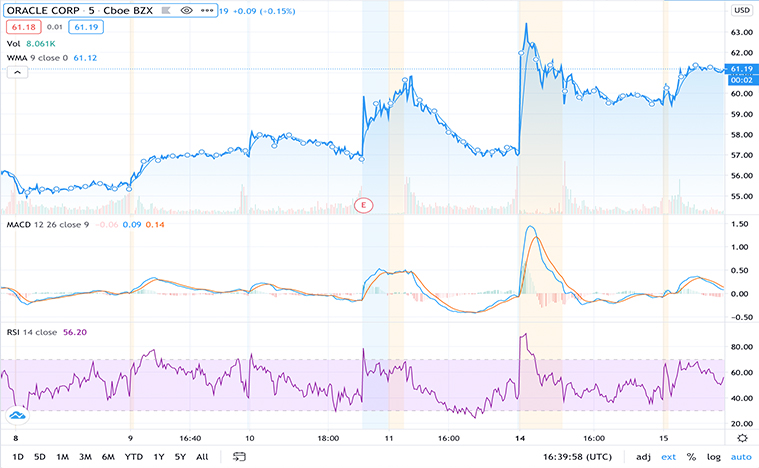

Best Cloud Stocks To Buy [Or Avoid] Now: Oracle

Oracle’s (ORCL Stock Report) stock has risen sharply in recent weeks. This followed earnings and expectations that the company will land the US arm of TikTok. However, the stock may be heading even higher based on existing option bets and a technical breakout trajectory.

The company is betting that by landing big cloud customers like TikTok and Zoom (ZM Stock Report) will be a good starting ground to get its infrastructure-as-a-service ambitions rolling.

Now, there’s yet to be definitive information on the exact nature of the deal between ByteDance and Oracle. No matter how the media puts it, both Oracle and Bytedance still face several hurdles in order for the deal to be completed. Only if Bytedance is able to get a deal through the White House that doesn’t require an outright forced sale, then it would mark a major feat for both companies. While Oracle and TikTok sound like an odd match, analysts say follow the money.