Is NIO Stock Still A Buy After The Sharp Rise?

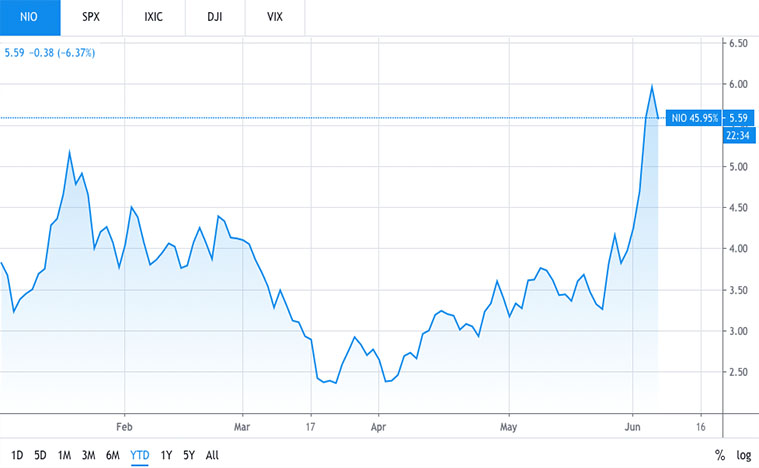

Electric vehicle stocks have been on fire. The rise in the broader market has also helped electric vehicle makers over the last few weeks. The biggest name among EV manufacturers right now are all enjoying the strong rally in the second quarter. Tesla (TSLA Stock Report) has risen 160% since the coronavirus-induced market sell-off In March, while NIO (NIO Stock Report) has risen 180% in the same period.

Electric Vehicle Optimism To Boost NIO Stock?

Optimism in the increasing shift from fossil fuel to electric energy in vehicles is gaining momentum. This came as many expect the drop in gas prices to be temporary. NIO stocks are now moving higher this week while start-up electric truck manufacturer Nikola (NKLA Stock Report) rose more than 100% in a day. Investors and traders are now taking the time to look for opportunities to ride on the boom in sentiments on EV stocks.

There wasn’t any specific news that drove the NIO shares higher on Tuesday afternoon. Hence, it appeared the spike in NIO stocks could be the halo effect driven by Nikola stock. Investors have been looking for stocks that can replicate the gains of Tesla in recent years. Actually, now that we are on it, the combination of NIO and Nikola could actually offer a potent challenge to Tesla. NIO’s sedans can compete with Tesla’s sedans, while Nikola’s all-electric Class 8 trucks could rival Tesla’s Cybertruck.

Sale Of New American Depositary Shares To Keep NIO Up and Running

Fundraising news doesn’t usually send out positive signals to existing investors. Because they know that, it will dilute their position in the particular company. But hey, running a disruptive business is no charity. Companies like Nio or Tesla need ongoing injections of capital to fund research and development, expand manufacturing base, develop sales and servicing network and more. The list just doesn’t end here.

NIO has been gaining increasing consumers’ attention in the world’s largest electric vehicle market. The company is experiencing a huge growth in demand, to the extent of putting consumers on a waiting list. Some analysts argue that the time to buy NIO stock is now. With massive financial backing and various partnerships with many state-owned companies, the concerns of financial troubles should be the last on the list.

Will NIO Be The Next Tesla?

One of the most common problems start-ups face is liquidity needs. Even Tesla faced a cash crunch in the past. Some critics might argue that Tesla is still not yet a success story because it is not currently profitable. But, we can’t ignore the fact that the company has come a long way and has produced excellent products. It is just a matter of time before they become profitable.

Tesla can bank on its innovation and leading position in the EV industry. However, NIO can expect support from the Chinese government. China has been supporting many green initiatives. It is no surprise that China continues to push for higher EV penetration. With the highly positive report from the company in the latest quarter, the company expects to achieve a positive gross margin in the second quarter. The EC6 Model is also coming up later this year.

For NIO stock to be a long term investment, it will have to maintain double-digit growth for a lot longer, or be much more profitable than expected. For now, it may be worth a speculative play, but near-term upside certainly doesn’t look as attractive today as it was two months ago.