Looking For Top Consumer Stocks To Watch? 4 Names To Know

Consumer stocks are on the rise in the stock market. Last week’s frenzy with GameStop’s (NYSE: GME) explosive gains is spilling over across the consumer world. GME stock has been up by over 1,000% year-to-date as day traders rushed into the stock and other top consumer stocks in recent days. For instance, Macy’s (NYSE: M) has also surged in share price in the last month. Could this just be the start for the consumer industry?

With talks of President Biden’s stimulus plan, consumer stocks could get another lifeline to kick start its journey in 2021. Despite Republicans wanting to downsize Joe Biden’s $1.9 trillion pandemic stimulus to $600 billion, the money will no doubt reach the millions of Americans who need them. The president is aware of the urgency of how badly these checks are needed.

More so by those who are still severely affected by this pandemic. This money would then be recirculated back into the economy, which could bode well for these consumer stocks. Considering all that has happened recently, it is understandable that these stocks have been on investors’ radar. With that in mind, here is a list of top consumer stocks to watch.

Top Consumer Stocks to Watch In February

- AMC Entertainment Holdings Inc. (NYSE: AMC)

- Electronic Arts Inc. (NASDAQ: EA)

- Chipotle Mexican Grill Inc. (NYSE: CMG)

- eBay Inc. (NASDAQ: EBAY)

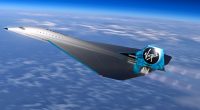

AMC Entertainment Holdings Inc.

AMC is a movie theatre chain that is based in Kansas and is the largest movie theatre chain in the world. It also has the largest share of the U.S. theatre market ahead of Regal and Cinemark (NYSE: CNK). AMC stock has been up by over 500% year-to-date and peaking at a 52-week high of $20.36 just last week. With the vaccine rollout taking place, will AMC stock return to its former glory?

Last week, the company reported that it has raised $917 million of fresh capital since December 2020. This increased liquidity should allow the company to weather through the pandemic. AMC CEO, Adam Aron had this to say, “Today, the sun is shining on AMC. After securing more than $1 billion of cash between April and November of 2020, through equity and debt raises along with a modest amount of asset sales, we are proud to announce today that over the past six weeks AMC has raised an additional $917 million capital infusion to bolster and solidify our liquidity and financial position. This means that any talk of an imminent bankruptcy for AMC is completely off the table.”

To top things off, the U.S. could see a degree of normality by fall if 70% to 85% of Americans are vaccinated by the end of summer. This could be good news for AMC as it tries to stay afloat in what could be the final months of the pandemic. All things considered, will you add AMC stock to your portfolio?

Read More

- 4 Top Silver Stocks To Watch Right Now

- Looking For The Top Entertainment Stocks To Watch Right Now? 2 Reporting Earnings Tomorrow

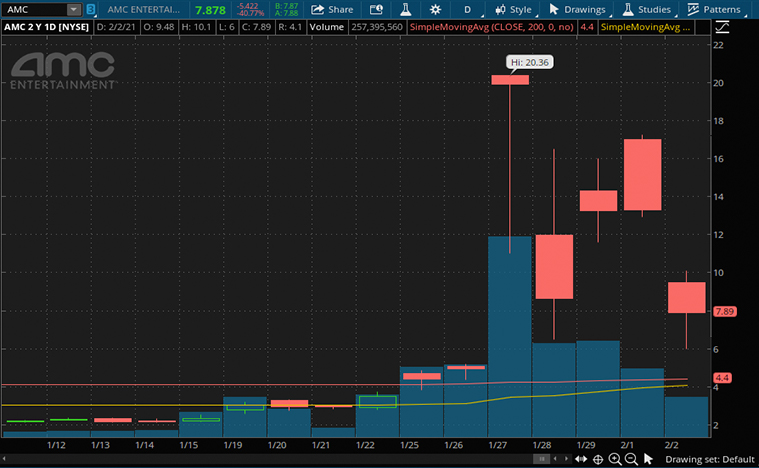

Electronic Arts Inc.

Electronic Arts or EA is a video game company that is based in California. The company is a pioneer of the early home computer game industry and has become one of the largest gaming companies in the Americas by revenue and market capitalization. EA stocks have been up by over 20% since November. The company will report its Q3 2021 after the market close today. Ahead of its earnings, how has the company been doing financially?

In its latest quarter financials posted in November, EA posted total revenue of $1.151 billion for the quarter. A chunk of this revenue came from its live services segment. The company also launched its highly successful EA SPORTS UFC 4 and Star Wars: Squadrons titles during the quarter. For its full-year 2021 ending on March 31, 2021, the company expects net revenue of approximately $5.625 billion. EA also expects to have a net income of approximately $924 million or diluted earnings per share of approximately $3.15. With that in mind, will you consider EA stock as a top consumer stock to watch?

[Read More] Best Biotech Stocks To Buy Right Now? 4 Reporting Earnings This Week

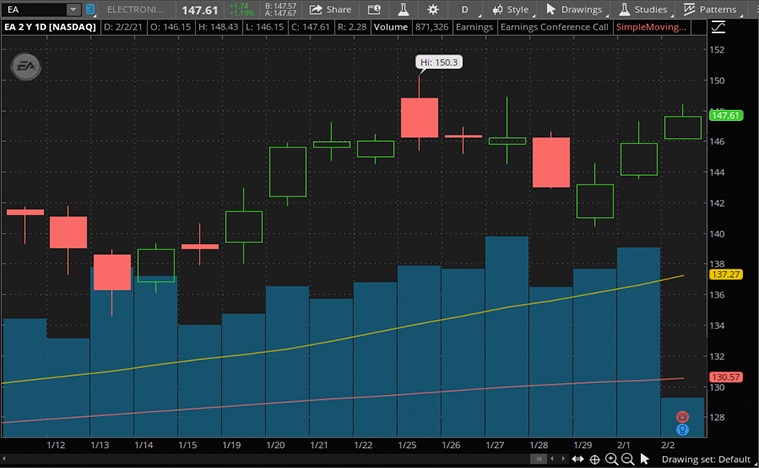

Chipotle Mexican Grill Inc.

Chipotle is a chain of fast-food restaurants in the U.S., U.K., Canada, Germany, and France, that specializes in tacos and burritos that are made to order in front of customers. The company has been on a tear in the last year, rising more than 70%. Chipotle has also been witnessing explosive digital growth so this could mean that its rally is not over yet. The company will announce its fourth-quarter financials after today’s closing bell.

In the company’s third-quarter fiscal, it saw its revenue increase by 14.1% to $1.6 billion. Chipotle also saw its comparable restaurant sales increase by 8.3%. Its digital sales grew by a whopping 202.5% and accounted for 48.8% of sales for the quarter. The company also reported diluted earnings per share of $2.82. For the quarter, it opened 44 new restaurants and closed three restaurants. Seeing how Chipotle has invested into its digital sales, it continues to show adaptability and has long-term potential.

Last week, the company announced that it is testing Chipotle Carside at 29 restaurants in California. This would allow consumers to get food delivered right to their parked cars using the Chipotle app. This in addition to its digital ordering channels, could help cater to a shift in consumer habits in a pandemic era, where person-to-person contact should be kept at a minimal. All things considered, will you have CMG stock on your watchlist?

[Read More] Making A List Of The Best Stocks To Buy Now? 4 Tech Stocks Reporting Earnings This Week

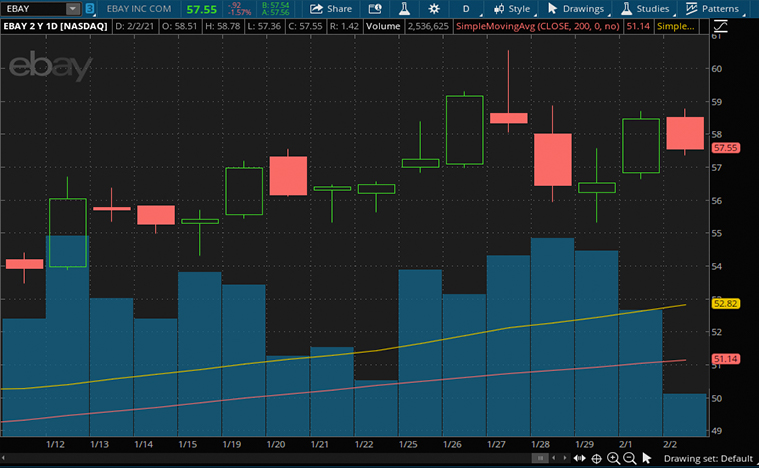

eBay Inc.

eBay is a multinational e-commerce corporation that facilitates customer-to-customer sales through its website, with operations in about 32 countries. eBay manages its website, an online auction, and shopping website where people and businesses can buy and sell a wide variety of products worldwide. The company’s shares are traded at $58.47 as of yesterday’s closing bell. eBay will report its fourth-quarter earnings tomorrow.

In its third-quarter fiscal, eBay reflected the strength of its newly focused strategy, coupled with the enormous untapped potential of its marketplace. It reported that its annual active buyers grew by 5% to a total of 183 million buyers. Its gross merchandise volume was $25 billion, up by 22%, year-over-year. The company also posted revenue of $2.6 billion, up by 25% compared to a year earlier. With such solid financials, will you want to own EBAY stock?