Are These 2 Tech Stocks To Buy Or Avoid This Month?

Tech stocks continue to expand in the market as more progression is made in the industry. Tech stocks include a wide range of electronic-based companies. Online services have proven to be top tech stocks during the current events in the world. Many are staying at home with more time to spend online. So online services are becoming more and more relevant in our lives.

As an example companies focused on online retailing and listings have seen a large increase in stock price. This is due to people wanting to still purchase things during the coronavirus outbreak safely. E-commerce has been on the rise too with many retail stores being closed. Most online businesses have seen a surge due to the current climate of the market.

The technology world is ever-changing so new tech advancements are always being made. It’s unsure what will happen to tech stocks as the economy continues to change. That being said, there are many tech stocks making investors profit. Now let’s discuss two trending tech stocks that have potential in the market.

Read More

- Top 3 Fintech Stocks To Watch In 2020

- Are These Tech Stocks Worth Buying On The Dip?

- Tesla Stock Surges Past $1,000; What’s Next?

Tech Stocks To Watch In June: Fangdd

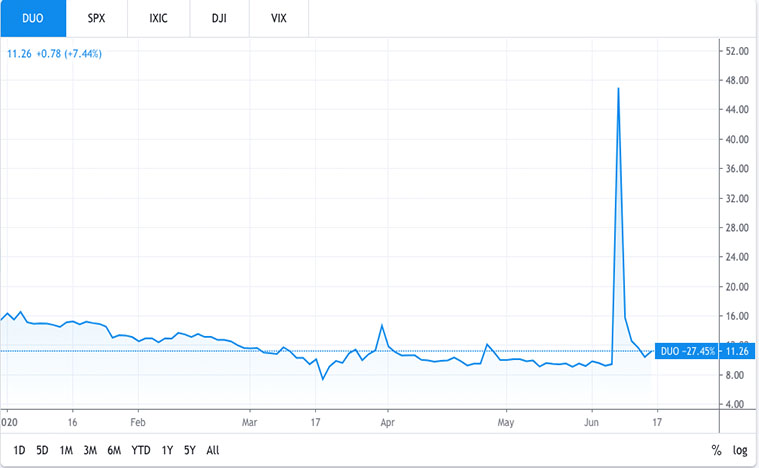

The first tech stock to watch is Fangdd Network Group Ltd. (DUO Stock Report). Fangdd is an online real estate marketplace based in China. DUO stock has performed rather strangely recently. Normally DUO stock price stayed around $10 for a very long time. Suddenly, it blasted up over 400% to over $100 a share on June 9th. Why did DUO stock go up so much you may ask? Well, nobody really has the answer to this question.

The company did have an earnings call on June 10th, but nothing was reported that would cause such a spike. FangDD says it does not comment on market activity. The company released a statement saying “In light of the increases in the price and trading volume of the Company’s American depositary shares, on June 9, 2020, FangDD stated that its policy is not to comment on unusual market activity or speculative matters. The Company cautions investors that the trading price of the Company’s ADSs could be subject to significant volatility for various reasons that are out of the Company’s control.”

As quick as this tech stock rose, it fell back down. On June 15th, DUO stock price dropped to $15 a share and on June 16th, it’s at $11.75 a share. This puts DUO stock almost right where it began. More than 40% of all real estate agents use FangDD to list their properties. Although this is a big company, this stock rose and then fell very quick. DUO stock shows potential still making this a possible tech stock to watch.

[Read More] Why Are Analysts Bullish On Airline Stocks Now?

Tech Stocks To Watch In June: IZEA Worldwide

The next tech stock to discuss is IZEA Worldwide Inc (IZEA Stock Report). IZEA Worldwide has a focus on creating online marketplaces. These marketplaces connect marketers and creators on one platform. The Florida based company was founded in 2006 and sells influencer marketing and content campaigns. Influencer marketing is something that has been used a lot more recently. Since everyone has been stuck inside, social media platforms have seen a lot more use. Influencer marketing allows a company to easily put its product in the face of millions of users.

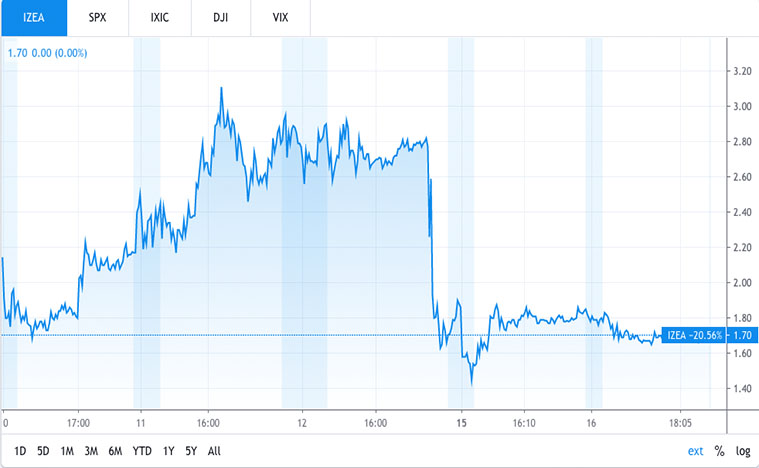

IZEA has been making a lot of moves. On May 26th IZEA announced that they have received a surge in customers despite the effects of the Covid-19 outbreak. The Chairman and CEO of the company, Ted Murphy said “The surge of customer wins in recent weeks is simply remarkable. Our sales team has delivered a parabolic rebound curve following the initial impacts from the pandemic. It has been an inspiring demonstration of the commitment and grit of our team and I am very proud of what we have just accomplished together.” IZEA’s financials have been greatly increased due to this surge.

IZEA stock has seen an increase as a result. Murphy also stated, “As of today, Q2 bookings for managed services in 2020 have already exceeded Q2 bookings for the same period in 2019, despite the loss of traction with some customers due to the pandemic. All of this, while working from home in the most challenging of business climates.” On June 9th, IZEA received contracts from two Fortune 500 retailers, one being a Fortune 10 company.

This caused shares of IZEA stock to rise as much as 375% over the course of a few days. IZEA stock price reached $2.90 a share on June 12th. Before any of this news, IZEA stock was at $0.60 a share on average. The hype has gone down for IZEA stock price, but it still is up at $1.69 a share on June 16th. With the company announcing plans to restore all employee salaries, another spike is possible for IZEA stock price.