4 Trending Tech Stocks To Watch In The Stock Market Today

After having a smooth sailing year in the stock market last year, tech stocks are seeing some turbulence. This comes as bond yields continue to rise which drives financials higher. However, one thing that has become evident in the last few months is the fact that tech has become a core part of everyone’s lives. Today, we do everything with the help of tech. We use the latest tech products from companies like Apple (NASDAQ: AAPL) and Google (NASDAQ: GOOGL). Be it surfing the web, learning, or making digital payments, these activities are elevated by the technology that we have. Furthermore, the best part of tech is that it will only continue to get better. Just a mere twenty years ago, you would not have imagined that video teleconferencing would be the norm to communicate for work or with family.

This could fuel demand in the long run for tech. It also gives incentive to the industry to continue to innovate and also further refine their products and services. Take graphics processing unit (GPU) leader Nvidia (NASDAQ: NVDA). Its latest iteration of graphic cards provides game-changing computing power that users could only dream of a mere decade ago. With that, gamers can now enjoy playing their favorite games at 4K resolution. Add resilience to the amazing innovation that the sector has shown, this could present an opportunity for investors to buy tech stocks today. With that in mind, here is a list of top tech stocks to consider buying today.

Best Tech Stocks To Buy [Or Avoid] Now

- Upstart Holdings Inc. (NASDAQ: UPST)

- Luminar Technologies Inc. (NASDAQ: LAZR)

- Accenture Plc (NYSE: ACN)

- Taoping Inc. (NASDAQ: TAOP)

Upstart Holdings Inc.

Upstart is a leading artificial intelligence (AI) lending platform that is designed to improve access to affordable credit. Its fintech platform can reduce the risks and costs of lending for its bank partners. In brief, the company is one of the first to apply AI to the multi-trillion dollar credit industry. It has proven that its model is significantly more accurate than traditional lending models. Ultimately, this would allow Upstart to approve more applicants at lower loss rates. UPST stock jumped by over 90% on today’s opening bell and currently trades at $115.73 as of 1:23 p.m. ET. Investors seem to be responding to its impressive fourth quarter and fiscal year 2020 financials.

In it, the company reported that its total revenue was $86.7 million for the quarter, a 39% increase year-over-year. Also, Upstart reported that its lending volume increased by over 57% for the same period. Income from operations was $10.4 million, which is a staggering 196% increase year-over-year. The fintech company has delivered strong growth and profits despite the challenges that came with the coronavirus pandemic. It also firmly believes that virtually all lending will be powered by AI in the future and that the company is still in the earliest stages to help its partners grow. With these developments, will you consider buying UPST stock?

[Read More] Making A List Of The Best Retail Stocks To Buy? 4 To Consider

Luminar Technologies Inc.

Next on the list is Luminar Technologies. The company is an autonomous vehicle and lidar technology company for passenger vehicles and trucks. Furthermore, the company has built a new type of lidar from the chip-level up, with technological breakthroughs across all core components. As a result, Luminar has created the only lidar sensor that meets the demanding performance, safety, and cost requirements to enable autonomous vehicles to be built. LAZR stock currently trades at $27.18 as of 1:23 p.m. ET. The company today announced two pieces of news that might attract investor interest.

First, Luminar announced a strategic partnership with SAIC Motor Corporation Limited, the largest automaker in China and a Fortune Global 100 company. It will power the autonomous capabilities and advanced safety features in SAIC’s new R brand vehicles for series production with its industry-leading lidar as well as components of Luminar’s Sentinel software system. The R brand program is expected to begin series production with Luminar in 2022. Second, it will be announcing its fourth-quarter financials after the market closes today. Given the excitement surrounding Luminar, will you consider adding LAZR stock to your portfolio?

Read More

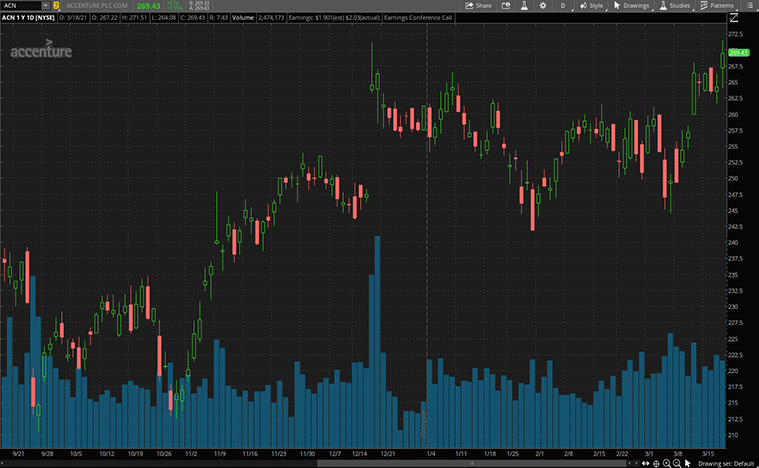

Accenture Plc

Accenture is a global professional services company with leading capabilities in digital, cloud, and security. Combining its unmatched experience and specialized skills across more than 40 industries, it offers consulting, interactive, technology, and operations services. It has one of the world’s largest networks of advanced technology and intelligent operations centers, with over 500,000 people in the company. ACN stock is up by more than 7% in the last two weeks and currently trades at $269.10 as of 1:24 p.m. ET.

The company today announced its second-quarter results and even raised its business outlook for fiscal 2021. In detail, Accenture reported a revenue of $12.1 billion, which is an 8% increase year-over-year. It also saw new bookings at a record $16 billion, which is a 13% increase from a year earlier. Impressively, the company also reported a GAAP earnings per share of $2.23, which is a 17% increase year-over-year. All things considered, will you buy ACN stock?

[Read More] CrowdStrike Holdings (CRWD) Vs Cloudflare (NET): Which Is A Better Cybersecurity Stock To Buy?

Taoping Inc.

Taoping is an internet company that is dedicated to the research and application of blockchain technology and digital assets. The company also provides overall solutions for industries such as internet education and new media through its cloud application technology. TAOP stock is up by over 10% on today’s opening bell. Investors seem to be responding to a press release by the company today.

The company announced that it has launched its newly-created Digital Culture Business Division that covers Taoping’s new-media business and education business. It will also appoint Zhixion Huang, COO of Taoping as the direction for this division. The Digital Culture Business Division plans to build a new interconnected and open platform ecosystem based on Taoping’s current smart cloud.

By utilizing AI and big data technology, the new platform will integrate offline scenes and online interaction channels. This could provide a one-stop solution for industries such as internet education and new media. With that in mind, will you buy TAOP stock?