Check Out These Trending AV Stocks In The Stock Market This Week

Autonomous vehicle (AV) stocks may be among the most enticing stocks to buy in the stock market today. While the industry may be quite young, the potential is also limitless. From time to time, you would see major tech companies pouring investments into the industry. Recently, we saw Alibaba (NYSE: BABA) leading investments of more than $300 million into Chinese autonomous driving start-up, DeepRoute.ai. The company’s involvement in the funding round shows its intention to get a foothold in the AV space. For those unaware, Alibaba has already invested in another AV start-up called AutoX last year.

On top of that, even retail giant Walmart (NYSE: WMT) is expanding its AV program to include Argo AI and Ford (NYSE: F). It appears that the collaboration will use Ford Escape hybrids with Argo AI tech for Walmart deliveries in Miami. Walmart customers within the area will be able to order groceries and other items online for door-to-door autonomous delivery. As you can see, autonomous driving not only increases road safety, it is also revolutionizing the transportation industry. With all these in mind, do you have a list of the top AV stocks to watch in the stock market today?

Best Autonomous Vehicle Stocks To Watch Now

- Intel Corporation (NASDAQ: INTC)

- Magna International Inc. (NYSE: MGA)

- Baidu Inc (NASDAQ: BIDU)

- NVIDIA Corporation (NASDAQ: NVDA)

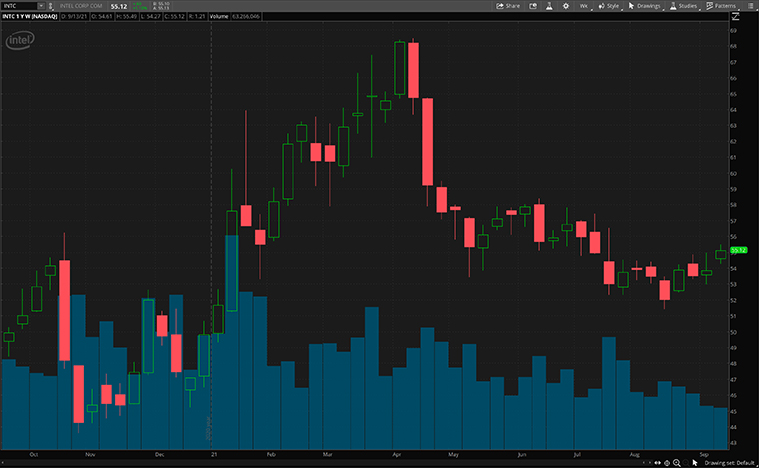

Intel Corporation

First, we have the tech giant, Intel. Its processor chips are vital components in countless laptops and desktops in use today. What some may not know is, the company has an autonomous driving segment, Mobileye. Mobileye essentially provides driving assistance and self-driving solutions.

During a keynote at IAA Mobility last week, the company’s CEO Pat Gelsinger and Sixt SE Co-CEO Alexander Sixt announced a collaboration. The partnership will begin offering autonomous ride-hailing services in Munich by 2022. This service will be operated by SIXT and leverage Intel’s subsidiary Moovit, carrying ride-hail passengers in Mobileye-owned AVs. Riders will have access to the service via the Moovit app as well as the SIXT app.

Well, if the driverless pilot is proven to be successful, both companies aspire to scale the service across Germany and other European countries in the future. In addition, Pat Gelsinger also predicts that semiconductors will account for more than 20% of the total premium vehicle bill of materials by 2030. So, it is no wonder that investors would be keeping tabs on the company’s offerings. With that in mind, do you have INTC stock on your watchlist?

Read More

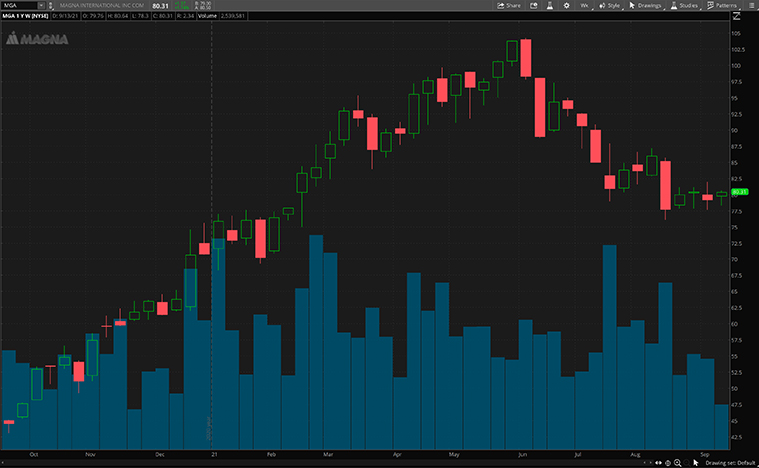

Magna International Inc.

Another way to invest in the AV industry would be through its automotive parts. This is where Magna comes into the picture. As a leading global automotive supplier, its products can be found on most vehicles today. Also, it is one of the auto equipment providers that is making considerable strides in amping up electrification and autonomous capabilities.

In August, Magna announced its second-quarter financial updates. Considering the extent of production disruptions due to semiconductor chip shortages, it was an impressive performance overall. Its revenue more than doubled to $9.0 billion during the quarter. Also, its diluted earnings per share were $1.40 compared to a loss of $1.71 the prior year. Safe to say, the company has made an impressive turnaround as it adapts to the changes in the production environment.

Besides that, Magna’s Chief Financial officer, Vince Galifi, expects that the coming years will see the recovery of lost industry production. Certainly, this would be a positive for its sales, earnings, and free cash flow moving forward. With MGA stock trading sideways in recent months, could it see brighter days ahead?

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

Baidu Inc

Following that, we will be looking at the Chinese tech giant, Baidu. Essentially, the company is a Chinese language Internet search provider. Much like Alphabet’s (NASDAQ: GOOGL) Google search, you could find information online, including webpages, news, images, and many more. However, Baidu has been pushing forward with its Intelligent Driving and AV solutions lately.

During the company’s Baidu World 2021 event held last month, Baidu showed its latest innovations that it hopes will transform and improve transportation and industry. The company CEO Robin Li unveiled his vision for mobility through “robocars”. He believes that cars of the future will drive autonomously and act as both an intelligent assistant and loyal companion while having the ability to self-learn. As more automotive trials are being made, this could soon be a reality.

Well, the company certainly isn’t resting on its laurels. Baidu announced on Monday that it will begin public testing of its Apollo Go robotaxis in Shanghai. This marks the fifth city where passengers will have the ability to trial the service. The trial will include 150 stations opened in phases throughout the city to provide users convenient access to residential areas, commercial areas, and public transportations. Given these exciting developments, would you consider BIDU stock a top AV stock to watch?

[Read more] Best Stocks To Invest In 2021? 3 Cyclical Stocks To Watch

NVIDIA Corporation

Last but not least, we have the leading tech company that dominates the graphic processing units (GPU) market, Nvidia. Also, it manufactures system-on-a-chip units for the mobile computing and automotive markets. Nvidia has researched autonomous driving technologies for several years. Its main role in AVs is its NVIDIA DRIVE AGX Orin, a highly advanced software-defined platform for autonomous vehicles and robots.

Last week, the company posted a presentation on its revised DRIVE Hyperion platform. It now creates a standard-based modular hardware offering with an open-source software stack. What this means is, the hardware can now be upgraded and replaced. Hence, lowering the cost of recalls while allowing car manufacturers to have absolute control over the software. So, from an autonomous driving perspective, autonomous systems can now be updated over time which leads to better reliability of the vehicle and safety for the passenger.

Nvidia’s recent second-quarter earnings report is as impressive as you would expect. It posted revenue of $6.51 billion, representing an increase of 68% year-over-year. Out of which, automotive revenue was $152 million, up by 37% year-over-year. Also, its GAAP earnings per diluted share for the quarter was $0.94, representing an increase of a staggering 276% from a year ago and 24% from the previous quarter. All things considered, would you add NVDA stock to your watchlist?