A dividend stock is a type of stock that pays out a portion of the company’s profits to shareholders in the form of dividends. These payments are generally paid on a regular basis. This can include quarterly or annually. While dividends are typically paid in cash. Although they can also be paid in the form of additional shares of stock. Dividend stocks are often appealing to investors because they provide a source of income in addition to any potential appreciation in the stock price.

One of the main benefits of dividend stocks is that they can provide a steady stream of income. This can be particularly attractive for investors who are in retirement or nearing retirement. This comes as dividends can help to supplement their other sources of income. Dividend stocks can also be a good option for investors who are looking for a more conservative investment strategy, as the dividends provide a buffer against any potential declines in the stock price.

In general, dividend stocks can be an attractive investment option for investors looking for a source of income or a more conservative investment strategy. It is important to carefully evaluate the financial health and sustainability of the dividend, as well as the industry and overall economic environment, before investing in dividend stocks. Considering this, here are three top dividend stocks to watch in the stock market in 2023.

Dividend Stocks To Watch For 2023

- The McDonald’s Corporation (NYSE: MCD)

- AbbVie Inc. (NYSE: ABBV)

- United Parcel Service Inc. (NYSE: UPS)

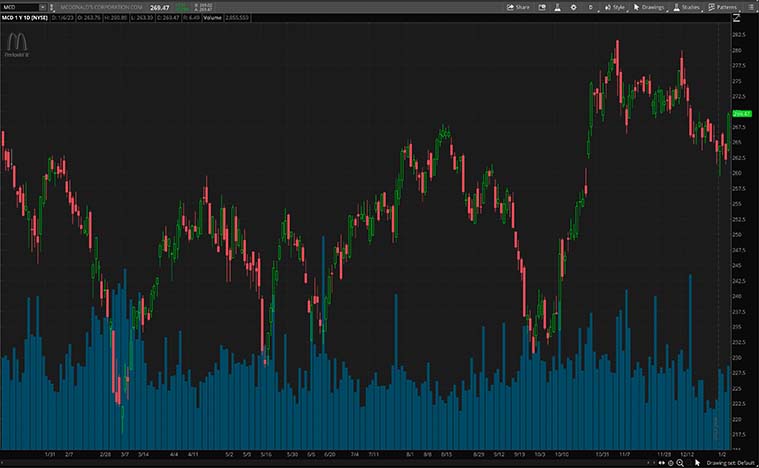

McDonald’s Corporation (MCD Stock)

Leading off, McDonald’s Corporation (MCD) is a multinational fast food company. It is the world’s largest restaurant chain by revenue. Additionally, the company is known for its burgers, fries, and shakes. As well as a variety of other menu items including chicken, salads, and breakfast items. Today, the company offers shareholders an annual dividend yield of 2.26%.

Meanwhile, back in October, the company reported its third-quarter financial results. In detail, during the third quarter of 2022, McDonald’s released financial results that exceeded expectations. The company earned $2.68 per share and had a revenue of $5.9 billion during this period. These figures surpassed the predictions of analysts, who anticipated earnings of $2.57 per share and revenue of $5.7 billion for the quarter.

Over the last six months, shares of MCD have increased by 6.39% as of Friday’s close. In the early Monday morning trading session, McDonald’s stock look to open the trading week at 269.47 a share.

[Read More] 3 Natural Gas Stocks To Watch In The Stock Market This Week

AbbVie (ABBV Stock)

Second, AbbVie (ABBV) is a global biopharmaceutical company. The company focuses on developing and marketing advanced therapies for a range of serious illnesses. This includes cancer, hepatitis C, multiple sclerosis, and rheumatoid arthritis. AbbVie’s portfolio includes a number of well-known drugs, including Humira, an anti-inflammatory treatment that is one of the best-selling drugs in the world. Today, ABBV offers its shareholders an annual dividend yield of 3.55%.

Next, in January, the company announced it will release its Q4 2022 financial results. Specifically, AbbVie will disclose its financial results for the fourth quarter of 2022 on February 9, 2023. The announcement will be made before the market opens and will be followed by a live webcast of the earnings conference call at 8 a.m. Central Time. The webcast will be accessible through the Investor Relations section of the company’s website.

In the last six months, shares of ABBV stock have rebounded by 8.69%. Meanwhile, as we head into this new trading week, ABBV looks to open Monday’s trading session at around $166.30 a share.

[Read More] 3 Blue Chip Stocks To Watch Ahead Of This Week

United Parcel Service (UPS Stock)

Topping off the list we have United Parcel Service (UPS). For starters, United Parcel Service (UPS) is a global delivery company. The company operates a fleet of planes, trucks, and cargo ships to deliver packages and freight to over 220 countries and territories around the world. Additionally, UPS offers a range of delivery services, including air and ground shipping, freight forwarding, and logistics solutions. Currently, UPS has an annual dividend yield of 3.40%.

In November, UPS announced they have completed its acquisition of Bomi Group, a global healthcare logistics company. As a result of this acquisition, UPS Healthcare will gain access to temperature-controlled facilities in 14 countries and will add 3,000 employees to its team in Europe and Latin America. Bomi Group will now operate under the name Bomi Group. Moreover, the acquisition will also expand UPS Healthcare’s reach, giving its customers access to 216 facilities with a total of 17 million square feet of compliant healthcare distribution space in 37 countries and territories.

In the last six months of trading, UPS stock has fallen by 3.08%. Meanwhile, going into this trading week, shares of UPS stock look set to open at around $178.95 a share.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!