Are These The Best E-Commerce Stocks To Buy In November 2020?

E-commerce stocks have been a boon for investors in the stock market this year. Many consumers have ramped up their use of online shopping this year. But I wouldn’t be surprised if some are just trying it out for the first time. Of course, online shopping has actually been here for the past two decades. Yes, you heard that right. Online shopping existed when the internet was still at its nascent stage. But the payment system wasn’t so seamless back then. And there was no next day shipping. How times have changed.

Of course, consumers today are familiar with household names like Amazon (AMZN Stock Report) and its offerings. But did you know that one of the earliest forms of trade conducted online was actually carried out by IBM (IBM Stock Report)? Granted, e-commerce only started taking off gradually with the rise in the number of internet users. Since Amazon and eBay launched their e-commerce sites around 1995, e-commerce companies have transformed drastically in terms of product offerings, payment methods, and delivery speeds.

The start of a megatrend in e-commerce isn’t something new to investors. Looking for the best e-commerce stocks to buy to capitalize on this major trend could prove to be very rewarding. When the pandemic came out of nowhere, stay-at-home measures provided a boost to e-commerce. You could say that the virus brought forward years of future e-commerce growth to the present. According to a report by eMarketer, the pandemic accelerated U.S. online shopping shift by nearly 2 years. With the trend as your friend, here’s a list of top e-commerce stocks to watch.

Read More

- Looking For The Best Stocks To Buy Now? 3 Epicenter Stocks To Watch

- 3 Top EV Stocks To Watch Right Now; 2 Started The Week On A Strong Note

Best E-Commerce Stocks To Buy For Long Term Gains #1 Alibaba Group Holdings

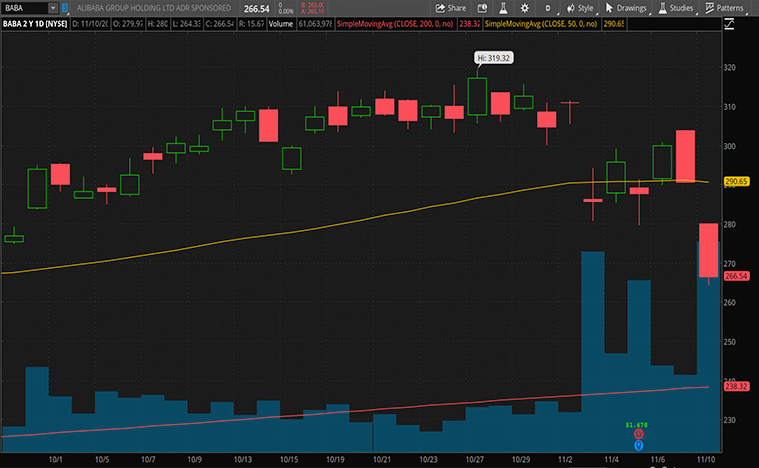

Among the top e-commerce stocks in the stock market today, one particularly worth watching is Alibaba (BABA Stock Report). The company has had one of its worst days in the stock market, where its shares plunged nearly 9% on Tuesday’s intraday trading. This came after Chinese regulators are taking steps to prevent monopolistic behavior among top Chinese tech companies. Investors appear to be unprepared for this judging by the way the stock price moved. The thing is, we have been hearing about antitrust issues around Big Tech stocks in the U.S. for some time now. Should we really be surprised if the same happens elsewhere? Of course, you could also say that the recent Ant Group IPO debacle is one of the reasons why the stock continues to spiral downwards.

Those aside, the company kicked off its annual ‘Singles Day’ event on November 11. During its opening hours on early Tuesday, the company has topped $56 billion in sales, well ahead of last year’s record pace. This came as consumers flocked to the world’s biggest shopping event. That number puts the $10.4 billion sales during Amazon’s Prime Day last month to shame. It appears the Chinese consumers are coming back with a vengeance after spending months earlier this year under lockdown.

Despite the suspension of Ant’s IPO and increasing scrutinization from Chinese regulators, Alibaba is still growing at a healthy pace and near-term growth is expected to be good. Its marketplaces continue to be popular among shoppers in China. Likewise, its cloud business is still the top dog in China. At about 30 times forward earnings, Alibaba is trading at an undemanding multiple for a big tech stock. Will you be picking BABA stock up on the dip?

Best E-Commerce Stocks To Buy For Long Term Gains #2 Sea Limited

Shares of Sea Limited (SE Stock Report) was spiraling downwards this week even though there was no specific news out regarding the Asian e-commerce and digital gaming company. Well, not exactly no news. The top e-commerce stocks in the market were all taking a hit after Pfizer’s announcement on Monday stating that its vaccine is at least 90% effective.

While such news may be good news for epicenter stocks and the world, it may not be entirely a good thing for companies that do business online. For instance, due to coronavirus related shutdowns, Sea Limited more than tripled in market cap this year as sales were up by 102% year-over-year. So, it’s not surprising when positive vaccine news like this would send SE stock lower.

Sure, the positive vaccine news means consumers could visit physical stores in no time. But let’s not forget that it will take some to fully vaccinate the global population, assuming there’s no logistical hurdles and vaccine hesitancy. And if we consider these factors, I personally believe that cautious consumers would still continue to do their shopping online. Of course, investing in SE stock at its existing valuation may be risky, especially if you have a short investment horizon. But if you are looking for a stock that you can keep for the next 5 or even 10 years, this might just be what you are looking for. With the growing economy and rising internet penetration in Southeast Asia, SE stock appears to have a long runway ahead.

[Read More] Leisure Stocks Jump On Pfizer’s Positive Vaccine News; 3 Names To Watch

Best E-Commerce Stocks To Buy For Long Term Gains #3 Jumia Technologies

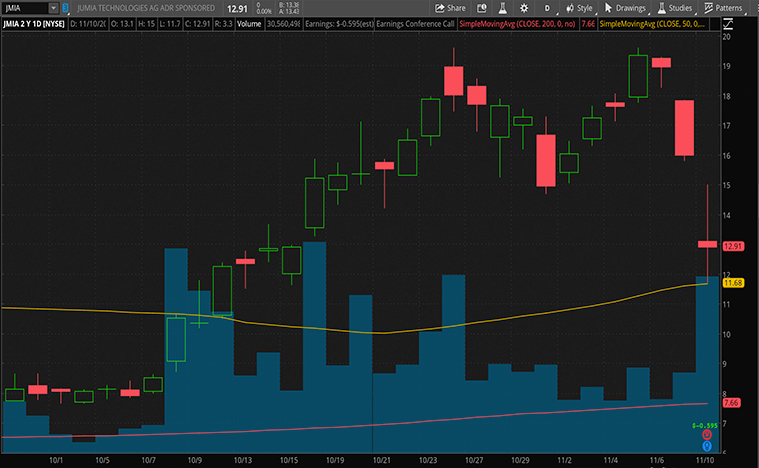

If you are looking for an overseas e-commerce player with huge potential, Jumia Technologies (JMIA Stock Report) might be an attractive option in the market. The African e-commerce and digital-payments company saw its company’s stock price soared by 87% in October. Since then, JMIA stock has been on many investors’ watchlist. But the company’s stock price took a hit on Tuesday, plunging nearly 20%. This came after the company reported third-quarter earnings of 2020. No doubt, expectations of e-commerce and fintech companies amid the pandemic have been sky-high. Unfortunately, those hopes deflated after the company saw revenue drop for the quarter.

Sure, the company’s revenue disappoints. But that should not be surprising as the company has intentionally shifted to become more of a third-party platform company. Besides, the company is showing some positive signs. The transition from first-party to third-party sales is more lucrative. Jumia’s gross profit rose 23% from the same period last year. In addition, annual active customers also increased by 23% to 6.7 million.

If you think about it, that’s a drop in the bucket in comparison with the large population in the geographies where Jumia operates. That suggests tremendous untapped potential. Besides, the total payment volume for JumiaPay grew by a stellar 50% from a year ago. With all that being said, is JMIA stock the best bet for access to the frontier markets?